As a business owner, filing taxes can be a daunting task, especially when it comes to complex forms like the IRS Form 3800. The General Business Credit form is used to claim various business credits, and filling it out correctly is crucial to avoid any delays or issues with your tax return. In this article, we will guide you through the 6 steps to fill out IRS Form 3800 correctly, ensuring you take advantage of the credits you're eligible for.

Understanding the Purpose of IRS Form 3800

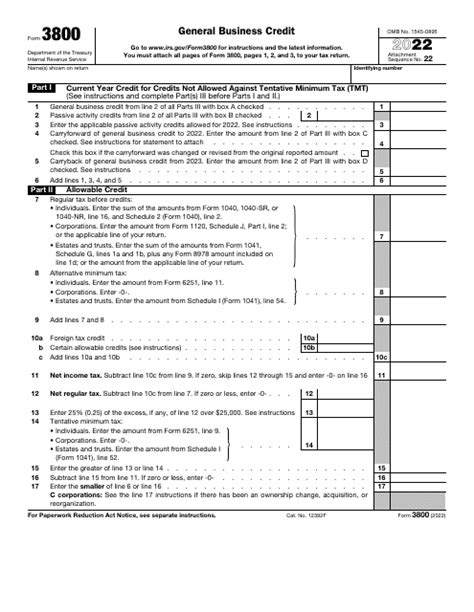

The IRS Form 3800 is used to calculate and claim various business credits, such as the investment credit, the work opportunity credit, and the research credit, among others. The form is designed to help businesses reduce their tax liability by claiming these credits. However, filling out the form correctly requires attention to detail and a thorough understanding of the credits you're eligible for.

Step 1: Gather Required Information and Documents

Before filling out the IRS Form 3800, gather all the necessary information and documents, including:

- Your business's tax return (Form 1040 or Form 1120)

- Records of qualified business expenses and investments

- Documentation supporting the credits you're claiming (e.g., research expenses, work opportunity credit certifications)

- Any other relevant documents, such as depreciation schedules and financial statements

Step 2: Determine Which Credits to Claim

Identify the credits your business is eligible for, based on your business activities and expenses. The IRS Form 3800 covers various credits, including:

- Investment credit (Form 3468)

- Work opportunity credit (Form 5884)

- Research credit (Form 6765)

- Low-income housing credit (Form 8586)

- Disabled access credit (Form 8826)

- Renewable energy credits (Form 8835)

Review each credit's requirements and ensure you meet the eligibility criteria.

Step 3: Calculate the Credits

Once you've identified the credits to claim, calculate the amount of each credit using the relevant forms and schedules. For example:

- Investment credit: Complete Form 3468 to calculate the credit amount

- Work opportunity credit: Complete Form 5884 to calculate the credit amount

Follow the instructions for each credit to ensure accurate calculations.

Step 4: Complete Form 3800

Fill out the IRS Form 3800, following these steps:

- Part I: General Business Credit

- List each credit you're claiming and the corresponding form number

- Calculate the total credit amount

- Part II: Credits from Other Forms

- List any credits from other forms (e.g., Form 3468, Form 5884)

- Calculate the total credit amount

- Part III: Summary

- Calculate the total general business credit

- Calculate the total credits from other forms

Step 5: Attach Supporting Documentation

Attach all supporting documentation, including:

- Completed forms and schedules for each credit claimed

- Records of qualified business expenses and investments

- Documentation supporting the credits you're claiming

Ensure all documentation is accurate and complete to avoid any delays or issues with your tax return.

Step 6: Review and Submit

Review the IRS Form 3800 carefully to ensure accuracy and completeness. Verify that all credits are calculated correctly and that you've attached all required documentation. Once you're satisfied with the form, submit it with your business tax return.

By following these 6 steps, you'll be able to fill out the IRS Form 3800 correctly and take advantage of the credits your business is eligible for. Remember to review the form carefully and seek professional help if needed to ensure accuracy and completeness.

We hope this article has provided you with a comprehensive guide to filling out the IRS Form 3800 correctly. If you have any further questions or concerns, please don't hesitate to comment below.

What is the purpose of IRS Form 3800?

+IRS Form 3800 is used to calculate and claim various business credits, such as the investment credit, the work opportunity credit, and the research credit, among others.

Which credits can I claim on IRS Form 3800?

+The IRS Form 3800 covers various credits, including investment credit, work opportunity credit, research credit, low-income housing credit, disabled access credit, and renewable energy credits.

What documentation do I need to attach to IRS Form 3800?

+You'll need to attach completed forms and schedules for each credit claimed, records of qualified business expenses and investments, and documentation supporting the credits you're claiming.