As an Uber Eats delivery partner, you're considered an independent contractor, not an employee. This means you're responsible for reporting your income and expenses on your tax return. In this article, we'll walk you through a 5-step tax filing guide to help you navigate the process.

Understanding Your Uber Eats 1099 Form

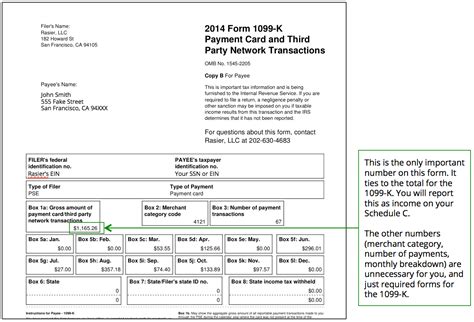

Before we dive into the 5-step guide, let's take a closer look at the Uber Eats 1099 form. As an independent contractor, you'll receive a 1099-MISC form from Uber, which reports the total amount of money you earned from delivering food through the platform. This form will include your gross earnings, but it won't include any expenses you incurred while making deliveries.

Step 1: Gather Your Tax Documents

To file your taxes, you'll need to gather all the necessary documents, including:

- Your Uber Eats 1099-MISC form

- Your Social Security number or Individual Taxpayer Identification Number (ITIN)

- Your business expense records (more on this later)

- Any other income statements, such as W-2 forms from other jobs

Step 2: Report Your Income

Using your 1099-MISC form, report your Uber Eats income on your tax return. You'll need to complete Schedule C (Form 1040), which is the form for self-employment income. You'll report your gross earnings from Uber Eats, as well as any other business income you earned.

- Gross Income: Report your total Uber Eats earnings on Line 1 of Schedule C.

- Business Expenses: Report your business expenses on Part II of Schedule C. We'll cover this in more detail in Step 3.

Step 3: Calculate Your Business Expenses

As an independent contractor, you're eligible to deduct business expenses on your tax return. This can help reduce your taxable income and lower your tax bill. Common business expenses for Uber Eats delivery partners include:

- Mileage expenses (gas, maintenance, insurance)

- Vehicle expenses (depreciation, registration)

- Phone and internet expenses

- Equipment expenses ( bags, containers, etc.)

To calculate your business expenses, you can use the following methods:

- Actual Expenses: Keep track of all your actual expenses throughout the year and report them on your tax return.

- Standard Mileage Rate: Use the standard mileage rate (58 cents per mile in 2022) to calculate your mileage expenses.

Step 4: Complete Your Tax Return

Now that you've reported your income and calculated your business expenses, it's time to complete your tax return. You'll need to:

- Complete Schedule C: Report your business income and expenses on Schedule C.

- Complete Schedule SE: Report your self-employment tax on Schedule SE.

- Complete Form 1040: Report your total income, deductions, and credits on Form 1040.

Step 5: File Your Tax Return

Finally, it's time to file your tax return. You can e-file your tax return through the IRS website or use tax software like TurboTax or H&R Block. Be sure to:

- File by the Deadline: File your tax return by the tax filing deadline (usually April 15th).

- Pay Any Taxes Owed: Pay any taxes owed by the deadline to avoid penalties and interest.

Common Tax Questions for Uber Eats Delivery Partners

Here are some common tax questions for Uber Eats delivery partners:

Do I need to file a tax return if I only earned a small amount from Uber Eats?

Yes, you're required to file a tax return if you earned more than $600 from Uber Eats. However, even if you earned less than $600, you may still want to file a tax return to report your income and claim any business expenses.

Can I deduct the cost of my vehicle as a business expense?

Yes, you can deduct the cost of your vehicle as a business expense, but only for the miles driven for Uber Eats. You can use the standard mileage rate or actual expenses to calculate your vehicle expenses.

Do I need to pay self-employment tax on my Uber Eats income?

Yes, as an independent contractor, you're required to pay self-employment tax on your Uber Eats income. This tax is used to fund Social Security and Medicare.

What is the deadline for filing my tax return?

+The deadline for filing your tax return is usually April 15th.

Can I deduct the cost of my phone as a business expense?

+Do I need to file a separate tax return for my Uber Eats income?

+No, you can report your Uber Eats income on your personal tax return (Form 1040).

We hope this 5-step tax filing guide has helped you navigate the process of filing your taxes as an Uber Eats delivery partner. Remember to gather all your tax documents, report your income, calculate your business expenses, complete your tax return, and file by the deadline. If you have any further questions, feel free to comment below!