Wisconsin residents, get ready to tackle your state income tax return with confidence! Filing your taxes can be a daunting task, but with this comprehensive guide, you'll be well-equipped to navigate the process. In this article, we'll delve into the world of Wisconsin income tax, focusing on Form 1, the individual income tax return. By the end of this guide, you'll be familiar with the ins and outs of Form 1, and you'll be ready to file your taxes with ease.

Wisconsin's tax system is designed to be straightforward, but it's essential to understand the specifics to avoid any potential pitfalls. Whether you're a seasoned tax filer or a newcomer to the world of taxation, this guide will walk you through the process step-by-step. So, grab a cup of coffee, sit back, and let's get started!

Understanding Wisconsin Income Tax

Before diving into the nitty-gritty of Form 1, it's essential to grasp the basics of Wisconsin income tax. Wisconsin is one of the 41 states that impose a state income tax on its residents. The state's tax system is designed to be progressive, with higher tax rates applied to higher income earners.

Wisconsin's tax rates range from 4% to 7.65%, with the highest rate applying to taxable income above $267,500. The state also offers various tax credits and deductions to help reduce the tax burden on residents.

Who Needs to File Form 1?

Form 1 is the standard individual income tax return for Wisconsin residents. You'll need to file Form 1 if:

- You're a Wisconsin resident and have income from any source, including wages, salaries, tips, and self-employment income.

- You're a non-resident with income earned in Wisconsin.

- You're a part-year resident with income earned in Wisconsin during the tax year.

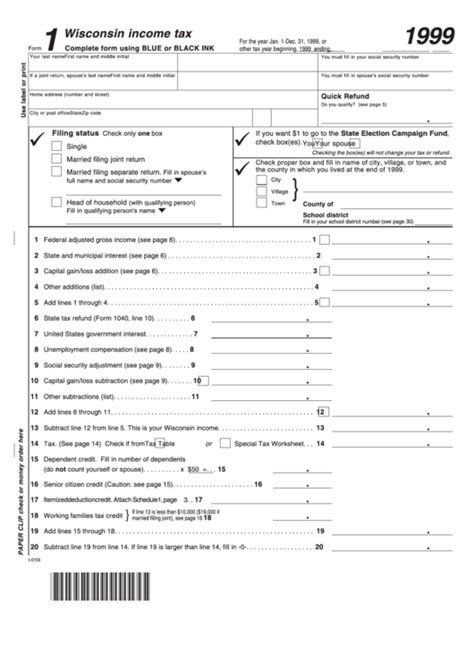

Form 1: A Closer Look

Form 1 is a multi-page document that requires you to report your income, claim deductions and credits, and calculate your tax liability. The form is divided into several sections, each with its own specific requirements.

Here's a breakdown of the main sections on Form 1:

- Identification: Provide your name, address, social security number, and other identifying information.

- Income: Report your income from various sources, including wages, salaries, tips, and self-employment income.

- Deductions and Credits: Claim deductions for items like mortgage interest, charitable donations, and medical expenses. Also, claim credits for items like child care expenses and education expenses.

- Tax Computation: Calculate your tax liability based on your income and deductions.

- Additional Taxes and Credits: Report any additional taxes or credits, such as the alternative minimum tax (AMT) or the earned income tax credit (EITC).

Supporting Schedules and Forms

Form 1 may require additional schedules and forms to be attached, depending on your specific situation. Some common supporting schedules and forms include:

- Schedule 1: Itemized deductions

- Schedule 2: Interest and dividend income

- Schedule 3: Capital gains and losses

- Form W-2: Wage and tax statements

- Form 1099: Miscellaneous income statements

Filing Requirements and Deadlines

Wisconsin requires individual income tax returns to be filed on or before April 15th for the previous tax year. If you need more time to file, you can request an automatic six-month extension by filing Form 1-ES, the Wisconsin income tax extension form.

It's essential to note that even if you're requesting an extension, you're still required to pay any estimated taxes by the original deadline to avoid penalties and interest.

Paying Your Taxes

You can pay your Wisconsin income tax liability using various methods, including:

- Electronic Funds Transfer (EFT): Pay online or by phone using the Wisconsin Department of Revenue's website or phone number.

- Check or Money Order: Mail a check or money order with your tax return.

- Credit Card: Pay using a credit card through the Wisconsin Department of Revenue's website.

E-Filing and Refund Options

Wisconsin offers electronic filing (e-filing) options for Form 1, making it faster and more convenient to file your taxes. You can e-file your return using the Wisconsin Department of Revenue's website or through a tax preparation software.

If you're due a refund, you can choose to receive it via:

- Direct Deposit: Have your refund deposited directly into your bank account.

- Paper Check: Receive a paper check by mail.

- Debit Card: Receive a prepaid debit card with your refund amount.

Audit and Examination Procedures

The Wisconsin Department of Revenue may select your return for audit or examination to ensure compliance with state tax laws. If you're selected for audit, you'll receive a notification with instructions on what to expect and how to respond.

Common Errors and Penalties

To avoid errors and penalties, it's essential to carefully review your return before filing. Common errors include:

- Math errors: Double-check your calculations to ensure accuracy.

- Missing or incorrect information: Verify your name, address, and social security number.

- Insufficient payment: Ensure you've paid the correct amount of tax.

Penalties for errors or non-compliance may include:

- Late filing penalty: 5% of the unpaid tax for each month or part of a month, up to 25%.

- Late payment penalty: 1.5% of the unpaid tax for each month or part of a month, up to 25%.

- Interest: Accrues on unpaid tax at a rate of 18% per annum.

Amending Your Return

If you need to make changes to your original return, you can file an amended return using Form 1X. You'll need to explain the changes and provide supporting documentation.

Conclusion

Filing your Wisconsin income tax return using Form 1 can seem daunting, but with this guide, you're now better equipped to navigate the process. Remember to carefully review your return, ensure accurate calculations, and pay any estimated taxes on time to avoid penalties and interest.

If you have any questions or concerns, don't hesitate to reach out to the Wisconsin Department of Revenue or a tax professional for assistance.

What is the deadline for filing Form 1?

+The deadline for filing Form 1 is April 15th for the previous tax year.

Can I e-file my Form 1 return?

+Yes, Wisconsin offers electronic filing (e-filing) options for Form 1.

How do I pay my Wisconsin income tax liability?

+You can pay your Wisconsin income tax liability using various methods, including electronic funds transfer (EFT), check or money order, or credit card.