As a resident of Idaho, it's essential to understand the process of filing your state tax return, also known as Form 40. Filing your taxes accurately and on time is crucial to avoid any penalties or delays in receiving your refund. In this article, we will provide a comprehensive guide on how to file your Idaho State Tax Form 40.

Understanding Form 40

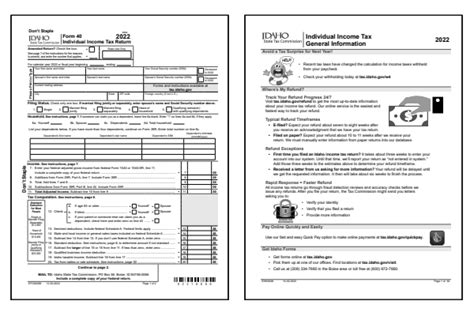

Form 40 is the standard form used by the Idaho State Tax Commission to report your state income tax. It's a straightforward form that requires you to report your income, deductions, and credits. The form is typically due on April 15th of each year, but it's recommended to file as soon as possible to avoid any delays.

Gathering Necessary Documents

Before you start filing your Form 40, make sure you have all the necessary documents. These may include:

- Your federal income tax return (Form 1040)

- W-2 forms from your employer(s)

- 1099 forms for any freelance work or self-employment income

- Interest statements from your bank(s)

- Dividend statements from your investments

- Charitable donation receipts

Residency Status

As an Idaho resident, you'll need to determine your residency status. You're considered a resident if you:

- Live in Idaho for more than 6 months of the year

- Have a permanent home in Idaho

- Are registered to vote in Idaho

If you're a non-resident or part-year resident, you may need to file a different form or report your income differently.

Filing Status

Your filing status will determine the tax rates and deductions you're eligible for. The filing statuses in Idaho are:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

Income Reporting

On Form 40, you'll need to report all your income from various sources, including:

- Wages, salaries, and tips

- Self-employment income

- Interest and dividends

- Capital gains and losses

- Rental income

Deductions and Credits

Idaho offers various deductions and credits to reduce your tax liability. These may include:

- Standard deduction or itemized deductions

- Mortgage interest deduction

- Charitable donation deduction

- Earned Income Tax Credit (EITC)

- Child Tax Credit

Filing Options

You have several options to file your Form 40:

- E-file: File electronically through the Idaho State Tax Commission's website or through a tax software provider.

- Mail: Mail your paper return to the Idaho State Tax Commission.

- Tax professional: Hire a tax professional to prepare and file your return.

Payment Options

If you owe taxes, you can pay online, by phone, or by mail. Idaho also offers payment plans and installment agreements if you're unable to pay your tax bill in full.

Refund Options

If you're due a refund, you can choose to:

- Receive a direct deposit into your bank account

- Receive a paper check

- Apply your refund to next year's tax bill

Audit and Appeal Process

If you're selected for an audit, the Idaho State Tax Commission will notify you in writing. You have the right to appeal any audit findings or tax assessments.

FAQs

What is the deadline for filing Form 40?

+The deadline for filing Form 40 is typically April 15th of each year.

Can I file my Form 40 electronically?

+Yes, you can file your Form 40 electronically through the Idaho State Tax Commission's website or through a tax software provider.

What if I owe taxes and can't pay my bill in full?

+Idaho offers payment plans and installment agreements if you're unable to pay your tax bill in full.

Conclusion

Filing your Idaho State Tax Form 40 can seem daunting, but with the right guidance, you can ensure you're taking advantage of all the deductions and credits available to you. Remember to gather all necessary documents, determine your residency status, and choose the filing option that works best for you. If you have any questions or concerns, don't hesitate to reach out to the Idaho State Tax Commission or a tax professional.

We hope this comprehensive guide has helped you understand the process of filing your Form 40. If you have any further questions or need additional assistance, please don't hesitate to comment below or share this article with others who may benefit from it.