The world of Twitch streaming has grown exponentially in recent years, with thousands of creators building communities and earning money through subscriptions, donations, and ad revenue. As a Twitch streamer, you're considered self-employed and are required to report your income and expenses on your tax return. The 1099 form is a crucial document that helps you do just that. In this article, we'll break down the 1099 form and provide 5 essential tips for navigating it as a Twitch streamer.

Understanding the 1099 Form

The 1099 form is a series of documents that the Internal Revenue Service (IRS) uses to report various types of income, such as freelance work, interest, and dividends. As a Twitch streamer, you'll receive a 1099-MISC form from Twitch, which reports the amount of money you earned from the platform in a given tax year. This form will show the total amount of money you earned from subscriptions, donations, and ad revenue.

Why is the 1099 Form Important?

The 1099 form is essential for tax purposes, as it helps you report your income accurately. As a self-employed individual, you're responsible for reporting your income and expenses on your tax return. The 1099 form provides a record of your income, which you'll use to complete your tax return. Failure to report your income accurately can result in penalties and fines, so it's crucial to understand the 1099 form and how to use it.

Tip 1: Keep Accurate Records

As a Twitch streamer, it's essential to keep accurate records of your income and expenses. This includes:

- Bank statements

- PayPal receipts

- Invoices from contractors or freelancers

- Records of equipment purchases

Having accurate records will help you complete your tax return accurately and ensure you're taking advantage of all the deductions you're eligible for.

How to Keep Accurate Records

There are several ways to keep accurate records, including:

- Using accounting software, such as QuickBooks or Xero

- Creating a spreadsheet to track your income and expenses

- Keeping a folder or binder with all your receipts and invoices

Tip 2: Understand Your Tax Obligations

As a self-employed individual, you're responsible for paying self-employment tax on your net earnings from self-employment. This includes income from Twitch, as well as any other freelance or business income you earn. You'll need to file Form 1040 and Schedule C to report your income and expenses.

What is Self-Employment Tax?

Self-employment tax is a tax on your net earnings from self-employment. This includes income from Twitch, as well as any other freelance or business income you earn. The self-employment tax rate is 15.3% of your net earnings from self-employment, which includes 12.4% for Social Security and 2.9% for Medicare.

Tip 3: Take Advantage of Deductions

As a Twitch streamer, you may be eligible for several deductions that can help reduce your taxable income. These include:

- Home office deduction: If you use a dedicated space for your Twitch streaming setup, you may be eligible for a home office deduction.

- Equipment deductions: You can deduct the cost of equipment, such as a computer, webcam, and microphone.

- Software deductions: You can deduct the cost of software, such as video editing software or streaming software.

- Travel deductions: If you attend gaming events or conferences, you may be eligible for travel deductions.

How to Take Advantage of Deductions

To take advantage of deductions, you'll need to keep accurate records of your expenses. This includes:

- Saving receipts for equipment and software purchases

- Keeping a log of your business use of your home

- Tracking your travel expenses

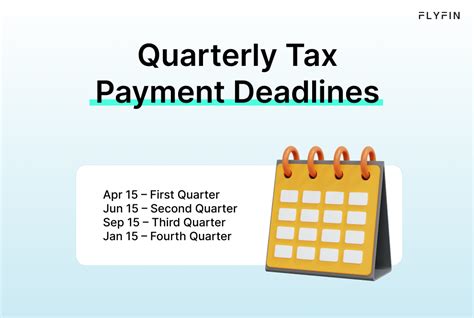

Tip 4: File Your Taxes on Time

It's essential to file your taxes on time to avoid penalties and fines. The deadline for filing your taxes is typically April 15th, but you can file for an extension if you need more time.

What Happens if You Miss the Deadline?

If you miss the deadline, you may be subject to penalties and fines. These can include:

- Late filing penalty: 5% of the unpaid tax for each month or part of a month, up to a maximum of 25%

- Late payment penalty: 0.5% of the unpaid tax for each month or part of a month, up to a maximum of 25%

Tip 5: Seek Professional Help

If you're unsure about how to navigate the 1099 form or complete your tax return, it's essential to seek professional help. A tax professional can help you ensure you're taking advantage of all the deductions you're eligible for and that you're reporting your income accurately.

How to Find a Tax Professional

There are several ways to find a tax professional, including:

- Asking for referrals from friends or family members

- Searching online for tax professionals in your area

- Checking with professional organizations, such as the National Association of Enrolled Agents (NAEA)

In conclusion, navigating the 1099 form as a Twitch streamer requires careful attention to detail and a understanding of your tax obligations. By keeping accurate records, understanding your tax obligations, taking advantage of deductions, filing your taxes on time, and seeking professional help, you can ensure you're reporting your income accurately and taking advantage of all the deductions you're eligible for.

What are your experiences with navigating the 1099 form as a Twitch streamer? Share your tips and advice in the comments below!

What is the deadline for filing my taxes?

+The deadline for filing your taxes is typically April 15th, but you can file for an extension if you need more time.

What happens if I miss the deadline?

+If you miss the deadline, you may be subject to penalties and fines, including a late filing penalty and a late payment penalty.

How do I find a tax professional?

+You can find a tax professional by asking for referrals from friends or family members, searching online for tax professionals in your area, or checking with professional organizations, such as the National Association of Enrolled Agents (NAEA).