If you're a taxpayer in the United States, you're probably familiar with the complexity of filing your annual income tax return. One crucial step in this process is calculating your total tax liability, which involves several components, including the income tax you owe. Form 1040, specifically Line 16, plays a pivotal role in this calculation. In this article, we'll delve into the details of how to calculate your income tax using Form 1040 Line 16, along with its significance in the broader context of your tax return.

Understanding Form 1040 and Line 16

Form 1040 is the standard form used by the Internal Revenue Service (IRS) for personal income tax returns. It is used by U.S. taxpayers to report their income, claim deductions and credits, and calculate their tax liability. The form is divided into sections, each focusing on a different aspect of your tax situation, from income and deductions to credits and tax payments.

Line 16 of Form 1040 is specifically for reporting the total tax amount, which includes income tax, self-employment tax, and any additional taxes owed. Calculating the amount for Line 16 involves several steps, including determining your income, applying the appropriate tax rates, and subtracting any credits or deductions you're eligible for.

How to Calculate Your Income Tax

Calculating your income tax starts with determining your total income, which includes wages, salaries, tips, and income from self-employment, investments, and other sources. Once you have your total income, you can proceed to calculate your tax liability.

-

Determine Your Filing Status: Your filing status (single, married filing jointly, married filing separately, head of household, or qualifying widow(er)) affects your tax rates and the standard deduction you can claim.

-

Calculate Your Taxable Income: After subtracting deductions and exemptions from your total income, you arrive at your taxable income.

-

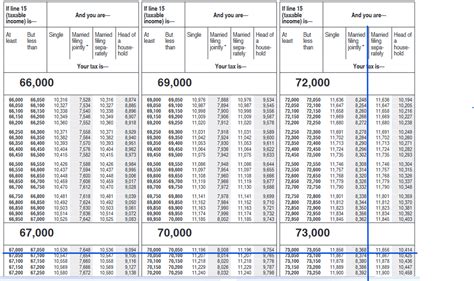

Apply the Tax Tables or Rates: The IRS issues tax tables and rates annually. You can use these to determine how much tax you owe based on your taxable income.

-

Subtract Any Tax Credits: Unlike deductions, which reduce your taxable income, tax credits directly reduce the amount of tax you owe. Claim any credits you're eligible for.

-

Calculate Any Additional Taxes: This includes self-employment tax, additional taxes on qualified plans, and other taxes.

Line 16 Calculation Process

The calculation for Line 16 involves summing up the amounts from various parts of your tax return, including:

-

Tax from the tax tables or your tax rate: This is the primary component, calculated based on your taxable income and filing status.

-

Self-employment tax: If you're self-employed, you'll report this on Schedule SE.

-

Additional taxes: This includes taxes on qualified retirement plans, Social Security and Medicare taxes on tip income not reported to your employer, taxes on excess golden parachute payments, and recapture taxes.

-

Other taxes: This category might include taxes on early distributions from retirement plans, recapture of an education credit, and taxes related to health savings accounts (HSAs).

-

Credits: While not a direct addition to Line 16, your credits will be subtracted from your total tax liability, reducing the amount you owe.

Example of Line 16 Calculation

Let's say John's tax from the tables is $10,000, he owes $2,000 in self-employment tax, and he has an additional tax of $500 on early distributions from his retirement account. His total tax liability (Line 16) would be $12,500 ($10,000 + $2,000 + $500). If John also has a tax credit of $1,000, his final tax liability would be $11,500.

Tips for Minimizing Your Tax Liability

While calculating your income tax accurately is crucial, there are also strategies to minimize your tax liability:

-

Maximize Your Deductions: Ensure you claim all deductions you're eligible for, including standard deductions, itemized deductions, and deductions for mortgage interest and charitable donations.

-

Utilize Tax Credits: Tax credits are more valuable than deductions because they directly reduce your tax liability. Claim credits for education expenses, child care, and earned income.

-

Take Advantage of Retirement Savings: Contributions to certain retirement accounts may be tax-deductible, reducing your taxable income.

-

Consider Tax-Deferred Investments: Investing in tax-deferred vehicles can help you pay taxes later when your income (and possibly tax rate) may be lower.

-

Consult a Tax Professional: Especially if your tax situation is complex, a professional can help you navigate the tax code and find the best strategies for minimizing your tax liability.

Engage with the Content

Now that you've read through this comprehensive guide on calculating your income tax with Form 1040 Line 16, you're better equipped to navigate your tax return. Remember, understanding and accurately completing Line 16 is crucial for a smooth tax filing experience.

Do you have questions about calculating your income tax or completing Line 16 on Form 1040? Share your thoughts and ask questions in the comments below!

What is Form 1040 Line 16 used for?

+Form 1040 Line 16 is used to report the total tax amount, which includes income tax, self-employment tax, and any additional taxes owed.

How do I calculate my income tax for Line 16?

+To calculate your income tax for Line 16, determine your taxable income, apply the appropriate tax rates, subtract any credits or deductions you're eligible for, and include any additional taxes.

What is the difference between a tax deduction and a tax credit?

+A tax deduction reduces your taxable income, while a tax credit directly reduces the amount of tax you owe.