HSBC, one of the largest banking and financial services organizations in the world, requires certain documentation from its customers to ensure compliance with various regulatory requirements. One such document is the W-9 form, also known as the Request for Taxpayer Identification Number and Certification. In this article, we will provide a step-by-step guide on how to complete the HSBC W9 form.

What is the HSBC W9 Form?

The HSBC W9 form is a document required by the bank to obtain the taxpayer identification number (TIN) and certification of its customers. The TIN is a unique number assigned to each taxpayer by the Internal Revenue Service (IRS) in the United States. The W9 form is used to certify the taxpayer's identity and provide the necessary information to HSBC to report income and taxes to the IRS.

Why is the HSBC W9 Form Required?

The HSBC W9 form is required for several reasons:

- To comply with the IRS regulations and reporting requirements

- To verify the taxpayer's identity and certification

- To obtain the taxpayer's TIN for reporting purposes

- To ensure that HSBC is in compliance with the Foreign Account Tax Compliance Act (FATCA) and other regulatory requirements

Who Needs to Complete the HSBC W9 Form?

The following individuals and entities need to complete the HSBC W9 form:

- U.S. citizens and resident aliens

- Non-U.S. citizens and non-resident aliens with U.S. sourced income

- Businesses and entities with a U.S. tax identification number

- Beneficiaries of HSBC accounts, including trusts and estates

How to Complete the HSBC W9 Form

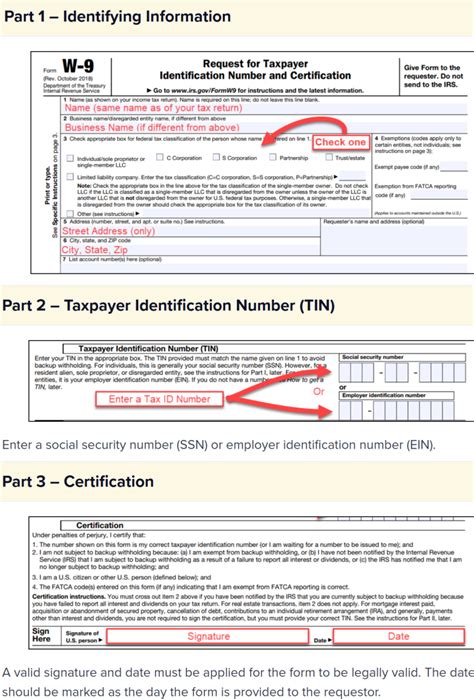

Here is a step-by-step guide on how to complete the HSBC W9 form:

- Download the Form: Download the W9 form from the IRS website or obtain a copy from HSBC.

- Read the Instructions: Read the instructions carefully before completing the form.

- Provide Your Name and Business Name: Enter your name and business name (if applicable) in the first section of the form.

- Provide Your Address: Enter your address in the second section of the form.

- Provide Your Taxpayer Identification Number: Enter your TIN in the third section of the form. If you are an individual, your TIN is your Social Security number or Individual Taxpayer Identification Number (ITIN).

- Certify Your Taxpayer Identification Number: Certify that the TIN provided is correct and that you are not subject to backup withholding.

- Sign and Date the Form: Sign and date the form in the presence of a notary public (if required).

- Return the Form to HSBC: Return the completed form to HSBC by mail, email, or in person.

Special Considerations

- Entity Types: If you are an entity, such as a corporation, partnership, or trust, you may need to provide additional documentation, such as a certificate of incorporation or a trust agreement.

- Beneficiaries: If you are a beneficiary of an HSBC account, you may need to provide additional documentation, such as a trust agreement or a will.

- Non-U.S. Citizens: If you are a non-U.S. citizen, you may need to provide additional documentation, such as a certificate of foreign status or a withholding certificate.

Consequences of Not Completing the HSBC W9 Form

Failure to complete the HSBC W9 form may result in the following consequences:

- Backup Withholding: HSBC may be required to withhold a portion of your income and report it to the IRS.

- Penalties and Fines: You may be subject to penalties and fines for failure to provide the required documentation.

- Account Restrictions: HSBC may restrict or close your account if you fail to provide the required documentation.

Conclusion

In conclusion, the HSBC W9 form is a required document for HSBC customers to provide their taxpayer identification number and certification. Failure to complete the form may result in backup withholding, penalties, and fines. It is essential to complete the form accurately and return it to HSBC in a timely manner.

Take Action: If you are an HSBC customer, take action today to complete the W9 form and return it to HSBC. If you have any questions or concerns, contact HSBC customer support for assistance.

Share Your Experience: Share your experience with completing the HSBC W9 form in the comments section below. Your feedback will help others who may be going through the same process.

Additional Resources: For additional resources and information on the HSBC W9 form, visit the IRS website or contact HSBC customer support.

What is the purpose of the HSBC W9 form?

+The purpose of the HSBC W9 form is to obtain the taxpayer identification number (TIN) and certification of HSBC customers.

Who needs to complete the HSBC W9 form?

+U.S. citizens and resident aliens, non-U.S. citizens and non-resident aliens with U.S. sourced income, businesses and entities with a U.S. tax identification number, and beneficiaries of HSBC accounts need to complete the HSBC W9 form.

What are the consequences of not completing the HSBC W9 form?

+Failure to complete the HSBC W9 form may result in backup withholding, penalties, and fines, as well as account restrictions or closure.