Refinancing your home can be a daunting task, especially when it comes to navigating the complex world of financial jargon and paperwork. At DCU, we understand the importance of making the refinancing process as smooth and stress-free as possible. In this article, we will delve into the world of DCU refinance information forms, providing you with a comprehensive guide on what to expect and how to prepare.

When it comes to refinancing your home, there are several key factors to consider, including interest rates, loan terms, and closing costs. By understanding the ins and outs of the DCU refinance information form, you can make informed decisions about your financial future. In this article, we will cover the basics of refinancing, the benefits of working with DCU, and provide a step-by-step guide on how to complete the DCU refinance information form.

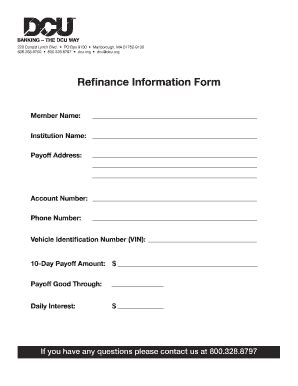

What is a DCU Refinance Information Form?

A DCU refinance information form is a document that provides detailed information about your refinancing options and requirements. The form typically includes sections for personal and financial information, property details, and loan specifications. By completing this form, you can provide DCU with the necessary information to assess your refinancing needs and provide personalized recommendations.

Benefits of Working with DCU

DCU is a leading credit union that offers a range of refinancing options to suit your needs. By working with DCU, you can enjoy the following benefits:

- Competitive interest rates

- Flexible loan terms

- Low closing costs

- Personalized service

- Expert guidance and support

How to Complete the DCU Refinance Information Form

Completing the DCU refinance information form is a straightforward process that requires some basic information and documentation. Here is a step-by-step guide to help you get started:

- Personal Information: Provide your personal details, including your name, address, phone number, and email address.

- Financial Information: Share your financial information, including your income, employment history, and credit score.

- Property Details: Provide details about the property you are refinancing, including the address, value, and current mortgage balance.

- Loan Specifications: Specify the loan amount, interest rate, and loan term you are seeking.

- Documentation: Attach required documentation, such as pay stubs, bank statements, and identification.

Required Documentation

To complete the DCU refinance information form, you will need to provide the following documentation:

- Pay stubs

- Bank statements

- Identification (driver's license or passport)

- Current mortgage statement

- Property deed

Tips for Completing the DCU Refinance Information Form

To ensure a smooth and efficient refinancing process, here are some tips to keep in mind when completing the DCU refinance information form:

- Gather all required documentation: Make sure you have all the necessary documents before starting the application process.

- Double-check your information: Verify your personal and financial information to avoid errors or delays.

- Seek expert advice: If you are unsure about any aspect of the form or refinancing process, don't hesitate to contact a DCU representative.

Common Mistakes to Avoid

When completing the DCU refinance information form, there are several common mistakes to avoid:

- Inaccurate information: Ensure that all personal and financial information is accurate and up-to-date.

- Insufficient documentation: Make sure you provide all required documentation to avoid delays or rejections.

- Failure to review terms: Carefully review the loan terms and conditions before signing the agreement.

By avoiding these common mistakes, you can ensure a smooth and efficient refinancing process with DCU.

Conclusion

Refinancing your home can be a complex and daunting task, but with the right guidance and support, it can also be a liberating experience. By understanding the ins and outs of the DCU refinance information form, you can make informed decisions about your financial future. Remember to gather all required documentation, double-check your information, and seek expert advice when needed. With DCU, you can enjoy competitive interest rates, flexible loan terms, and personalized service.

We hope this guide has been helpful in providing you with a comprehensive understanding of the DCU refinance information form. If you have any further questions or concerns, please don't hesitate to contact a DCU representative.

What is the minimum credit score required for refinancing with DCU?

+The minimum credit score required for refinancing with DCU is 620. However, the interest rate and loan terms may vary depending on your credit score and other factors.

How long does the refinancing process typically take with DCU?

+The refinancing process with DCU typically takes 30-60 days, depending on the complexity of the loan and the availability of required documentation.

Can I refinance my home with DCU if I have an existing mortgage with another lender?

+Yes, you can refinance your home with DCU even if you have an existing mortgage with another lender. However, you may need to provide additional documentation and meet specific requirements.