Filing taxes can be a daunting task, especially when dealing with state-specific forms. In Oklahoma, residents and non-residents alike must navigate the complexities of state income tax returns. Oklahoma Form 512 is the primary document used for reporting state income taxes. In this article, we will delve into the intricacies of Oklahoma Form 512, providing a comprehensive guide to help individuals and businesses understand the process.

Understanding Oklahoma Form 512

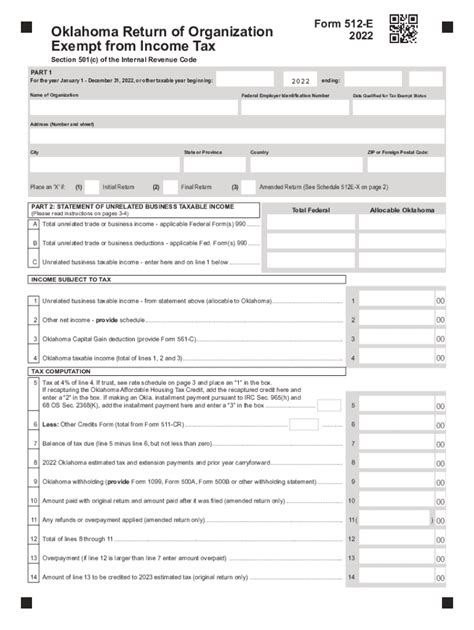

Oklahoma Form 512 is the standard form used for reporting Oklahoma state income taxes. It is used by residents, non-residents, and businesses to report their income earned within the state. The form is divided into several sections, each requiring specific information about the taxpayer's income, deductions, and credits.

Who Must File Oklahoma Form 512?

Not everyone is required to file Oklahoma Form 512. To determine if you need to file, consider the following:

- Residents: If you are a resident of Oklahoma, you must file Form 512 if your gross income exceeds the minimum filing threshold, which varies based on filing status and age.

- Non-residents: If you are a non-resident with Oklahoma-source income, you must file Form 512 to report that income.

- Businesses: Oklahoma businesses, including corporations, partnerships, and sole proprietorships, must file Form 512 to report their state income taxes.

What Information is Required on Oklahoma Form 512?

To complete Oklahoma Form 512, you will need to gather various documents and information, including:

- Federal income tax return (Form 1040)

- W-2 forms

- 1099 forms

- Interest and dividend statements

- Oklahoma-specific tax credits and deductions

Step-by-Step Guide to Filing Oklahoma Form 512

Filing Oklahoma Form 512 involves several steps:

- Gather required documents: Collect all necessary documents and information before starting the filing process.

- Choose the correct filing status: Select the correct filing status, which affects the minimum filing threshold and tax rates.

- Report income: Report all income earned within Oklahoma, including wages, tips, and self-employment income.

- Claim deductions and credits: Claim Oklahoma-specific deductions and credits, such as the Oklahoma standard deduction or the Oklahoma earned income tax credit.

- Calculate tax liability: Calculate your tax liability based on your income, deductions, and credits.

- Submit the return: Submit the completed Form 512 to the Oklahoma Tax Commission by the designated deadline.

Oklahoma Tax Credits and Deductions

Oklahoma offers various tax credits and deductions to reduce tax liability. Some of the most common include:

- Oklahoma standard deduction: A deduction of up to $6,300 for single filers and $12,600 for joint filers.

- Oklahoma earned income tax credit: A credit of up to $100 for low-income working individuals and families.

- Oklahoma child care credit: A credit of up to $100 for child care expenses.

Common Errors to Avoid

When filing Oklahoma Form 512, it's essential to avoid common errors that can lead to delays or penalties:

- Incorrect filing status: Ensure you choose the correct filing status to avoid incorrect tax rates or minimum filing thresholds.

- Incomplete or missing information: Ensure all required documents and information are included to avoid delays or penalties.

- Math errors: Double-check calculations to avoid errors in tax liability or refund amounts.

Amending Oklahoma Form 512

If you need to make changes to your original return, you can file an amended return using Form 512X. This form is used to correct errors or report additional income.

Oklahoma Tax Commission Resources

The Oklahoma Tax Commission provides various resources to help taxpayers navigate the filing process:

- Oklahoma Tax Commission website: Access forms, instructions, and FAQs on the Oklahoma Tax Commission website.

- Taxpayer assistance: Contact the Oklahoma Tax Commission for assistance with filing or questions about the process.

Frequently Asked Questions

What is the minimum filing threshold for Oklahoma Form 512?

+The minimum filing threshold for Oklahoma Form 512 varies based on filing status and age. For the 2022 tax year, the minimum filing threshold is $12,400 for single filers and $24,800 for joint filers.

Can I file Oklahoma Form 512 electronically?

+What is the deadline for filing Oklahoma Form 512?

+The deadline for filing Oklahoma Form 512 is April 15th of each year.

We hope this guide has provided you with a comprehensive understanding of Oklahoma Form 512 and the filing process. Remember to gather all necessary documents, choose the correct filing status, and claim deductions and credits to minimize your tax liability. If you have any further questions or concerns, don't hesitate to contact the Oklahoma Tax Commission or seek professional assistance.