As a business owner, you're constantly looking for ways to save money and increase your bottom line. One way to do this is by taking advantage of tax incentives offered by the government. The New Employment Credit (NEC) is a great example of this. Introduced by the California Franchise Tax Board (FTB), the NEC provides a tax credit to businesses that hire new employees and increase their workforce. In this article, we'll explore the New Employment Credit Form 3554 and provide a step-by-step guide on how to claim your tax incentive.

What is the New Employment Credit?

The New Employment Credit is a tax credit designed to encourage businesses to hire new employees and increase their workforce. The credit is available to businesses that have a net increase in full-time employees and can be claimed for a period of five years. The credit is calculated based on the increase in full-time employees and the wages paid to those employees.

Who is Eligible for the New Employment Credit?

To be eligible for the New Employment Credit, businesses must meet the following requirements:

- Be a qualified business, such as a corporation, partnership, or limited liability company

- Have a net increase in full-time employees

- Pay wages to the new employees

- Be subject to the California Franchise Tax or the California Personal Income Tax

How to Claim the New Employment Credit

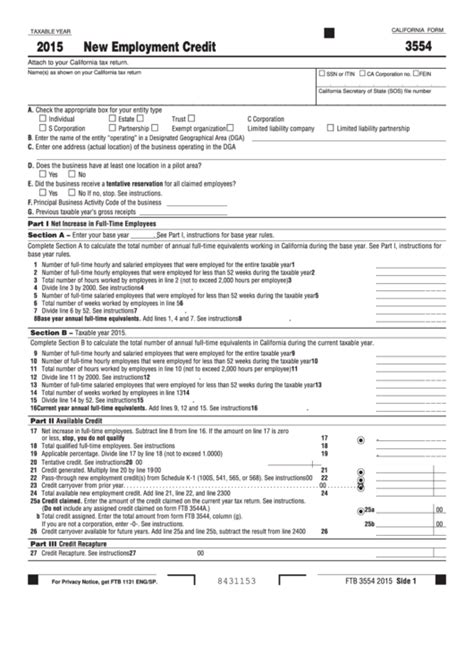

To claim the New Employment Credit, businesses must complete and submit Form 3554, New Employment Credit, to the California Franchise Tax Board. Here's a step-by-step guide on how to claim your tax incentive:

Step 1: Determine Your Net Increase in Full-Time Employees

To calculate your net increase in full-time employees, you'll need to determine the number of full-time employees you had in the preceding tax year and the number of full-time employees you had in the current tax year. The net increase is the difference between the two numbers.

Step 2: Calculate Your Credit

To calculate your credit, you'll need to multiply the net increase in full-time employees by the average annual wage of those employees. The average annual wage is calculated by dividing the total wages paid to the new employees by the number of new employees.

Step 3: Complete Form 3554

Once you've calculated your credit, you'll need to complete Form 3554. The form will ask for information such as:

- Business name and address

- Tax year and accounting period

- Net increase in full-time employees

- Average annual wage of new employees

- Total wages paid to new employees

- Credit calculation

Step 4: Submit Form 3554

Once you've completed Form 3554, you'll need to submit it to the California Franchise Tax Board. You can submit the form electronically or by mail.

Tips and Reminders

Here are some tips and reminders to keep in mind when claiming the New Employment Credit:

- Make sure to keep accurate records of your workforce and wages paid to new employees

- Calculate your credit correctly to avoid any errors or penalties

- Submit Form 3554 on time to avoid any delays or penalties

- Claim the credit for a period of five years to maximize your tax savings

FAQs

Here are some frequently asked questions about the New Employment Credit:

Q: What is the New Employment Credit?

A: The New Employment Credit is a tax credit designed to encourage businesses to hire new employees and increase their workforce.

Q: Who is eligible for the New Employment Credit?

A: Businesses that have a net increase in full-time employees and pay wages to those employees are eligible for the credit.

Q: How do I claim the New Employment Credit?

A: To claim the credit, businesses must complete and submit Form 3554 to the California Franchise Tax Board.

Q: What is the credit calculation based on?

A: The credit calculation is based on the net increase in full-time employees and the average annual wage of those employees.

Q: How long can I claim the credit for?

A: Businesses can claim the credit for a period of five years.

What is the deadline for submitting Form 3554?

+The deadline for submitting Form 3554 is the same as the deadline for filing your tax return.

Can I claim the credit if I have a decrease in full-time employees?

+No, you can only claim the credit if you have a net increase in full-time employees.

Can I claim the credit for part-time employees?

+No, the credit is only available for full-time employees.

We hope this article has provided you with a comprehensive guide on how to claim the New Employment Credit. By following these steps and tips, you can maximize your tax savings and take advantage of this great incentive. Don't forget to share this article with your colleagues and friends who may be eligible for the credit. Happy claiming!