The process of selling business property can be a complex and nuanced one, involving a multitude of factors and considerations. As a business owner, it's essential to understand the implications of such a sale on your tax obligations. This is where Form 4797 comes into play, specifically Part 1, which deals with the sales of business property. In this article, we'll delve into the details of Form 4797 Part 1, exploring what it entails, how to complete it, and what you need to know to ensure compliance with the IRS.

What is Form 4797 Part 1?

Form 4797 is used to report the sale of business property, including assets such as real estate, equipment, and vehicles. Part 1 of this form specifically deals with the sales of business property, including the calculation of gains and losses. As a business owner, you'll need to complete Form 4797 Part 1 if you've sold or disposed of business property during the tax year.

Who Needs to File Form 4797 Part 1?

Any business that has sold or disposed of property during the tax year will need to file Form 4797 Part 1. This includes:

- Sole proprietorships

- Partnerships

- S corporations

- C corporations

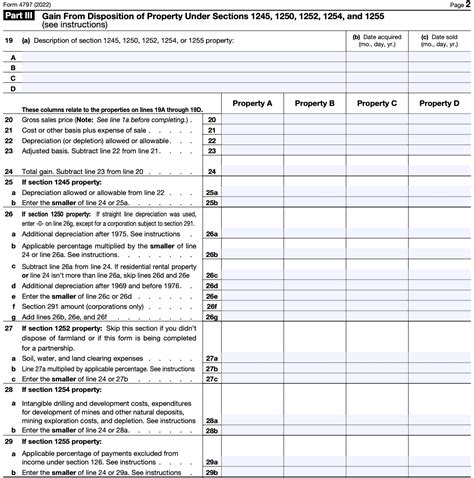

What Information is Required on Form 4797 Part 1?

To complete Form 4797 Part 1, you'll need to provide the following information:

- Description of the property sold

- Date of sale

- Sales price

- Basis of the property (i.e., the original purchase price plus any improvements)

- Depreciation taken on the property

- Gain or loss on the sale

How to Complete Form 4797 Part 1

Completing Form 4797 Part 1 involves several steps:

- Identify the property sold: List the property sold, including its description, date of sale, and sales price.

- Determine the basis: Calculate the basis of the property, including the original purchase price plus any improvements.

- Calculate depreciation: Calculate the depreciation taken on the property.

- Calculate gain or loss: Calculate the gain or loss on the sale, using the formula: Gain/Loss = Sales Price - Basis - Depreciation

- Report the gain or loss: Report the gain or loss on Form 4797 Part 1.

Example of Completing Form 4797 Part 1

Let's say you sold a piece of equipment for $10,000. The original purchase price was $5,000, and you've taken $2,000 in depreciation. To complete Form 4797 Part 1, you would:

- List the equipment as the property sold, with a sales price of $10,000.

- Calculate the basis: $5,000 (original purchase price) + $0 (improvements) = $5,000.

- Calculate depreciation: $2,000.

- Calculate gain or loss: $10,000 (sales price) - $5,000 (basis) - $2,000 (depreciation) = $3,000 gain.

- Report the gain on Form 4797 Part 1.

Benefits of Filing Form 4797 Part 1

Filing Form 4797 Part 1 provides several benefits, including:

- Accurate tax reporting: By reporting the sale of business property, you can ensure accurate tax reporting and avoid potential penalties.

- Claiming losses: If you've sold property at a loss, filing Form 4797 Part 1 allows you to claim that loss on your tax return.

- Reducing tax liability: By reporting gains and losses, you can reduce your tax liability and minimize your tax bill.

Common Mistakes to Avoid

When completing Form 4797 Part 1, it's essential to avoid common mistakes, including:

- Incorrect basis: Failing to calculate the correct basis of the property sold can result in incorrect gain or loss calculations.

- Depreciation errors: Failing to account for depreciation can result in incorrect gain or loss calculations.

- Failure to report: Failing to report the sale of business property can result in penalties and interest.

Tips for Completing Form 4797 Part 1

To ensure accurate and complete reporting, follow these tips:

- Keep accurate records: Keep accurate records of the property sold, including the sales price, basis, and depreciation.

- Consult a tax professional: If you're unsure about completing Form 4797 Part 1, consult a tax professional.

- Double-check calculations: Double-check your calculations to ensure accuracy.

Conclusion

Form 4797 Part 1 is a crucial form for businesses that have sold or disposed of property during the tax year. By understanding what information is required, how to complete the form, and avoiding common mistakes, you can ensure accurate tax reporting and minimize your tax liability. Remember to keep accurate records, consult a tax professional if needed, and double-check calculations to ensure accuracy.

FAQs

What is Form 4797 Part 1 used for?

+Form 4797 Part 1 is used to report the sale of business property, including the calculation of gains and losses.

Who needs to file Form 4797 Part 1?

+Any business that has sold or disposed of property during the tax year needs to file Form 4797 Part 1.

What information is required on Form 4797 Part 1?

+The form requires the description of the property sold, date of sale, sales price, basis of the property, depreciation taken, and gain or loss on the sale.