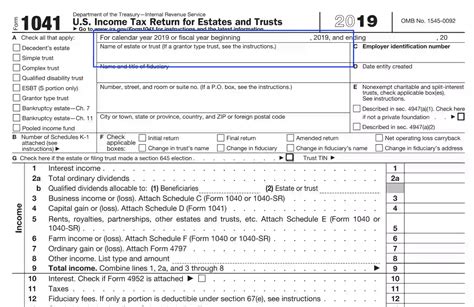

As a fiduciary, preparing and filing Form 1041, the U.S. Income Tax Return for Estates and Trusts, can be a daunting task. The complexity of the form, combined with the numerous schedules and supporting documentation required, can lead to errors and delays. To mitigate these risks, many fiduciaries turn to tax preparation software solutions specifically designed for Form 1041. In this article, we will explore the benefits and features of these software solutions, as well as provide guidance on selecting the right one for your needs.

Benefits of Form 1041 Tax Preparation Software

Tax preparation software solutions for Form 1041 offer numerous benefits, including:

- Accuracy and Compliance: These software solutions ensure accurate calculations and compliance with IRS regulations, reducing the risk of errors and penalties.

- Time Savings: Automated processes and intuitive interfaces save time and effort, allowing fiduciaries to focus on other critical tasks.

- Organization and Management: Software solutions help fiduciaries manage and track multiple estates and trusts, including supporting documentation and schedules.

- Security and Confidentiality: Reputable software solutions prioritize data security and confidentiality, protecting sensitive information and maintaining confidentiality.

Key Features of Form 1041 Tax Preparation Software

Features and Functionality

When selecting a tax preparation software solution for Form 1041, consider the following key features:

- Form 1041 Preparation: Look for software that allows for seamless preparation of Form 1041, including schedules and supporting documentation.

- Automated Calculations: Ensure the software performs accurate calculations, including income, deductions, and credits.

- Data Import and Export: Select software that allows for easy import and export of data, including prior-year returns and supporting documentation.

- Collaboration and Sharing: Consider software that enables collaboration and sharing with co-fiduciaries, accountants, and other stakeholders.

- Audit and Compliance Tools: Opt for software that includes built-in audit and compliance tools to identify potential errors and ensure regulatory compliance.

Top Form 1041 Tax Preparation Software Solutions

Software Solutions for Fiduciaries

Some of the top tax preparation software solutions for Form 1041 include:

- Wolters Kluwer CCH: A comprehensive software solution for fiduciaries, offering automated calculations, data import and export, and collaboration tools.

- Thomson Reuters UltraTax: A powerful software solution that streamlines Form 1041 preparation, including automated calculations and audit and compliance tools.

- Drake Software: A user-friendly software solution that offers automated calculations, data import and export, and collaboration tools for fiduciaries.

Selecting the Right Software Solution

Choosing the Best Software for Your Needs

When selecting a tax preparation software solution for Form 1041, consider the following factors:

- Ease of Use: Choose software with an intuitive interface that is easy to navigate, even for those without extensive tax knowledge.

- Features and Functionality: Ensure the software meets your specific needs, including automated calculations, data import and export, and collaboration tools.

- Customer Support: Opt for software with comprehensive customer support, including training, resources, and technical assistance.

- Security and Confidentiality: Prioritize software solutions that prioritize data security and confidentiality.

Frequently Asked Questions

What is Form 1041?

+Form 1041 is the U.S. Income Tax Return for Estates and Trusts, filed annually with the IRS.

Who is required to file Form 1041?

+Fiduciaries, including executors, administrators, and trustees, are required to file Form 1041 on behalf of the estate or trust.

What are the benefits of using tax preparation software for Form 1041?

+The benefits of using tax preparation software for Form 1041 include accuracy and compliance, time savings, organization and management, and security and confidentiality.

Take the Next Step

If you're a fiduciary looking to streamline your Form 1041 preparation process, consider exploring tax preparation software solutions. With the right software, you can ensure accuracy and compliance, save time, and maintain organization and management of multiple estates and trusts. Take the first step today and discover the benefits of using tax preparation software for Form 1041.

Please share your experiences or questions about Form 1041 tax preparation software solutions in the comments below.