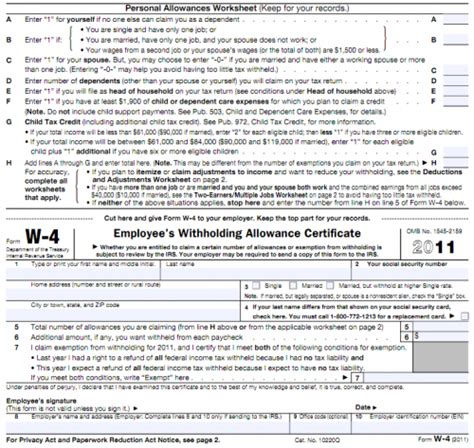

The W-4 form, also known as the Employee's Withholding Certificate, is a crucial document that helps employers determine the correct amount of taxes to withhold from an employee's paycheck. Understanding how to fill out the W-4 form correctly is essential for both employees and employers to avoid any potential tax issues. In this article, we will break down the W-4 form into 5 simple steps, making it easy for you to comprehend and complete the form accurately.

What is the Purpose of the W-4 Form?

The primary purpose of the W-4 form is to provide employers with the necessary information to calculate the correct amount of federal income taxes to withhold from an employee's wages. The form helps employers determine the employee's tax filing status, number of allowances, and any additional withholding amounts. This information is used to ensure that the correct amount of taxes is withheld from the employee's paycheck, reducing the likelihood of tax underpayment or overpayment.

Step 1: Determine Your Filing Status

The first step in filling out the W-4 form is to determine your filing status. Your filing status affects the amount of taxes withheld from your paycheck. You can choose from the following filing statuses:

- Single

- Married filing jointly

- Married filing separately

- Head of household

- Qualifying widow(er)

How to Choose Your Filing Status

To choose your filing status, consider the following:

- If you are unmarried or separated, you are considered single.

- If you are married, you can choose to file jointly or separately.

- If you are divorced or separated, you may be considered single or head of household.

- If you are a widow or widower, you may be considered qualifying widow(er).

Step 2: Claim Your Allowances

The next step is to claim your allowances. An allowance is an exemption from income tax withholding. You can claim allowances for yourself, your spouse, and your dependents. The number of allowances you claim affects the amount of taxes withheld from your paycheck.

How to Calculate Your Allowances

To calculate your allowances, consider the following:

- Claim one allowance for yourself.

- Claim one allowance for your spouse, if applicable.

- Claim one allowance for each dependent, if applicable.

Step 3: Account for Multiple Jobs or Spousal Income

If you have multiple jobs or your spouse works, you may need to adjust your withholding to avoid underpayment or overpayment of taxes. You can use the Two-Earners/Multiple Jobs Worksheet on page 2 of the W-4 form to calculate the correct withholding amount.

How to Use the Worksheet

To use the worksheet:

- Enter your income from all jobs.

- Enter your spouse's income, if applicable.

- Calculate the total income.

- Use the chart to determine the correct withholding amount.

Step 4: Claim Additional Withholding or Exemptions

You may need to claim additional withholding or exemptions, such as:

- Additional withholding for a specific amount

- Exemptions for student loan interest or mortgage interest

- Exemptions for child care or education expenses

How to Claim Additional Withholding or Exemptions

To claim additional withholding or exemptions:

- Enter the specific amount of additional withholding, if applicable.

- Claim exemptions for student loan interest or mortgage interest, if applicable.

- Claim exemptions for child care or education expenses, if applicable.

Step 5: Sign and Date the Form

The final step is to sign and date the W-4 form. Make sure to sign the form in ink and date it. This certifies that the information provided is accurate and true.

What to Do Next

After completing the W-4 form, submit it to your employer. Your employer will use the information provided to calculate the correct amount of taxes to withhold from your paycheck.

What is the W-4 form used for?

+The W-4 form is used to determine the correct amount of federal income taxes to withhold from an employee's wages.

How often do I need to update my W-4 form?

+You should update your W-4 form whenever your tax situation changes, such as when you get married, have children, or change jobs.

Can I claim additional withholding on my W-4 form?

+Yes, you can claim additional withholding on your W-4 form. You can specify a specific amount or use the Two-Earners/Multiple Jobs Worksheet to calculate the correct withholding amount.

In conclusion, filling out the W-4 form is a straightforward process that requires careful consideration of your tax situation. By following these 5 simple steps, you can ensure that your employer withholds the correct amount of taxes from your paycheck, reducing the likelihood of tax underpayment or overpayment. Remember to review and update your W-4 form regularly to reflect any changes in your tax situation.