Filling out a Paycor direct deposit form is a straightforward process that allows you to receive your paychecks electronically, eliminating the need for paper checks and ensuring that your funds are deposited directly into your bank account. This process is convenient, secure, and environmentally friendly. Here are the 5 easy steps to fill out a Paycor direct deposit form:

Understanding the Benefits of Direct Deposit

Before we dive into the steps to fill out the form, it's essential to understand the benefits of direct deposit. With direct deposit, you can enjoy faster access to your funds, reduced risk of lost or stolen checks, and lower fees compared to traditional paper checks. Additionally, direct deposit helps reduce paper waste, making it an eco-friendly option.

What You Need to Get Started

To fill out the Paycor direct deposit form, you'll need the following information:

- Your bank account number

- Your bank routing number

- Your bank name and address

- A voided check or a deposit slip to verify your account information

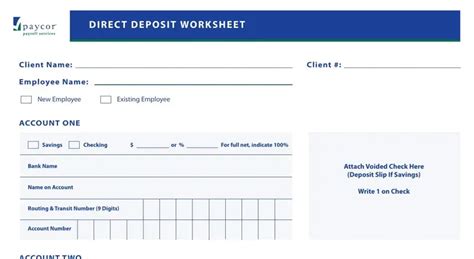

Step 1: Download and Print the Form

You can download the Paycor direct deposit form from the Paycor website or obtain a copy from your HR representative. Once you have the form, print it out and ensure you have a pen or pencil ready to fill it out.

Step 2: Fill Out Your Employee Information

Start by filling out your employee information, including:

- Your name

- Your employee ID number (if applicable)

- Your address

- Your social security number or tax ID number

Ensure that your information is accurate and matches the information on file with your employer.

Step 3: Enter Your Bank Account Information

Next, fill out your bank account information, including:

- Your bank account number

- Your bank routing number

- Your bank name and address

You can find this information on a voided check or a deposit slip. Ensure that your account information is accurate to avoid any errors or delays in processing your direct deposit.

Step 4: Specify Your Deposit Allocation

You can choose to allocate your direct deposit to multiple accounts, such as a primary account and a secondary account. Specify the percentage or dollar amount you want to allocate to each account.

Step 5: Review and Submit the Form

Review your form carefully to ensure that all the information is accurate and complete. Sign and date the form, then submit it to your HR representative or the designated contact person.

What to Expect Next

Once you've submitted the form, your HR representative will review and process it. You can expect to receive a confirmation email or notification when your direct deposit is set up. Your first direct deposit will typically take place on the next available pay date.

By following these 5 easy steps, you can fill out the Paycor direct deposit form and start enjoying the convenience and security of electronic direct deposit.

What is the deadline for submitting the direct deposit form?

+The deadline for submitting the direct deposit form may vary depending on your employer's payroll schedule. It's best to check with your HR representative for specific deadlines.

Can I change my direct deposit information after submitting the form?

+Yes, you can change your direct deposit information by submitting a new form or contacting your HR representative. Ensure that you provide accurate and updated information to avoid any errors or delays.

How long does it take for the direct deposit to take effect?

+The direct deposit typically takes effect on the next available pay date after submitting the form. However, this may vary depending on your employer's payroll schedule and processing time.