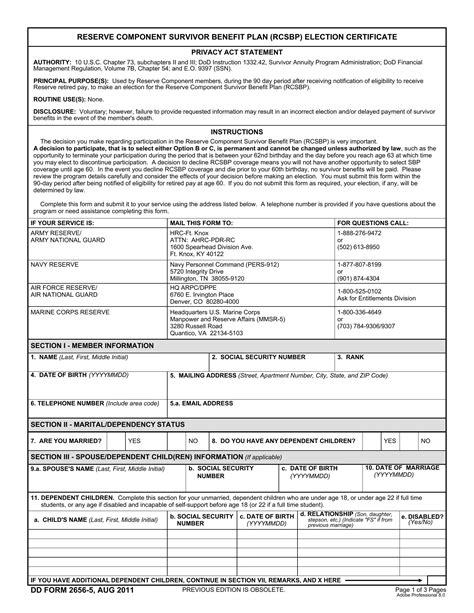

The DD Form 2656-5 is a crucial document for military personnel, particularly those in the United States Army, Navy, Air Force, and Marine Corps. It's a data form that helps determine the eligibility and suitability of service members for retirement or separation pay. However, filling out this form can be overwhelming, especially for those who are new to the military or unfamiliar with the process. In this article, we'll break down the DD Form 2656-5 into manageable sections and provide a step-by-step guide on how to fill it out accurately.

Understanding the DD Form 2656-5

Before we dive into the instructions, it's essential to understand the purpose of the DD Form 2656-5. This form is used to:

- Determine a service member's eligibility for retirement or separation pay

- Calculate the amount of pay they're entitled to receive

- Verify the service member's identity and military service history

The form consists of multiple sections, each requiring specific information. Let's break down the sections and provide guidance on how to fill them out.

Section 1: Service Member's Information

This section requires basic information about the service member, including:

- Name

- Social Security number

- Date of birth

- Military service number

- Rank and branch of service

Make sure to fill out this section accurately, as any errors can delay the processing of the form.

Section 2: Military Service History

In this section, you'll need to provide information about the service member's military service history, including:

- Dates of active duty

- Type of discharge

- Reason for discharge

- Total service time

Use your military records to ensure accuracy when filling out this section.

Section 3: Retirement or Separation Pay

This section requires information about the service member's eligibility for retirement or separation pay, including:

- Type of pay (retirement or separation)

- Amount of pay

- Date of entitlement

Use the tables and charts provided in the form to determine the correct amount of pay.

Section 4: Dependents and Beneficiaries

In this section, you'll need to provide information about the service member's dependents and beneficiaries, including:

- Spouse's name and Social Security number

- Children's names and dates of birth

- Beneficiaries' names and relationships

Make sure to include all dependents and beneficiaries, as this information will affect the service member's pay.

Section 5: Certification and Signature

The final section requires the service member's certification and signature, acknowledging that the information provided is accurate and true.

Tips and Reminders

- Use black ink to fill out the form, and make sure to print clearly.

- Use the tables and charts provided in the form to determine the correct amount of pay.

- Make sure to include all dependents and beneficiaries.

- Double-check the form for accuracy before submitting it.

By following these steps and tips, you'll be able to fill out the DD Form 2656-5 accurately and efficiently. Remember to take your time and seek help if you're unsure about any section.

Common Mistakes to Avoid

- Inaccurate or incomplete information

- Failure to include all dependents and beneficiaries

- Incorrect calculation of pay

- Illegible handwriting or incorrect formatting

By avoiding these common mistakes, you can ensure that the form is processed quickly and efficiently.

Conclusion

Filling out the DD Form 2656-5 can be a daunting task, but by breaking it down into manageable sections and following the steps outlined in this article, you'll be able to complete it with confidence. Remember to take your time, seek help if needed, and double-check the form for accuracy. By doing so, you'll ensure that the service member receives the correct amount of pay and benefits.

What is the purpose of the DD Form 2656-5?

+The DD Form 2656-5 is used to determine a service member's eligibility for retirement or separation pay and to calculate the amount of pay they're entitled to receive.

How do I calculate the correct amount of pay?

+Use the tables and charts provided in the form to determine the correct amount of pay. You can also seek help from a military financial advisor or a personnel specialist.

What happens if I make a mistake on the form?

+If you make a mistake on the form, it may delay the processing of the form. Make sure to double-check the form for accuracy before submitting it.