Understanding the Importance of Wisconsin State Tax Forms

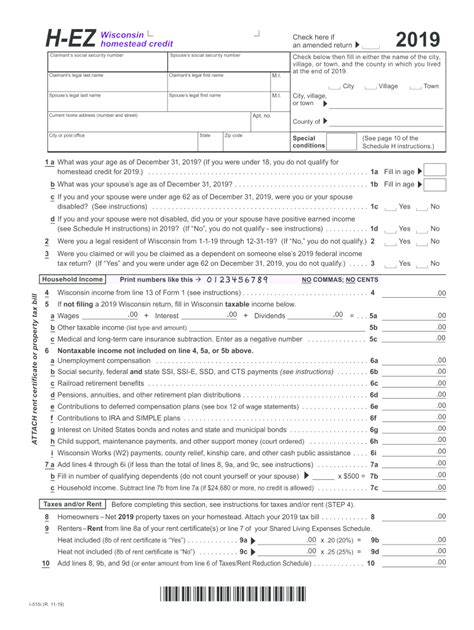

As a resident of Wisconsin, it is essential to understand the importance of filing your state tax forms accurately and on time. The Wisconsin Department of Revenue requires individuals and businesses to file their tax returns to report their income, claim deductions and credits, and pay any taxes owed. In this article, we will provide a comprehensive guide to help you navigate the Wisconsin state tax form filing process, including easy filing instructions and tips to ensure a smooth and stress-free experience.

The Wisconsin state tax form is used to report an individual's or business's income, deductions, and credits for the tax year. The form is typically due on April 15th of each year, and failure to file or pay taxes on time can result in penalties and interest. It is crucial to understand the filing requirements, deadlines, and instructions to avoid any errors or delays.

Types of Wisconsin State Tax Forms

Wisconsin offers various tax forms for individuals and businesses, including:

- Form 1: Individual Income Tax Return

- Form 1A: Wisconsin Individual Income Tax Return (Short Form)

- Form 4: Wisconsin Corporation Franchise or Income Tax Return

- Form 5: Wisconsin Partnership Return

Each form has its unique instructions and requirements, and it is essential to choose the correct form to ensure accurate filing.

Easy Filing Instructions for Wisconsin State Tax Forms

To file your Wisconsin state tax form, follow these easy steps:

- Gather required documents: Collect all necessary documents, including your W-2 forms, 1099 forms, and any other relevant tax-related documents.

- Choose the correct form: Select the correct Wisconsin state tax form based on your filing status and type of income.

- Fill out the form: Complete the form accurately and thoroughly, following the instructions provided.

- Calculate your tax: Calculate your total tax liability, including any deductions and credits you are eligible for.

- Pay any taxes owed: Pay any taxes owed by the deadline to avoid penalties and interest.

- File your return: File your completed return electronically or by mail, depending on your preference.

Electronic Filing Options for Wisconsin State Tax Forms

Wisconsin offers electronic filing options for individuals and businesses, making it easier and faster to file your tax return. You can file your return through:

- Wisconsin e-file: The official electronic filing system for Wisconsin state tax returns.

- Tax preparation software: Many tax preparation software programs, such as TurboTax and H&R Block, offer electronic filing options for Wisconsin state tax returns.

Benefits of Filing Wisconsin State Tax Forms Electronically

Filing your Wisconsin state tax form electronically offers several benefits, including:

- Faster refunds: Electronic filing allows for faster processing and refunds.

- Reduced errors: Electronic filing reduces the risk of errors and inaccuracies.

- Increased security: Electronic filing provides a secure and confidential way to file your tax return.

- Environmentally friendly: Electronic filing reduces paper waste and is more environmentally friendly.

Common Mistakes to Avoid When Filing Wisconsin State Tax Forms

To ensure accurate and smooth filing, avoid the following common mistakes:

- Incorrect form: Filing the wrong form can result in delays and errors.

- Incomplete information: Failing to provide complete and accurate information can result in errors and delays.

- Math errors: Mathematical errors can result in incorrect tax calculations and penalties.

- Missing documentation: Failing to provide required documentation can result in delays and errors.

Wisconsin State Tax Form Deadlines and Penalties

The Wisconsin state tax form deadline is typically April 15th of each year. Failure to file or pay taxes on time can result in penalties and interest. The penalties and interest rates are as follows:

- Late filing penalty: 5% of the unpaid tax for each month or part of a month, up to 25%.

- Late payment penalty: 1% of the unpaid tax for each month or part of a month, up to 12%.

- Interest rate: The interest rate is currently 6% per year, compounded daily.

Amending a Wisconsin State Tax Form

If you need to make changes to your Wisconsin state tax form, you can file an amended return using Form 1X. You can file an amended return electronically or by mail, and it is essential to follow the instructions provided.

Wisconsin State Tax Form FAQs

Here are some frequently asked questions and answers related to Wisconsin state tax forms:

- Q: What is the deadline for filing a Wisconsin state tax form? A: The deadline for filing a Wisconsin state tax form is typically April 15th of each year.

- Q: Can I file my Wisconsin state tax form electronically? A: Yes, you can file your Wisconsin state tax form electronically using Wisconsin e-file or tax preparation software.

- Q: What are the penalties for late filing or payment of Wisconsin state taxes? A: The penalties for late filing or payment of Wisconsin state taxes include a late filing penalty of 5% of the unpaid tax for each month or part of a month, up to 25%, and a late payment penalty of 1% of the unpaid tax for each month or part of a month, up to 12%.

Conclusion

Filing your Wisconsin state tax form accurately and on time is crucial to avoid penalties and interest. By following the easy filing instructions and tips provided in this article, you can ensure a smooth and stress-free experience. Remember to gather required documents, choose the correct form, fill out the form accurately, calculate your tax, pay any taxes owed, and file your return electronically or by mail. If you have any questions or concerns, refer to the Wisconsin state tax form FAQs or contact the Wisconsin Department of Revenue for assistance.

What is the deadline for filing a Wisconsin state tax form?

+The deadline for filing a Wisconsin state tax form is typically April 15th of each year.

Can I file my Wisconsin state tax form electronically?

+Yes, you can file your Wisconsin state tax form electronically using Wisconsin e-file or tax preparation software.

What are the penalties for late filing or payment of Wisconsin state taxes?

+The penalties for late filing or payment of Wisconsin state taxes include a late filing penalty of 5% of the unpaid tax for each month or part of a month, up to 25%, and a late payment penalty of 1% of the unpaid tax for each month or part of a month, up to 12%.