The Illinois CRT-61 form is a crucial document for businesses operating in the state of Illinois. As a seller, lessor, or agent, it's essential to understand the importance of filing this form accurately and on time. In this article, we'll delve into the world of Illinois CRT-61 form, explaining its purpose, benefits, and providing a step-by-step guide on how to file it.

Understanding the Illinois CRT-61 Form

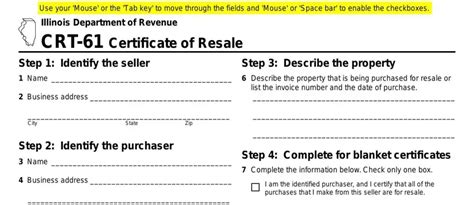

The Illinois CRT-61 form, also known as the "Certificate of Registration," is a document required by the Illinois Department of Revenue. Its primary purpose is to register businesses that sell, lease, or rent tangible personal property, including but not limited to:

- Retailers

- Lessors

- Agents

- Brokers

The form is used to collect taxes on the sale or lease of tangible personal property, and it's essential for businesses to file it accurately to avoid penalties and fines.

Benefits of Filing the Illinois CRT-61 Form

Filing the Illinois CRT-61 form comes with several benefits, including:

- Compliance with Illinois state laws: By filing the form, businesses demonstrate their compliance with Illinois state laws and regulations.

- Avoidance of penalties and fines: Accurate and timely filing helps businesses avoid penalties and fines associated with non-compliance.

- Streamlined tax collection: The form helps the Illinois Department of Revenue collect taxes efficiently, reducing the risk of errors and disputes.

- Improved business credibility: Filing the Illinois CRT-61 form demonstrates a business's commitment to transparency and accountability, enhancing its credibility with customers, partners, and investors.

Step-by-Step Guide to Filing the Illinois CRT-61 Form

Filing the Illinois CRT-61 form involves several steps:

- Gather required information: Collect the necessary documents and information, including:

- Business name and address

- Federal Employer Identification Number (FEIN)

- Illinois Tax Identification Number (TIN)

- Type of business (retailer, lessor, agent, etc.)

- Description of tangible personal property sold, leased, or rented

- Download and complete the form: Obtain the Illinois CRT-61 form from the Illinois Department of Revenue website or through a registered tax preparer. Complete the form accurately, ensuring all required fields are filled in.

- Calculate and report tax liability: Calculate the tax liability based on the sale or lease of tangible personal property. Report this amount on the form.

- Attach supporting documentation: Attach supporting documentation, such as invoices, receipts, and contracts, to the form.

- Submit the form: Submit the completed form to the Illinois Department of Revenue by mail or electronically through the state's online portal.

- Pay any associated fees: Pay any associated fees, such as registration fees or taxes, when submitting the form.

Common Mistakes to Avoid When Filing the Illinois CRT-61 Form

When filing the Illinois CRT-61 form, businesses should avoid common mistakes, including:

- Inaccurate or incomplete information: Ensure all required fields are filled in accurately and completely.

- Late filing: File the form on time to avoid penalties and fines.

- Insufficient documentation: Attach all required supporting documentation to the form.

- Incorrect tax calculation: Calculate tax liability accurately to avoid errors or disputes.

Conclusion: Streamlining Your Illinois CRT-61 Form Filing Process

Filing the Illinois CRT-61 form is a crucial step for businesses operating in the state of Illinois. By understanding the purpose and benefits of the form, following the step-by-step guide, and avoiding common mistakes, businesses can streamline their filing process and ensure compliance with Illinois state laws. Don't hesitate to reach out to a registered tax preparer or the Illinois Department of Revenue for assistance with filing the Illinois CRT-61 form.

We encourage you to share your experiences or ask questions about filing the Illinois CRT-61 form in the comments section below. Your feedback will help others navigate the process more efficiently.

FAQ Section

What is the purpose of the Illinois CRT-61 form?

+The Illinois CRT-61 form is used to register businesses that sell, lease, or rent tangible personal property, including retailers, lessors, agents, and brokers.

What are the benefits of filing the Illinois CRT-61 form?

+Filing the Illinois CRT-61 form comes with several benefits, including compliance with Illinois state laws, avoidance of penalties and fines, streamlined tax collection, and improved business credibility.

How do I file the Illinois CRT-61 form?

+Follow the step-by-step guide provided in this article, ensuring you gather required information, complete the form accurately, calculate and report tax liability, attach supporting documentation, submit the form, and pay any associated fees.