As a taxpayer, you may have encountered the IRS Consent Form 4506-C, also known as the IVES (Income Verification Express Service) Request for Transcript of Tax Return. This form is crucial in various situations, such as verifying income for mortgage applications, student loan processing, or even tax preparation. However, many individuals are unsure about the purpose, benefits, and usage of this form. In this article, we will delve into the world of IRS Consent Form 4506-C and provide you with 5 essential facts to help you better understand its significance.

What is IRS Consent Form 4506-C?

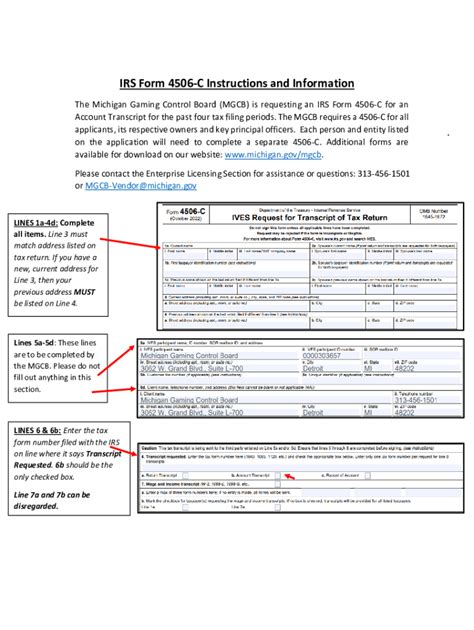

The IRS Consent Form 4506-C is a document that authorizes the Internal Revenue Service (IRS) to disclose your tax return information to a third-party requester, such as a lender, tax preparer, or government agency. This form is typically used to verify your income, and it allows the IRS to provide a transcript of your tax return to the requester. The form is usually completed by the taxpayer and submitted to the IRS, along with a request for a tax return transcript.

Key Elements of the Form

The IRS Consent Form 4506-C consists of several key elements, including:

- Your name and social security number or individual taxpayer identification number (ITIN)

- The type of tax return transcript being requested (e.g., Form 1040, Form W-2, etc.)

- The tax year(s) for which the transcript is being requested

- The name and address of the third-party requester

- Your signature and date of signature

Benefits of Using IRS Consent Form 4506-C

Using the IRS Consent Form 4506-C can provide several benefits, including:

- Verification of Income: The form allows lenders, tax preparers, and government agencies to verify your income, which is essential for mortgage applications, student loan processing, and other financial transactions.

- Convenience: The form enables you to authorize the IRS to disclose your tax return information to a third-party requester, saving you time and effort.

- Security: The form ensures that your tax return information is protected and only disclosed to authorized parties.

Common Uses of IRS Consent Form 4506-C

The IRS Consent Form 4506-C is commonly used in various situations, including:

- Mortgage applications: Lenders use the form to verify borrowers' income and creditworthiness.

- Student loan processing: Lenders and government agencies use the form to verify borrowers' income and creditworthiness.

- Tax preparation: Tax preparers use the form to obtain tax return transcripts for their clients.

- Government benefits: Government agencies use the form to verify applicants' income and eligibility for benefits.

How to Complete IRS Consent Form 4506-C

Completing the IRS Consent Form 4506-C is a straightforward process. Here are the steps to follow:

- Download the form: You can download the form from the IRS website or obtain it from a tax professional.

- Fill out the form: Complete the form by providing the required information, including your name, social security number or ITIN, and the type of tax return transcript being requested.

- Sign the form: Sign and date the form to authorize the IRS to disclose your tax return information to the third-party requester.

- Submit the form: Submit the form to the IRS, along with a request for a tax return transcript.

Tips for Completing the Form

Here are some tips to keep in mind when completing the IRS Consent Form 4506-C:

- Use black ink: Use black ink to sign the form, as it will be scanned and stored electronically.

- Be accurate: Ensure that the information provided on the form is accurate and complete.

- Keep a copy: Keep a copy of the completed form for your records.

Conclusion: Unlocking the Power of IRS Consent Form 4506-C

In conclusion, the IRS Consent Form 4506-C is a powerful tool that enables you to authorize the IRS to disclose your tax return information to third-party requesters. By understanding the benefits, uses, and completion process of this form, you can unlock its power and streamline various financial transactions. Remember to always complete the form accurately and keep a copy for your records.

We hope this article has provided you with valuable insights into the world of IRS Consent Form 4506-C. If you have any questions or comments, please feel free to share them below.

What is the purpose of IRS Consent Form 4506-C?

+The purpose of IRS Consent Form 4506-C is to authorize the IRS to disclose your tax return information to a third-party requester.

What are the benefits of using IRS Consent Form 4506-C?

+The benefits of using IRS Consent Form 4506-C include verification of income, convenience, and security.

How do I complete IRS Consent Form 4506-C?

+To complete IRS Consent Form 4506-C, fill out the form by providing the required information, sign the form, and submit it to the IRS along with a request for a tax return transcript.