As a Mercari seller, you're likely no stranger to the world of online marketplaces and the opportunities they provide for turning unwanted items into cash. However, with the benefits of selling on Mercari come certain responsibilities, including navigating the complexities of tax compliance. One crucial aspect of tax compliance for Mercari sellers is understanding the requirements surrounding the W-9 tax form. In this comprehensive guide, we'll delve into the world of W-9 tax forms, exploring what they are, who needs to file them, and how to complete them accurately.

What is a W-9 Tax Form?

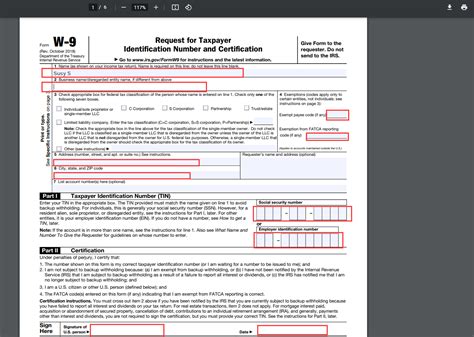

A W-9 tax form, also known as the Request for Taxpayer Identification Number and Certification, is a document used by the Internal Revenue Service (IRS) to collect identifying information from individuals and businesses that receive income from various sources, including freelance work, independent contracting, and selling on online marketplaces like Mercari. The form requires taxpayers to provide their name, address, taxpayer identification number (such as a Social Security number or Employer Identification Number), and certify their identity.

Who Needs to File a W-9 Tax Form?

As a Mercari seller, you may be wondering if you need to file a W-9 tax form. The answer depends on the amount of money you earn from selling on the platform. According to the IRS, you must file a W-9 tax form if you receive more than $600 in income from Mercari in a calendar year. This threshold applies to both individual and business sellers.

Why is the W-9 Tax Form Important for Mercari Sellers?

The W-9 tax form is crucial for Mercari sellers because it helps the IRS track income earned from selling on the platform. By providing accurate identifying information, you ensure that Mercari can report your income correctly and that you receive the necessary tax documents, such as the 1099-K form, at the end of the year.

Consequences of Not Filing a W-9 Tax Form

Failure to file a W-9 tax form can result in delays or even rejection of your tax return. Additionally, if you're required to file a W-9 and don't, you may face penalties and fines from the IRS. To avoid these consequences, it's essential to understand the W-9 tax form requirements and ensure you're in compliance.

How to Complete a W-9 Tax Form

Completing a W-9 tax form is a straightforward process. Here's a step-by-step guide to help you get started:

- Download the W-9 Form: You can obtain a W-9 tax form from the IRS website or request one from Mercari.

- Provide Your Name and Address: Enter your name and address as it appears on your tax return.

- Enter Your Taxpayer Identification Number: Provide your Social Security number or Employer Identification Number.

- Certify Your Identity: Sign and date the form, certifying that the information you've provided is accurate.

Tips for Mercari Sellers

As a Mercari seller, here are some additional tips to keep in mind when dealing with W-9 tax forms:

- Keep Accurate Records: Ensure you maintain accurate records of your income and expenses, including receipts, invoices, and bank statements.

- Consult a Tax Professional: If you're unsure about any aspect of the W-9 tax form or tax compliance, consider consulting a tax professional.

- Stay Organized: Keep all tax-related documents, including your W-9 form, in a safe and easily accessible location.

Common Questions and Answers

Here are some common questions and answers related to W-9 tax forms for Mercari sellers:

Q: Do I need to file a W-9 tax form if I only sell occasionally on Mercari?

A: Yes, if you earn more than $600 in a calendar year from selling on Mercari, you're required to file a W-9 tax form.Q: Can I file a W-9 tax form electronically?

A: Yes, you can file a W-9 tax form electronically through the IRS website or through Mercari's platform.Q: What happens if I don't file a W-9 tax form?

A: Failure to file a W-9 tax form can result in delays or rejection of your tax return, as well as penalties and fines from the IRS.

Conclusion

In conclusion, understanding the W-9 tax form requirements is crucial for Mercari sellers to ensure tax compliance and avoid any potential penalties or fines. By following the steps outlined in this guide, you'll be well on your way to accurately completing your W-9 tax form and maintaining a successful selling experience on Mercari.

We hope this guide has provided you with valuable insights and information on W-9 tax forms for Mercari sellers. If you have any further questions or concerns, please don't hesitate to reach out to us.

What is the deadline for filing a W-9 tax form?

+The deadline for filing a W-9 tax form is typically January 31st of each year. However, it's essential to check with Mercari or the IRS for specific deadlines and requirements.

Can I file a W-9 tax form if I'm not a U.S. citizen?

+Yes, non-U.S. citizens can file a W-9 tax form. However, you may need to provide additional documentation, such as a copy of your passport or visa.

How do I obtain a copy of my W-9 tax form?

+You can obtain a copy of your W-9 tax form by contacting Mercari or the IRS. You can also download a copy from the IRS website.