Small businesses are the backbone of the US economy, providing jobs, driving innovation, and fostering economic growth. To support these entrepreneurs, the Small Business Administration (SBA) offers various loan programs, such as the 7(a) loan program. When applying for an SBA loan, borrowers must complete and submit Form 3511, which can be a daunting task. In this article, we will delve into the world of SBA Form 3511, exploring its importance, key components, and providing essential filing tips to ensure a smooth application process.

The SBA Form 3511 is a crucial document that provides lenders with the necessary information to process loan applications. It is a comprehensive form that requires borrowers to disclose their business and financial information, making it a critical component of the SBA loan application process. By understanding the importance of Form 3511 and following the essential filing tips outlined below, small business owners can increase their chances of securing the funding they need to grow and thrive.

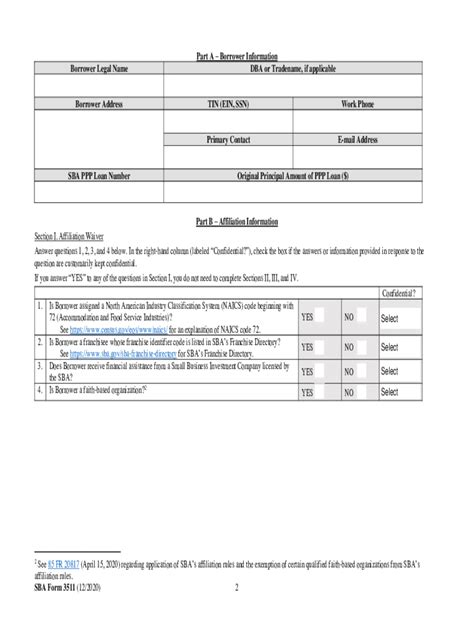

Understanding SBA Form 3511

Before diving into the filing tips, it's essential to understand the purpose and key components of Form 3511. The form is designed to provide lenders with a comprehensive overview of the borrower's business, including their financial situation, management team, and industry.

Key Components of Form 3511

Form 3511 consists of several sections, each requiring borrowers to provide specific information about their business. The key components of the form include:

- Business information: This section requires borrowers to provide details about their business, including the company name, address, and industry.

- Financial information: Borrowers must disclose their financial situation, including their income, expenses, and debt obligations.

- Management team: This section requires borrowers to provide information about their management team, including their experience and qualifications.

- Industry analysis: Borrowers must provide an analysis of their industry, including market trends and competition.

Essential Filing Tips for SBA Form 3511

To ensure a smooth application process, borrowers must carefully complete and submit Form 3511. Here are five essential filing tips to keep in mind:

1. Review and Understand the Form

Before starting the application process, borrowers should review and understand the requirements of Form 3511. This will help them prepare the necessary documents and information, reducing the risk of errors and delays.

2. Gather Required Documents

Borrowers must gather all required documents, including financial statements, tax returns, and business licenses. Ensuring that all documents are complete and accurate will help lenders process the application quickly and efficiently.

3. Complete the Form Accurately

Borrowers must complete Form 3511 accurately and thoroughly, providing all required information. Incomplete or inaccurate applications can lead to delays or even rejection.

4. Use Clear and Concise Language

Borrowers should use clear and concise language when completing the form, avoiding jargon and technical terms. This will help lenders understand the application and make an informed decision.

5. Submit the Application on Time

Borrowers must submit the application on time, allowing lenders sufficient time to review and process the loan. Late submissions can lead to delays or rejection.

Common Mistakes to Avoid

When completing Form 3511, borrowers should avoid common mistakes that can lead to delays or rejection. Here are some common mistakes to avoid:

- Incomplete or inaccurate information

- Failure to provide required documents

- Late submission

- Poorly written or unclear application

- Failure to disclose all relevant information

Conclusion: Unlocking SBA Form 3511

SBA Form 3511 is a critical component of the SBA loan application process, providing lenders with the necessary information to process loan applications. By understanding the importance of the form, key components, and following the essential filing tips outlined above, small business owners can increase their chances of securing the funding they need to grow and thrive. Remember to review and understand the form, gather required documents, complete the form accurately, use clear and concise language, and submit the application on time. By avoiding common mistakes and following these tips, borrowers can unlock the secrets of SBA Form 3511 and achieve their business goals.

We hope this article has provided you with valuable insights into SBA Form 3511 and the essential filing tips to ensure a smooth application process. If you have any questions or comments, please feel free to share them below. Don't forget to share this article with your friends and colleagues who may be interested in SBA loans.

What is SBA Form 3511?

+SBA Form 3511 is a comprehensive form that requires borrowers to disclose their business and financial information, making it a critical component of the SBA loan application process.

What are the key components of Form 3511?

+The key components of Form 3511 include business information, financial information, management team, and industry analysis.

What are the essential filing tips for Form 3511?

+The essential filing tips for Form 3511 include reviewing and understanding the form, gathering required documents, completing the form accurately, using clear and concise language, and submitting the application on time.