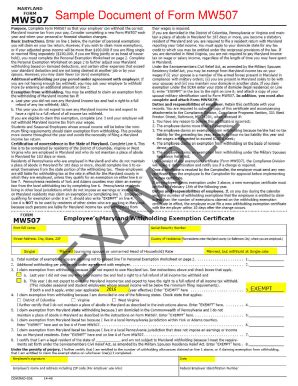

Completing the MW507 form, also known as the Maryland Employee's Withholding Exemption Certificate, is a crucial task for both employers and employees in the state of Maryland. This form is used to determine the correct amount of state income tax to withhold from an employee's wages. In this article, we will walk you through the 5 easy steps to fill out the MW507 form accurately and efficiently.

Step 1: Gather Required Information

Before starting to fill out the MW507 form, it's essential to gather all the necessary information. This includes:

- Employee's name and address

- Employee's Social Security number or Individual Taxpayer Identification Number (ITIN)

- Number of exemptions claimed

- Filing status (single, married, head of household, etc.)

- Number of dependents

Having this information readily available will make the process of filling out the form much smoother.

What You Need to Know About Exemptions

In Maryland, an exemption is a certain amount of money that is subtracted from an employee's taxable income. The number of exemptions an employee claims will affect the amount of state income tax withheld from their wages. It's essential to understand the different types of exemptions available, including:

- Personal exemption: This is a standard exemption that every employee is eligible for.

- Dependent exemption: This is an exemption for each dependent the employee claims.

- Other exemptions: There may be additional exemptions available, such as for blindness or disability.

Step 2: Determine Your Filing Status

Your filing status will also impact the amount of state income tax withheld from your wages. The MW507 form allows you to choose from the following filing statuses:

- Single

- Married

- Head of household

- Qualifying widow(er)

It's essential to choose the correct filing status to ensure accurate tax withholding.

Step 3: Calculate Your Exemptions

Once you have determined your filing status, you can calculate your exemptions. The MW507 form provides a worksheet to help you calculate the number of exemptions you are eligible for. Be sure to follow the instructions carefully and use the correct numbers to avoid errors.

How to Calculate Your Exemptions

To calculate your exemptions, you will need to consider the following:

- Number of dependents

- Filing status

- Personal exemption

- Other exemptions (if applicable)

Use the worksheet provided on the MW507 form to calculate your total exemptions.

Step 4: Complete the MW507 Form

Now that you have gathered all the necessary information and calculated your exemptions, it's time to complete the MW507 form. Be sure to:

- Fill out the form accurately and legibly

- Use black or blue ink

- Sign and date the form

Step 5: Submit the Form to Your Employer

Once you have completed the MW507 form, submit it to your employer. Your employer will use the information on the form to determine the correct amount of state income tax to withhold from your wages.

What Happens Next

After submitting the MW507 form to your employer, you can expect the following:

- Your employer will update your tax withholding information

- Your state income tax withholding will be adjusted accordingly

- You will receive a new pay stub reflecting the changes

By following these 5 easy steps, you can ensure that your MW507 form is completed accurately and efficiently.

What is the purpose of the MW507 form?

+The MW507 form is used to determine the correct amount of state income tax to withhold from an employee's wages in the state of Maryland.

How often do I need to complete the MW507 form?

+You typically need to complete the MW507 form when you start a new job or when your tax withholding information changes.

Can I submit the MW507 form electronically?

+Check with your employer to see if they accept electronic submissions of the MW507 form.

We hope this article has been helpful in guiding you through the process of filling out the MW507 form. If you have any further questions or concerns, don't hesitate to reach out to your employer or a tax professional.