The world of insurance can be complex and overwhelming, with numerous forms and documents to navigate. One such document is the No Loss Statement Acord Form, which plays a crucial role in the insurance claims process. In this article, we will delve into the intricacies of the No Loss Statement Acord Form, exploring its purpose, benefits, and importance in the insurance industry.

What is a No Loss Statement Acord Form?

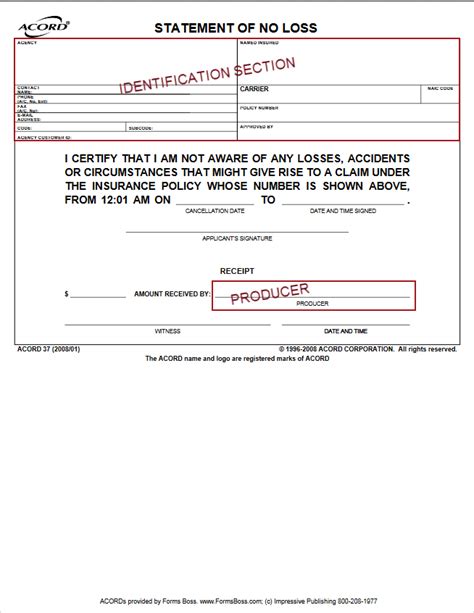

A No Loss Statement Acord Form is a document used by insurance companies to verify that a policyholder has not suffered a loss or damage to their property during a specific period. This form is typically required when a policyholder is requesting a certificate of insurance or an insurance binder. The form is usually completed by the policyholder or their representative and is used to confirm that there are no outstanding claims or losses.

Why is a No Loss Statement Acord Form Important?

The No Loss Statement Acord Form serves several purposes:

- Verification of Losses: The form helps insurance companies verify that a policyholder has not suffered any losses or damages during a specific period. This information is crucial in determining the policyholder's premium rates and coverage.

- Risk Assessment: By verifying the absence of losses, insurance companies can assess the risk associated with the policyholder and adjust their premiums accordingly.

- Compliance: The No Loss Statement Acord Form is often required by regulatory bodies and is used to ensure compliance with insurance laws and regulations.

Benefits of Using a No Loss Statement Acord Form

Using a No Loss Statement Acord Form offers several benefits to insurance companies and policyholders alike:

- Streamlined Claims Process: The form helps to streamline the claims process by verifying the absence of losses, which reduces the time and effort required to process claims.

- Accurate Risk Assessment: By verifying the absence of losses, insurance companies can accurately assess the risk associated with the policyholder, which leads to more accurate premium rates.

- Reduced Administrative Burden: The form reduces the administrative burden on insurance companies by providing a standardized way of verifying losses.

How to Complete a No Loss Statement Acord Form

Completing a No Loss Statement Acord Form is a straightforward process that requires the following steps:

- Gather Required Information: Gather all the required information, including the policyholder's name, policy number, and the period for which the form is being completed.

- Fill Out the Form: Fill out the form accurately and completely, ensuring that all the required information is provided.

- Sign and Date the Form: Sign and date the form, confirming that the information provided is accurate and true.

Common Mistakes to Avoid When Completing a No Loss Statement Acord Form

When completing a No Loss Statement Acord Form, it's essential to avoid the following common mistakes:

- Inaccurate Information: Providing inaccurate information can lead to delays or even the rejection of the form.

- Incomplete Information: Failing to provide complete information can also lead to delays or rejection.

- Failure to Sign and Date the Form: Failing to sign and date the form can render it invalid.

Conclusion

In conclusion, the No Loss Statement Acord Form is a critical document in the insurance industry that serves to verify the absence of losses or damages. By understanding the purpose, benefits, and importance of this form, insurance companies and policyholders can ensure a smoother and more efficient claims process. By following the steps outlined above and avoiding common mistakes, policyholders can ensure that their No Loss Statement Acord Form is completed accurately and efficiently.

FAQs

What is the purpose of a No Loss Statement Acord Form?

+The purpose of a No Loss Statement Acord Form is to verify that a policyholder has not suffered a loss or damage to their property during a specific period.

Why is a No Loss Statement Acord Form important?

+A No Loss Statement Acord Form is important because it helps insurance companies verify the absence of losses, which is crucial in determining premium rates and coverage.

How do I complete a No Loss Statement Acord Form?

+To complete a No Loss Statement Acord Form, gather all the required information, fill out the form accurately and completely, and sign and date the form.