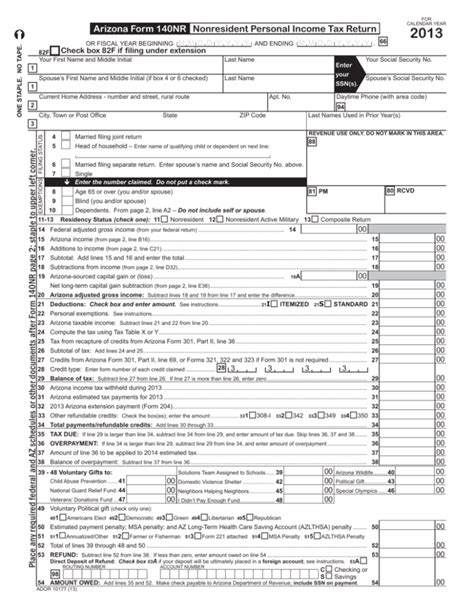

As a non-resident of Arizona, understanding your tax obligations is crucial to avoid any penalties or fines. One of the most important tax forms for non-residents is the Arizona Form 140NR. In this article, we will provide a comprehensive guide on Arizona Form 140NR, its requirements, and how to file it correctly.

Arizona Form 140NR is used by non-residents to report their Arizona income and claim any applicable credits or deductions. As a non-resident, you are required to file this form if you have income from Arizona sources, such as rental income, dividends, or capital gains.

Who Needs to File Arizona Form 140NR?

You need to file Arizona Form 140NR if you are a non-resident and have income from Arizona sources. This includes:

- Individuals who are not residents of Arizona but have income from Arizona sources

- Estates and trusts that have income from Arizona sources

- Non-resident aliens who have income from Arizona sources

Some common examples of income from Arizona sources include:

- Rental income from Arizona properties

- Dividends from Arizona corporations

- Capital gains from the sale of Arizona real estate or securities

- Interest income from Arizona banks or financial institutions

What is Considered Arizona Income?

Arizona income includes any income that is earned or derived from Arizona sources. This can include:

- Wages and salaries earned in Arizona

- Rent and royalties from Arizona properties

- Dividends and interest from Arizona corporations and financial institutions

- Capital gains from the sale of Arizona real estate or securities

- Business income from Arizona businesses

Filing Requirements for Arizona Form 140NR

To file Arizona Form 140NR, you will need to meet the following requirements:

- You must have income from Arizona sources

- You must be a non-resident of Arizona

- You must have a valid Social Security number or Individual Taxpayer Identification Number (ITIN)

- You must have a valid Arizona tax account number (if you have previously filed an Arizona tax return)

How to File Arizona Form 140NR

To file Arizona Form 140NR, you can follow these steps:

- Gather all necessary documents and information, including:

- Your Social Security number or ITIN

- Your Arizona tax account number (if applicable)

- Your income statements and tax returns from Arizona sources

- Any applicable credits or deductions

- Download and complete Arizona Form 140NR from the Arizona Department of Revenue website

- Attach all necessary supporting documentation, including:

- Copies of your income statements and tax returns

- Proof of Arizona residency (if applicable)

- Any other supporting documentation required by the Arizona Department of Revenue

- Submit your completed form and supporting documentation to the Arizona Department of Revenue by the filing deadline

Filing Deadlines for Arizona Form 140NR

The filing deadline for Arizona Form 140NR is typically April 15th of each year. However, if you need an extension, you can file Form 204 by the original deadline to receive an automatic six-month extension.

Credits and Deductions for Arizona Form 140NR

As a non-resident, you may be eligible for certain credits and deductions on your Arizona Form 140NR. Some common credits and deductions include:

- The Arizona standard deduction

- The Arizona exemption credit

- The Arizona child care credit

- The Arizona education credit

- The Arizona charitable contribution deduction

Penalties for Not Filing Arizona Form 140NR

If you fail to file Arizona Form 140NR, you may be subject to penalties and fines. The Arizona Department of Revenue may impose penalties for:

- Failure to file a return

- Failure to pay taxes due

- Failure to report income

- Failure to claim credits or deductions

To avoid penalties, it is essential to file your Arizona Form 140NR accurately and on time.

Conclusion

Filing Arizona Form 140NR is a crucial step for non-residents with income from Arizona sources. By understanding the requirements and filing procedures, you can ensure compliance with Arizona tax laws and avoid any penalties or fines. Remember to gather all necessary documents and information, complete the form accurately, and submit it by the filing deadline.

We hope this guide has provided you with valuable information on Arizona Form 140NR. If you have any further questions or concerns, please don't hesitate to comment below.

Who needs to file Arizona Form 140NR?

+Non-residents with income from Arizona sources need to file Arizona Form 140NR.

What is considered Arizona income?

+Arizona income includes any income earned or derived from Arizona sources, such as wages, rent, dividends, and capital gains.

What are the filing requirements for Arizona Form 140NR?

+To file Arizona Form 140NR, you must have income from Arizona sources, be a non-resident, and have a valid Social Security number or ITIN.