FERC Form 556 is a crucial document required by the Federal Energy Regulatory Commission (FERC) for public utilities and licensees to report on their activities. Filing this form accurately and on time is essential to maintain compliance with FERC regulations. In this article, we will provide you with 5 essential tips to help you navigate the FERC Form 556 filing process successfully.

Understanding the Purpose and Scope of FERC Form 556

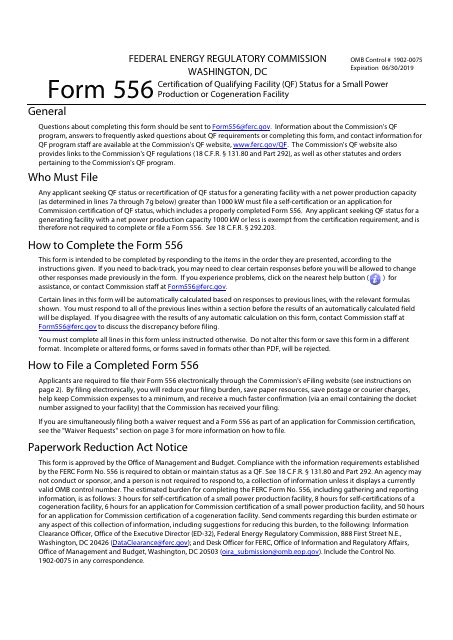

Before diving into the tips, it's essential to understand the purpose and scope of FERC Form 556. This form is designed to collect information on the activities of public utilities and licensees, including their financial performance, operational data, and compliance with FERC regulations. The data collected through this form helps FERC to monitor and regulate the energy industry, ensuring that companies operate in a safe, reliable, and efficient manner.

Benefits of Accurate and Timely FERC Form 556 Filings

Accurate and timely FERC Form 556 filings offer several benefits to public utilities and licensees. These include:

- Avoiding penalties and fines for non-compliance

- Demonstrating transparency and accountability in operations

- Enhancing credibility with stakeholders, including investors and customers

- Providing valuable insights into industry trends and best practices

Tips for Successful FERC Form 556 Filings

Now, let's move on to the 5 essential tips for successful FERC Form 556 filings:

Tip 1: Understand the Filing Requirements and Deadlines

The first step to successful FERC Form 556 filings is to understand the filing requirements and deadlines. Public utilities and licensees must file this form annually, within 60 days of the end of their fiscal year. It's essential to review the FERC regulations and guidelines to ensure that you meet all the requirements and deadlines.

Tip 2: Gather Accurate and Complete Data

Gathering accurate and complete data is critical to successful FERC Form 556 filings. Public utilities and licensees must ensure that their financial and operational data is accurate, complete, and consistent with FERC regulations. This includes data on revenues, expenses, assets, liabilities, and operational performance.

Tip 3: Use the Correct FERC Form 556 Template

Using the correct FERC Form 556 template is essential to ensure that your filing is accurate and complete. FERC provides a template for this form, which includes instructions and guidelines for completion. Public utilities and licensees must use this template to ensure that their filing meets all the requirements.

Tip 4: Review and Edit Your Filing Carefully

Reviewing and editing your FERC Form 556 filing carefully is critical to ensure that it is accurate and complete. Public utilities and licensees must review their filing carefully to ensure that all data is accurate, complete, and consistent with FERC regulations.

Tip 5: Seek Professional Help When Needed

Finally, seeking professional help when needed is essential to successful FERC Form 556 filings. Public utilities and licensees may need to seek help from FERC experts or consultants to ensure that their filing meets all the requirements and deadlines.

Best Practices for FERC Form 556 Filings

In addition to the tips above, here are some best practices for FERC Form 556 filings:

- Use a centralized system to manage and track your filing data

- Ensure that all data is accurate, complete, and consistent with FERC regulations

- Use the correct FERC Form 556 template

- Review and edit your filing carefully

- Seek professional help when needed

Conclusion

In conclusion, FERC Form 556 filings are a critical aspect of compliance with FERC regulations. By following the 5 essential tips outlined above, public utilities and licensees can ensure that their filings are accurate, complete, and timely. Remember to seek professional help when needed, and use best practices to manage and track your filing data.

We encourage you to comment below and share your experiences with FERC Form 556 filings. What challenges have you faced, and how have you overcome them? Your insights will help others in the industry to improve their compliance and filing processes.

What is the purpose of FERC Form 556?

+The purpose of FERC Form 556 is to collect information on the activities of public utilities and licensees, including their financial performance, operational data, and compliance with FERC regulations.

When is the deadline for FERC Form 556 filings?

+The deadline for FERC Form 556 filings is within 60 days of the end of the fiscal year.

What are the consequences of late or inaccurate FERC Form 556 filings?

+The consequences of late or inaccurate FERC Form 556 filings include penalties, fines, and reputational damage.