As a parent, managing your child's tax obligations can be a daunting task. One crucial step is filing Form 8615, which reports the income tax return of a child under 18 years old. Fortunately, using TurboTax can simplify the process. However, it's essential to follow the correct steps to ensure accuracy and avoid any potential issues. In this article, we'll provide five tips for filing Form 8615 with TurboTax.

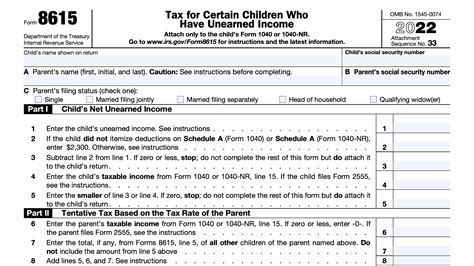

Understanding Form 8615

Form 8615 is a tax form used to report the income tax return of a child under 18 years old. This form is required when a child has income that exceeds a certain threshold, such as interest, dividends, or capital gains. The form helps to calculate the child's tax liability and report it to the IRS.

Tip 1: Gather All Necessary Documents

Before starting the filing process, ensure you have all the necessary documents. These include:

- Your child's Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your child's income statements, such as 1099-INT and 1099-DIV

- Your child's capital gains or losses statements

- Any other relevant tax documents

Having all the necessary documents will help you accurately complete Form 8615 and avoid any potential errors.

Tip 2: Choose the Correct Filing Status

When filing Form 8615, you'll need to choose the correct filing status for your child. The filing status will depend on the child's age and income level. For children under 18, the filing status is typically "single." However, if your child is married or has dependents, you may need to choose a different filing status.

- Single: The child is unmarried and has no dependents.

- Married filing jointly: The child is married and files a joint tax return with their spouse.

- Married filing separately: The child is married and files a separate tax return from their spouse.

Choosing the correct filing status is crucial to ensure accurate calculations and avoid any potential errors.

Tip 3: Report Income and Capital Gains Correctly

When completing Form 8615, you'll need to report your child's income and capital gains correctly. This includes:

- Interest income: Report the interest income earned by your child, such as from savings accounts or investments.

- Dividend income: Report the dividend income earned by your child, such as from stocks or mutual funds.

- Capital gains: Report any capital gains or losses from the sale of assets, such as stocks or real estate.

Ensure you accurately report all income and capital gains to avoid any potential errors or penalties.

Tip 4: Claim the Parent's Election

As a parent, you may be eligible to claim the parent's election on Form 8615. This allows you to report your child's income on your tax return, rather than filing a separate return for your child.

- To claim the parent's election, you must meet certain requirements, such as:

- Your child is under 18 years old.

- Your child has only interest and dividend income.

- Your child has no capital gains or losses.

Claiming the parent's election can simplify the filing process and reduce the complexity of completing Form 8615.

Tip 5: Review and Edit Carefully

Once you've completed Form 8615, review and edit it carefully to ensure accuracy. Check for any errors or omissions, such as:

- Incomplete or missing information

- Incorrect calculations

- Unsigned or undated forms

Reviewing and editing your return carefully will help you avoid any potential errors or penalties.

Final Thoughts

Filing Form 8615 with TurboTax can be a straightforward process if you follow the correct steps. By gathering all necessary documents, choosing the correct filing status, reporting income and capital gains correctly, claiming the parent's election, and reviewing and editing carefully, you can ensure an accurate and error-free return. Remember to take your time and seek professional advice if needed to ensure a smooth filing process.

We hope this article has provided you with valuable insights and tips for filing Form 8615 with TurboTax. If you have any further questions or concerns, please don't hesitate to comment below. Share this article with others who may find it helpful, and don't forget to subscribe to our blog for more tax-related topics.

What is Form 8615?

+Form 8615 is a tax form used to report the income tax return of a child under 18 years old.

What is the parent's election?

+The parent's election allows you to report your child's income on your tax return, rather than filing a separate return for your child.

What documents do I need to file Form 8615?

+You'll need your child's Social Security number or ITIN, income statements, capital gains or losses statements, and any other relevant tax documents.