As a responsible taxpayer, it's essential to understand the various tax forms and schedules that are required to be filed with the Internal Revenue Service (IRS). One such form is the Form 740NP-WH, which is used to report certain types of income and claim a credit or refund. In this article, we will delve into the details of Form 740NP-WH, its purpose, and provide a step-by-step guide on how to fill it out accurately.

What is Form 740NP-WH?

Form 740NP-WH is a tax form used by nonresident aliens and foreign corporations to report income that is not subject to withholding. The form is used to report income from U.S. sources, such as dividends, interest, and rents, that are not subject to withholding. It is also used to claim a credit or refund for overpaid taxes.

Who needs to file Form 740NP-WH?

Not everyone needs to file Form 740NP-WH. The following individuals and entities are required to file this form:

- Nonresident aliens who have U.S. sourced income that is not subject to withholding

- Foreign corporations that have U.S. sourced income that is not subject to withholding

- Estates and trusts that have U.S. sourced income that is not subject to withholding

Purpose of Form 740NP-WH

The primary purpose of Form 740NP-WH is to report income that is not subject to withholding and to claim a credit or refund for overpaid taxes. The form is used to report income from U.S. sources, such as:

- Dividends

- Interest

- Rents

- Royalties

- Other types of income

Benefits of filing Form 740NP-WH

Filing Form 740NP-WH can have several benefits, including:

- Claiming a credit or refund for overpaid taxes

- Reporting income that is not subject to withholding

- Complying with IRS regulations and avoiding penalties

- Reducing tax liability

How to fill out Form 740NP-WH

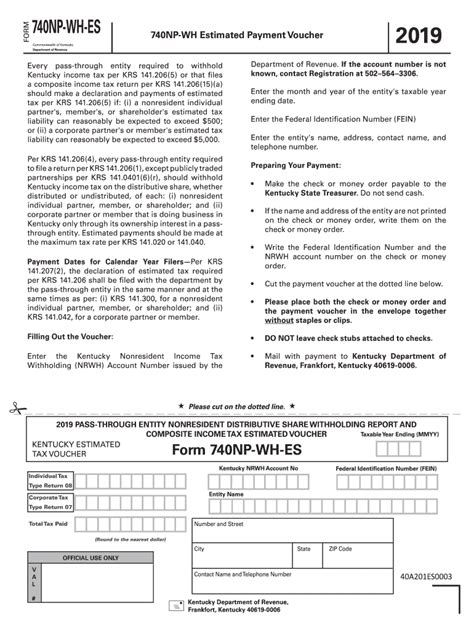

Filling out Form 740NP-WH can be a complex process, but it can be broken down into several steps. Here's a step-by-step guide to help you fill out the form accurately:

- Identify the type of income: Identify the type of income you are reporting, such as dividends, interest, or rents.

- Determine the amount of income: Determine the amount of income you are reporting.

- Complete Part I: Complete Part I of the form, which includes your name, address, and taxpayer identification number.

- Complete Part II: Complete Part II of the form, which includes the type and amount of income you are reporting.

- Complete Part III: Complete Part III of the form, which includes the calculation of your tax liability.

- Sign and date the form: Sign and date the form.

Common mistakes to avoid

When filling out Form 740NP-WH, it's essential to avoid common mistakes, such as:

- Incorrectly identifying the type of income

- Incorrectly calculating the amount of income

- Failing to sign and date the form

FAQs

Here are some frequently asked questions about Form 740NP-WH:

Q: Who needs to file Form 740NP-WH? A: Nonresident aliens, foreign corporations, and estates and trusts that have U.S. sourced income that is not subject to withholding need to file Form 740NP-WH.

Q: What is the purpose of Form 740NP-WH? A: The primary purpose of Form 740NP-WH is to report income that is not subject to withholding and to claim a credit or refund for overpaid taxes.

Q: How do I fill out Form 740NP-WH? A: Filling out Form 740NP-WH involves identifying the type of income, determining the amount of income, completing Part I, Part II, and Part III of the form, and signing and dating the form.

What is the deadline for filing Form 740NP-WH?

+The deadline for filing Form 740NP-WH is April 15th of each year.

Can I file Form 740NP-WH electronically?

+No, Form 740NP-WH cannot be filed electronically. It must be filed by mail.

What are the penalties for not filing Form 740NP-WH?

+The penalties for not filing Form 740NP-WH can include fines, penalties, and interest on unpaid taxes.

Conclusion

Filing Form 740NP-WH can be a complex process, but it's essential to report income that is not subject to withholding and to claim a credit or refund for overpaid taxes. By following the steps outlined in this article and avoiding common mistakes, you can ensure that you file Form 740NP-WH accurately and on time.

We hope this article has provided you with a comprehensive guide to understanding Form 740NP-WH. If you have any further questions or concerns, please don't hesitate to reach out to us.