Mastering Form 1120 M-3 is crucial for corporations and businesses that require precise and detailed financial reporting. The complexities of this form can be overwhelming, but with the right guidance, you can navigate the process with ease. In this article, we will delve into the world of Form 1120 M-3, exploring its purpose, benefits, and providing five essential filing tips to ensure accuracy and compliance.

Understanding the Purpose of Form 1120 M-3

Form 1120 M-3 is an essential component of the corporate tax return, providing a detailed breakdown of a company's financial performance. The form is used to report a corporation's income, deductions, and credits, and is typically filed along with Form 1120, the U.S. Corporation Income Tax Return. By accurately completing Form 1120 M-3, corporations can ensure compliance with the Internal Revenue Code (IRC) and avoid potential penalties.

Benefits of Accurate Form 1120 M-3 Filing

Accurate filing of Form 1120 M-3 offers numerous benefits, including:

- Enhanced financial transparency and accountability

- Improved compliance with tax laws and regulations

- Reduced risk of audits and penalties

- Increased efficiency in financial reporting and planning

5 Essential Filing Tips for Form 1120 M-3

To ensure accurate and compliant filing of Form 1120 M-3, follow these five essential tips:

Tip 1: Understand the Components of Form 1120 M-3

Form 1120 M-3 consists of several components, including:

- Part I: Income Statement

- Part II: Reconciliation of Income (Loss) per Books With Income (Loss) per Return

- Part III: Reconciliation of Unrelated Business Income Tax (UBIT)

- Part IV: Miscellaneous Information

Understanding each component is crucial for accurate filing.

Part I: Income Statement

Part I of Form 1120 M-3 requires corporations to report their income from various sources, including sales, services, and investments. Ensure accurate reporting of income and account for any adjustments or reconciliations.

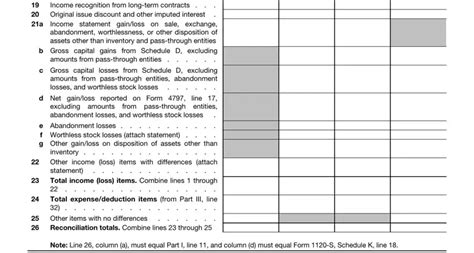

Part II: Reconciliation of Income (Loss) per Books With Income (Loss) per Return

Part II requires corporations to reconcile their book income with their tax return income. This involves accounting for differences between financial statement income and taxable income.

Part III: Reconciliation of Unrelated Business Income Tax (UBIT)

Part III focuses on unrelated business income tax (UBIT) and requires corporations to report UBIT income and calculate UBIT tax liability.

Part IV: Miscellaneous Information

Part IV is used to report miscellaneous information, such as depreciation, amortization, and other adjustments.

Tip 2: Maintain Accurate and Detailed Financial Records

Accurate and detailed financial records are essential for completing Form 1120 M-3. Ensure that your financial records are:

- Up-to-date and accurate

- Detailed and comprehensive

- Organized and easily accessible

Maintaining accurate financial records will help you navigate the complexities of Form 1120 M-3 and ensure compliance.

Tip 3: Reconcile Financial Statements with Tax Returns

Reconciling financial statements with tax returns is crucial for accurate filing of Form 1120 M-3. Ensure that:

- Financial statements are accurate and up-to-date

- Tax returns are accurate and complete

- Reconciliations are performed regularly and thoroughly

Regular reconciliations will help identify any discrepancies or errors, ensuring accurate filing.

Tip 4: Seek Professional Guidance When Needed

Form 1120 M-3 can be complex and overwhelming. Don't hesitate to seek professional guidance when needed. Consult with a tax professional or accountant to ensure accurate filing and compliance.

Tip 5: Review and Verify Form 1120 M-3 Before Filing

Before filing Form 1120 M-3, review and verify the accuracy of the information. Ensure that:

- All components are complete and accurate

- Financial records are up-to-date and accurate

- Reconciliations are performed and accurate

Verifying the accuracy of Form 1120 M-3 will help avoid errors, penalties, and potential audits.

By following these five essential filing tips, corporations can ensure accurate and compliant filing of Form 1120 M-3, reducing the risk of audits and penalties.

What's Next?

Mastering Form 1120 M-3 requires dedication and attention to detail. By following these tips and staying up-to-date with the latest tax laws and regulations, corporations can ensure accurate and compliant filing. Share your experiences and tips for filing Form 1120 M-3 in the comments below!

What is Form 1120 M-3 used for?

+Form 1120 M-3 is used to report a corporation's income, deductions, and credits, and is typically filed along with Form 1120, the U.S. Corporation Income Tax Return.

What are the components of Form 1120 M-3?

+Form 1120 M-3 consists of several components, including Part I: Income Statement, Part II: Reconciliation of Income (Loss) per Books With Income (Loss) per Return, Part III: Reconciliation of Unrelated Business Income Tax (UBIT), and Part IV: Miscellaneous Information.

Why is it important to reconcile financial statements with tax returns?

+Reconciling financial statements with tax returns is crucial for accurate filing of Form 1120 M-3, as it helps identify any discrepancies or errors, ensuring accurate filing and compliance.