The W-4 tax form is a crucial document for employees in the United States, as it determines the amount of taxes withheld from their paychecks. Understanding the W-4 form is essential for anyone who wants to manage their tax obligations effectively. In this article, we will provide a comprehensive guide to the W-4 tax form, covering its purpose, how to fill it out, and common mistakes to avoid.

What is the W-4 Tax Form?

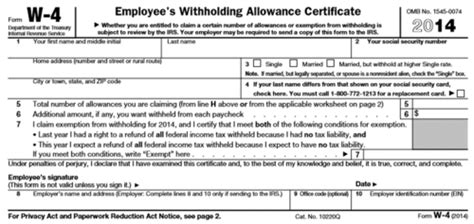

The W-4 tax form, also known as the Employee's Withholding Certificate, is a document that employees must complete and submit to their employers to determine the amount of federal income taxes to be withheld from their paychecks. The form is used to calculate the employee's tax obligations based on their income, filing status, and number of dependents.

Why is the W-4 Tax Form Important?

The W-4 tax form is essential because it helps employees avoid overpaying or underpaying their taxes. If an employee fails to complete the form correctly, they may end up owing taxes when they file their tax return or receiving a smaller refund than expected. Moreover, the W-4 form helps employers comply with tax laws and regulations by withholding the correct amount of taxes from employee paychecks.

How to Fill Out the W-4 Tax Form

Filling out the W-4 tax form can seem daunting, but it's a straightforward process. Here's a step-by-step guide to help you complete the form:

- Step 1: Provide Personal Information

- Write your name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Step 2: Choose Your Filing Status

- Select your filing status: Single, Married, Head of Household, Qualifying Widow(er), or Married Filing Separately.

- Step 3: Claim Allowances

- Claim the number of allowances you're eligible for based on your income, filing status, and number of dependents.

- Step 4: Report Additional Income or Deductions

- Report any additional income, such as freelance work or investments, or deductions, such as mortgage interest or charitable donations.

- Step 5: Sign and Date the Form

- Sign and date the form to certify that the information is accurate and complete.

Common Mistakes to Avoid

When filling out the W-4 tax form, it's essential to avoid common mistakes that can lead to errors in tax withholding. Here are some mistakes to avoid:

- Failing to report all income: Make sure to report all income, including freelance work, investments, or side hustles.

- Claiming too many allowances: Claiming too many allowances can result in underpayment of taxes, leading to penalties and interest.

- Not updating the form: Failing to update the W-4 form when your tax situation changes can lead to errors in tax withholding.

Everfi Tax Filing: A Convenient Solution

Everfi is a popular tax filing platform that offers a convenient and user-friendly solution for filing taxes. With Everfi, you can easily complete and submit your W-4 tax form, as well as file your tax return. Everfi's platform provides:

- Easy W-4 form completion: Everfi's platform guides you through the W-4 form completion process, ensuring accuracy and compliance.

- Tax return filing: Everfi allows you to file your tax return electronically, reducing the risk of errors and delays.

- Tax planning and optimization: Everfi's platform provides tax planning and optimization tools to help you minimize your tax liability.

Benefits of Using Everfi for Tax Filing

Using Everfi for tax filing offers several benefits, including:

- Convenience: Everfi's platform is user-friendly and accessible from anywhere, making it easy to complete and submit your W-4 form and file your tax return.

- Accuracy: Everfi's platform ensures accuracy and compliance, reducing the risk of errors and penalties.

- Time-saving: Everfi's platform saves you time and effort, allowing you to focus on other important tasks.

Conclusion

The W-4 tax form is a critical document for employees in the United States, and understanding how to fill it out correctly is essential for managing tax obligations effectively. By following the steps outlined in this article and avoiding common mistakes, you can ensure accurate tax withholding and minimize the risk of errors and penalties. Everfi's tax filing platform offers a convenient and user-friendly solution for completing and submitting the W-4 form, as well as filing your tax return.

We encourage you to share your experiences and tips for filling out the W-4 tax form in the comments below. If you have any questions or need further guidance, please don't hesitate to ask.

What is the purpose of the W-4 tax form?

+The W-4 tax form is used to determine the amount of federal income taxes to be withheld from an employee's paycheck.

How do I fill out the W-4 tax form?

+Follow the steps outlined in the article to fill out the W-4 tax form, including providing personal information, choosing your filing status, claiming allowances, reporting additional income or deductions, and signing and dating the form.

What are the benefits of using Everfi for tax filing?

+Using Everfi for tax filing offers several benefits, including convenience, accuracy, and time-saving.