Filling out Form AZ-8879, also known as the "Arizona Tuition Deduction for Contributions to School Tuition Organizations" form, is a straightforward process that can help you take advantage of Arizona's tax deduction for contributions to school tuition organizations. In this article, we will break down the form into manageable sections and provide step-by-step instructions on how to fill it out.

Understanding Form AZ-8879

Before we dive into the instructions, it's essential to understand what Form AZ-8879 is and what it's used for. The form is used to claim a tax deduction for contributions made to school tuition organizations (STOs) in Arizona. STOs are non-profit organizations that provide scholarships to students attending private schools in Arizona.

What is a School Tuition Organization (STO)?

A school tuition organization (STO) is a non-profit organization that provides scholarships to students attending private schools in Arizona. STOs are established under Arizona Revised Statutes (ARS) 43-1083 and are subject to specific regulations.

Filling Out Form AZ-8879

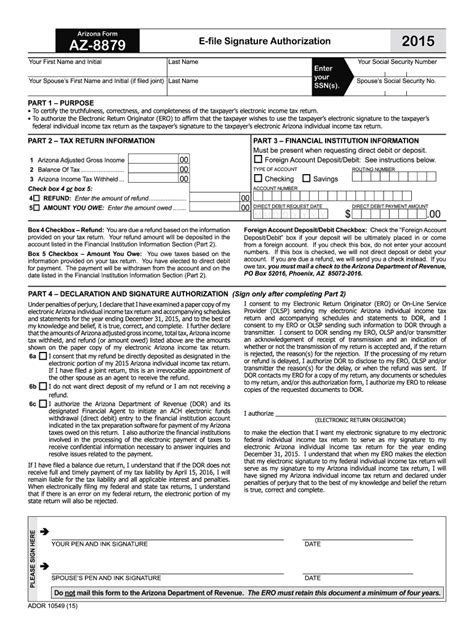

Now that we understand the purpose of Form AZ-8879, let's move on to filling it out. The form is relatively straightforward, but we'll break it down into sections to ensure accuracy.

Section 1: Taxpayer Information

- Name: Enter your name as it appears on your Arizona tax return.

- Spouse's Name (if joint return): If you're filing a joint return, enter your spouse's name.

- Social Security Number or Individual Taxpayer Identification Number (ITIN): Enter your Social Security Number or ITIN.

Section 2: Contribution Information

- Name of School Tuition Organization (STO): Enter the name of the STO to which you made the contribution.

- Federal Employer Identification Number (FEIN): Enter the FEIN of the STO.

- Date of Contribution: Enter the date you made the contribution.

- Amount of Contribution: Enter the amount of your contribution.

Section 3: Qualified Tuition Reduction

- Name of Student: Enter the name of the student who received the tuition reduction.

- Student's Social Security Number or ITIN: Enter the student's Social Security Number or ITIN.

- Amount of Tuition Reduction: Enter the amount of tuition reduction received by the student.

Section 4: Certification

- I certify that the above information is accurate: Check the box to certify that the information provided is accurate.

Common Mistakes to Avoid

When filling out Form AZ-8879, there are a few common mistakes to avoid:

- Inaccurate taxpayer information: Ensure that your name, Social Security Number, and address are accurate.

- Incorrect STO information: Verify the STO's name, FEIN, and address.

- Incorrect contribution date: Ensure that the contribution date is accurate.

- Incorrect tuition reduction amount: Verify the tuition reduction amount.

Submission and Deadline

Once you've completed Form AZ-8879, submit it to the Arizona Department of Revenue by the deadline, which is typically April 15th for individual tax returns. You can submit the form electronically or by mail.

Conclusion

Filling out Form AZ-8879 is a relatively straightforward process that can help you take advantage of Arizona's tax deduction for contributions to school tuition organizations. By following the instructions outlined in this article and avoiding common mistakes, you can ensure accuracy and submit your form on time.

Call to Action: If you have any questions or concerns about filling out Form AZ-8879, please don't hesitate to reach out to us. We're here to help.

FAQ Section:

What is the deadline for submitting Form AZ-8879?

+The deadline for submitting Form AZ-8879 is typically April 15th for individual tax returns.

Can I submit Form AZ-8879 electronically?

+Yes, you can submit Form AZ-8879 electronically through the Arizona Department of Revenue's website.

What is a school tuition organization (STO)?

+A school tuition organization (STO) is a non-profit organization that provides scholarships to students attending private schools in Arizona.