California is renowned for its thriving business environment, with many entrepreneurs and companies choosing to establish themselves in the state. However, navigating the complex landscape of California's tax laws and regulations can be a daunting task for many business owners. One crucial aspect of doing business in California is understanding the various tax forms and codes that apply to your company. In this article, we will delve into the specifics of California Form 3514, also known as the Business Code, and explore its significance for businesses operating in the state.

California Form 3514 is a vital document for businesses in the state, as it provides essential information about a company's tax obligations and compliance. In this article, we will discuss five essential facts about California Form 3514, including its purpose, the types of businesses that must file it, and the potential consequences of non-compliance.

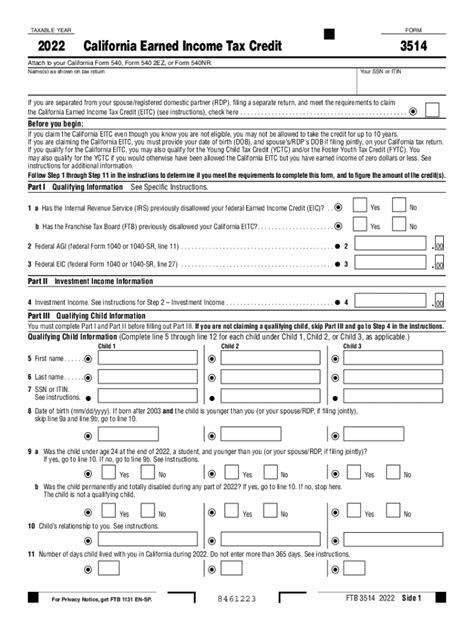

What is California Form 3514?

California Form 3514, also known as the Business Code, is a tax form used by the California Franchise Tax Board (FTB) to classify and identify businesses operating in the state. The form is used to assign a unique business code to each company, which is then used to track and report tax obligations, including income tax, sales tax, and employment tax.

Why is California Form 3514 Important?

California Form 3514 is essential for businesses operating in the state because it helps the FTB to:

- Classify businesses by industry and type

- Assign a unique business code for tax purposes

- Track and report tax obligations

- Identify potential tax compliance issues

By completing and submitting California Form 3514, businesses can ensure that they are in compliance with the state's tax laws and regulations, avoiding potential penalties and fines.

Who Must File California Form 3514?

Not all businesses operating in California are required to file Form 3514. The following types of businesses must file the form:

- Corporations and limited liability companies (LLCs)

- Partnerships and limited partnerships

- S corporations and sole proprietorships

- Businesses with employees or independent contractors

- Businesses with gross receipts exceeding $100,000

Businesses that are exempt from filing Form 3514 include:

- Non-profit organizations

- Government agencies

- Small businesses with gross receipts below $100,000

Consequences of Non-Compliance

Failure to file California Form 3514 or providing inaccurate information can result in severe consequences, including:

- Penalties and fines

- Interest on unpaid taxes

- Loss of business license or permit

- Audit and examination by the FTB

To avoid these consequences, businesses must ensure that they complete and submit Form 3514 accurately and on time.

How to Complete and Submit California Form 3514

Completing and submitting California Form 3514 involves the following steps:

- Download and complete the form from the FTB website or obtain a paper copy from the FTB office

- Provide accurate and complete information about the business, including its name, address, and industry classification

- Assign a unique business code using the FTB's business code classification system

- Submit the form electronically or by mail to the FTB office

Businesses can also consult with a tax professional or accountant to ensure that the form is completed accurately and on time.

Deadlines and Filing Requirements

The deadline for filing California Form 3514 varies depending on the business type and filing frequency. The following deadlines apply:

- Annual filers: March 15th

- Quarterly filers: April 15th, July 15th, October 15th, and January 15th

Businesses must file Form 3514 annually or quarterly, depending on their filing frequency. Failure to meet the filing deadline can result in penalties and fines.

Conclusion

California Form 3514 is a critical document for businesses operating in the state, providing essential information about tax obligations and compliance. By understanding the purpose, types of businesses that must file, and potential consequences of non-compliance, businesses can ensure that they are in compliance with the state's tax laws and regulations. If you have any questions or concerns about completing and submitting Form 3514, consult with a tax professional or accountant to ensure accuracy and timeliness.

We encourage you to share your experiences and insights about California Form 3514 in the comments section below. Your feedback will help other business owners navigate the complex world of California tax laws and regulations.

FAQ Section

What is the purpose of California Form 3514?

+California Form 3514 is used to classify and identify businesses operating in the state, assigning a unique business code for tax purposes.

Who must file California Form 3514?

+Corporations, LLCs, partnerships, S corporations, and sole proprietorships with employees or independent contractors must file Form 3514.

What are the consequences of non-compliance with California Form 3514?

+Failure to file or providing inaccurate information can result in penalties, fines, interest on unpaid taxes, and loss of business license or permit.