In today's complex tax landscape, it's essential to navigate the various forms and regulations that govern our financial lives. One such form that plays a crucial role in the tax credits for qualified plug-in electric drive motor vehicles is Form 8936. If you're eligible for this credit, understanding how to complete Form 8936 is vital for a smooth tax filing process. In this article, we'll break down the steps to complete Form 8936 accurately and efficiently.

Understanding Form 8936

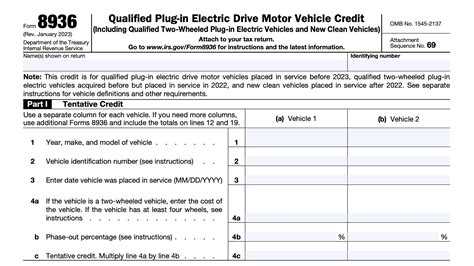

Before we dive into the steps, it's essential to grasp what Form 8936 is and its purpose. Form 8936 is used to calculate the qualified plug-in electric drive motor vehicle credit, which is a tax credit provided by the Internal Revenue Service (IRS) to encourage the adoption of environmentally friendly vehicles. This form is specifically designed for vehicles that qualify for the credit and helps taxpayers determine the amount of credit they are eligible for.

Step 1: Gather Required Information

To complete Form 8936, you'll need to gather specific information about the vehicle and your tax situation. Here are the essential documents and details you should have ready:

- Vehicle identification number (VIN)

- Vehicle's make, model, and year

- Date of purchase

- Gross vehicle weight rating

- Battery capacity

- Your tax return information (e.g., Form 1040)

Vehicle Information

You'll need to provide detailed information about the vehicle. Ensure you have the correct VIN, as this will be crucial for verifying the vehicle's eligibility for the credit.

Tax Return Information

Have your tax return documents ready, including your adjusted gross income (AGI) and any other relevant tax information.

Step 2: Determine Vehicle Eligibility

Not all electric vehicles qualify for the credit. You'll need to verify that your vehicle meets the IRS's eligibility criteria, which include:

- The vehicle must be a qualified plug-in electric drive motor vehicle.

- The vehicle must have a gross vehicle weight rating of less than 14,000 pounds.

- The vehicle must be made by a qualified manufacturer.

- The vehicle must be acquired for use or lease.

Consult the IRS's website or contact the manufacturer to confirm your vehicle's eligibility.

Step 3: Calculate the Vehicle's Credit

The credit amount is based on the vehicle's battery capacity. You'll need to calculate the credit using the following formula:

Credit = $2,500 + ($417 x number of kilowatt-hours in excess of 4 kilowatt-hours)

You can find the battery capacity information in your vehicle's documentation or by contacting the manufacturer.

Step 4: Complete Form 8936

Now that you have gathered all the necessary information, it's time to complete Form 8936. Here are the steps to follow:

- Fill in your name, address, and taxpayer identification number.

- Enter the vehicle's VIN and other required information.

- Calculate the credit using the formula above.

- Complete the rest of the form, following the instructions carefully.

Step 5: Attach Form 8936 to Your Tax Return

Once you've completed Form 8936, attach it to your tax return (Form 1040). Make sure to sign and date the form.

Step 6: Claim the Credit on Your Tax Return

Claim the credit on your tax return by reporting it on Form 1040. You'll need to complete the "Credit" section of the form and enter the credit amount.

Step 7: Keep Records

Finally, keep a copy of Form 8936 and all supporting documentation with your tax records. This will help you in case of an audit or if you need to refer to the information in the future.

By following these steps, you'll be able to complete Form 8936 accurately and claim the qualified plug-in electric drive motor vehicle credit. Remember to stay up-to-date with any changes to the tax laws and regulations to ensure you're taking advantage of all the credits available to you.

We encourage you to share your experiences with completing Form 8936 or ask any questions you may have in the comments section below. If you found this article helpful, please share it with others who may be eligible for the credit.