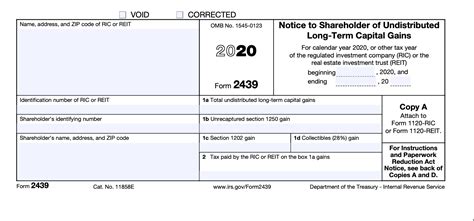

Form 2439 is a tax document used to report undistributed long-term capital gains, which are a type of investment income. If you have received a Form 2439, you may be wondering where to report this information on your tax return. In this article, we will guide you through the process of reporting Form 2439 on your tax return.

Understanding Form 2439

Form 2439 is an informational tax document that reports undistributed long-term capital gains from mutual funds, real estate investment trusts (REITs), and other types of investment entities. These gains are typically reported on a Schedule D (Form 1040), which is the tax form used to report capital gains and losses.

Types of Investments Reported on Form 2439

The following types of investments may report undistributed long-term capital gains on Form 2439:

- Mutual funds

- Real estate investment trusts (REITs)

- Real estate mutual funds

- Exchange-traded funds (ETFs)

- Closed-end funds

Where to Report Form 2439 on Your Tax Return

To report Form 2439 on your tax return, you will need to complete the following steps:

- Report on Schedule D (Form 1040): Report the undistributed long-term capital gains from Form 2439 on Schedule D (Form 1040). This schedule is used to report capital gains and losses from the sale of investments.

- Complete Form 8949: If you have sold any investments, you will also need to complete Form 8949, which is used to report sales and other dispositions of capital assets.

- Report on Form 1040: Report the total capital gains and losses from Schedule D on Form 1040.

Step-by-Step Instructions

Here are the step-by-step instructions for reporting Form 2439 on your tax return:

- Enter the undistributed long-term capital gains: Enter the undistributed long-term capital gains from Form 2439 on Line 13 of Schedule D (Form 1040).

- Complete Form 8949: If you have sold any investments, complete Form 8949 to report the sales and other dispositions of capital assets.

- Report on Form 1040: Report the total capital gains and losses from Schedule D on Line 13 of Form 1040.

Additional Reporting Requirements

In addition to reporting Form 2439 on your tax return, you may also need to complete other tax forms, such as:

- Form 8615: If you have children who have received unearned income, such as investment income, you may need to complete Form 8615, which is used to report the kiddie tax.

- Form 8949: If you have sold any investments, you will need to complete Form 8949 to report the sales and other dispositions of capital assets.

Common Errors to Avoid

Here are some common errors to avoid when reporting Form 2439 on your tax return:

- Failure to report undistributed long-term capital gains: Make sure to report the undistributed long-term capital gains from Form 2439 on Schedule D (Form 1040).

- Failure to complete Form 8949: If you have sold any investments, make sure to complete Form 8949 to report the sales and other dispositions of capital assets.

- Failure to report on Form 1040: Make sure to report the total capital gains and losses from Schedule D on Form 1040.

Conclusion

Reporting Form 2439 on your tax return can be a complex process, but by following the steps outlined in this article, you can ensure that you report this information correctly. Remember to report the undistributed long-term capital gains from Form 2439 on Schedule D (Form 1040), complete Form 8949 if necessary, and report the total capital gains and losses on Form 1040.

We hope this article has been helpful in guiding you through the process of reporting Form 2439 on your tax return. If you have any further questions or concerns, please don't hesitate to reach out to a tax professional or the IRS for assistance.

Take Action

If you have received a Form 2439, take action today to report this information on your tax return. Don't wait until the last minute to file your taxes - gather all the necessary documents and seek professional help if needed. By reporting Form 2439 correctly, you can avoid any potential penalties or fines.

What is Form 2439?

+Form 2439 is an informational tax document that reports undistributed long-term capital gains from mutual funds, real estate investment trusts (REITs), and other types of investment entities.

Where do I report Form 2439 on my tax return?

+Report the undistributed long-term capital gains from Form 2439 on Schedule D (Form 1040). If you have sold any investments, complete Form 8949 to report the sales and other dispositions of capital assets. Report the total capital gains and losses from Schedule D on Form 1040.

What are the additional reporting requirements for Form 2439?

+In addition to reporting Form 2439 on your tax return, you may also need to complete other tax forms, such as Form 8615 (kiddie tax) and Form 8949 (sales and other dispositions of capital assets).