Filling out the FL-141 form in California can be a daunting task, especially if you're not familiar with the legal terminology and requirements. However, with the right guidance, you can complete this form accurately and efficiently. In this article, we'll break down the FL-141 form into manageable sections and provide step-by-step instructions on how to fill it out.

What is the FL-141 Form?

The FL-141 form, also known as the "Declaration of Disclosure," is a mandatory form required in California divorce proceedings. This form provides a comprehensive summary of the couple's financial situation, including assets, debts, income, and expenses. The purpose of the FL-141 form is to ensure transparency and fairness in the divorce process.

Gathering Required Information

Before filling out the FL-141 form, you'll need to gather specific information about your financial situation. This includes:

- Income from all sources (jobs, investments, etc.)

- Expenses (housing, food, transportation, etc.)

- Assets (real estate, bank accounts, investments, etc.)

- Debts (credit cards, loans, etc.)

- Retirement accounts and other benefits

5 Ways to Fill Out the FL-141 Form

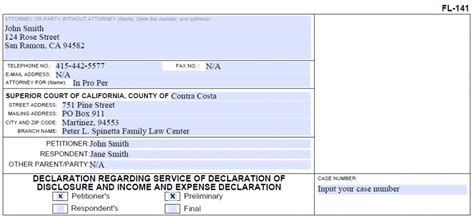

1. Section 1: Identification and Contact Information

Start by filling out the identification and contact information section. This includes your name, address, phone number, and email address. Make sure to provide accurate and up-to-date information.

Tips:

- Use your full name as it appears on your identification documents.

- Provide a valid phone number and email address for communication purposes.

2. Section 2: Income

In this section, you'll need to list all sources of income, including employment, investments, and any other financial resources. Be sure to include the following information:

- Employer name and address

- Job title and date of hire

- Gross income (before taxes)

- Net income (after taxes)

Tips:

- Include all income sources, even if you're not currently receiving income from that source.

- Use the most recent pay stub or W-2 form to determine your gross income.

3. Section 3: Assets

This section requires you to list all assets, including real estate, bank accounts, investments, and personal property. Be sure to include the following information:

- Asset type (real estate, bank account, etc.)

- Asset value (estimated or appraised)

- Date acquired

- Location (for real estate and other tangible assets)

Tips:

- Include all assets, even if they're not currently in your possession.

- Use the most recent financial statements or appraisals to determine asset values.

4. Section 4: Debts

In this section, you'll need to list all debts, including credit cards, loans, and other financial obligations. Be sure to include the following information:

- Creditor name and address

- Debt type (credit card, loan, etc.)

- Outstanding balance

- Monthly payment amount

Tips:

- Include all debts, even if they're not currently due.

- Use the most recent credit reports or financial statements to determine debt amounts.

5. Section 5: Signatures and Declarations

The final section requires your signature and a declaration that the information provided is accurate and true. Be sure to:

- Sign and date the form

- Include a statement that the information is true and accurate to the best of your knowledge

Tips:

- Make sure to sign the form in the presence of a notary public, if required.

- Keep a copy of the completed form for your records.

By following these steps and tips, you can accurately and efficiently fill out the FL-141 form in California. Remember to gather all required information before starting the form, and don't hesitate to seek professional help if you need assistance.

What's Next?

Once you've completed the FL-141 form, you'll need to submit it to the court as part of your divorce proceedings. Be sure to follow the specific filing requirements and deadlines set by the court.

Conclusion

Filling out the FL-141 form in California can be a complex and time-consuming process. However, by following the steps and tips outlined in this article, you can ensure that your form is accurate and complete. Remember to seek professional help if you need assistance, and don't hesitate to reach out to us with any questions or concerns.

FAQ Section

What is the purpose of the FL-141 form?

+The FL-141 form, also known as the "Declaration of Disclosure," is a mandatory form required in California divorce proceedings. Its purpose is to provide a comprehensive summary of the couple's financial situation, including assets, debts, income, and expenses.

What information do I need to gather before filling out the FL-141 form?

+You'll need to gather information about your income, expenses, assets, debts, and retirement accounts. This includes documents such as pay stubs, financial statements, and credit reports.

Do I need to have the FL-141 form notarized?

+Yes, the FL-141 form must be signed in the presence of a notary public. This ensures that the information provided is accurate and true.