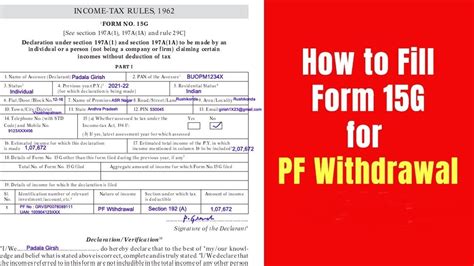

Withdrawing your Provident Fund (PF) can be a daunting task, especially when it comes to filling out the necessary forms. One of the most crucial forms for PF withdrawal is Form 15G, which is a declaration form that helps you avoid Tax Deducted at Source (TDS) on your PF withdrawal amount. In this article, we will guide you through the process of filling out Form 15G for PF withdrawal.

Understanding Form 15G

Before we dive into the process of filling out Form 15G, it's essential to understand what this form is and why it's necessary. Form 15G is a declaration form that you need to submit to your employer or the PF authorities to avoid TDS on your PF withdrawal amount. This form is typically required when you're withdrawing your PF amount before completing five years of continuous service.

Benefits of Filling Form 15G

Filling out Form 15G can help you avoid TDS on your PF withdrawal amount, which can be a significant saving. Here are some benefits of filling out Form 15G:

- Avoid TDS on PF withdrawal amount

- Get your full PF amount without any deductions

- Simplify the PF withdrawal process

5 Ways to Fill Form 15G for PF Withdrawal

Now that we've understood the importance of Form 15G, let's move on to the five ways to fill it out for PF withdrawal.

1. Online Method

You can fill out Form 15G online through the EPFO portal. Here's a step-by-step guide to filling out Form 15G online:

- Log in to the EPFO portal using your UAN and password

- Click on the "Online Services" tab and select "Form 15G"

- Fill out the required details, including your personal and PF account information

- Submit the form and take a printout of the acknowledgement slip

2. Offline Method

You can also fill out Form 15G offline by downloading the form from the EPFO portal or obtaining it from your employer. Here's a step-by-step guide to filling out Form 15G offline:

- Download the Form 15G from the EPFO portal or obtain it from your employer

- Fill out the required details, including your personal and PF account information

- Sign the form and attach the required documents, including your PAN card and Aadhaar card

- Submit the form to your employer or the PF authorities

3. Through Employer

You can also fill out Form 15G through your employer. Here's a step-by-step guide to filling out Form 15G through your employer:

- Inform your employer about your intention to withdraw your PF amount

- Your employer will provide you with Form 15G and guide you through the filling process

- Fill out the required details and sign the form

- Submit the form to your employer, who will then forward it to the PF authorities

4. Through a PF Consultant

You can also fill out Form 15G through a PF consultant. Here's a step-by-step guide to filling out Form 15G through a PF consultant:

- Find a reputable PF consultant in your area

- Provide the consultant with your personal and PF account information

- The consultant will fill out Form 15G on your behalf and guide you through the submission process

- Submit the form to the PF authorities and take a printout of the acknowledgement slip

5. Through a Digital Signature

You can also fill out Form 15G through a digital signature. Here's a step-by-step guide to filling out Form 15G through a digital signature:

- Obtain a digital signature certificate from a reputable certifying authority

- Log in to the EPFO portal using your UAN and password

- Click on the "Online Services" tab and select "Form 15G"

- Fill out the required details and sign the form using your digital signature

- Submit the form and take a printout of the acknowledgement slip

Frequently Asked Questions

Here are some frequently asked questions about filling out Form 15G for PF withdrawal:

What is Form 15G?

+Form 15G is a declaration form that helps you avoid Tax Deducted at Source (TDS) on your PF withdrawal amount.

How do I fill out Form 15G online?

+Log in to the EPFO portal using your UAN and password, click on the "Online Services" tab, and select "Form 15G". Fill out the required details and submit the form.

Can I fill out Form 15G offline?

+Yes, you can fill out Form 15G offline by downloading the form from the EPFO portal or obtaining it from your employer.

Final Thoughts

Filling out Form 15G is a crucial step in the PF withdrawal process. By following the five methods outlined above, you can avoid TDS on your PF withdrawal amount and get your full PF amount without any deductions. Remember to fill out the form carefully and submit it to the PF authorities to avoid any delays or complications.