As the tax season approaches, employers in Illinois must prepare to file their W-2 forms with the state and federal governments. The Illinois W-2 form is a critical document that reports employee wages and taxes withheld to the Illinois Department of Revenue and the Social Security Administration. In this comprehensive guide, we will walk you through the process of filing the Illinois W-2 form, including the requirements, deadlines, and step-by-step instructions.

Understanding the Illinois W-2 Form

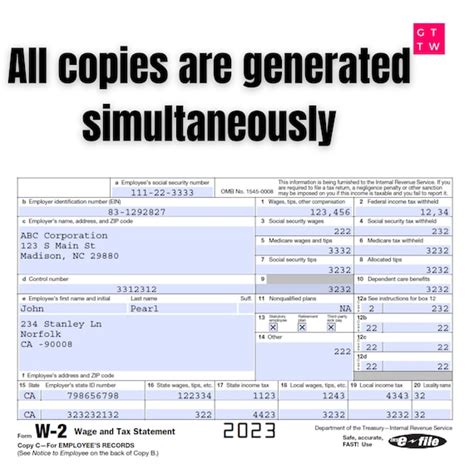

The Illinois W-2 form, also known as the Wage and Tax Statement, is a crucial document that employers must provide to their employees and the state and federal governments. The form reports the employee's wages, taxes withheld, and other relevant information. Employers must file the W-2 form for each employee who earned wages subject to Illinois income tax withholding.

Requirements for Filing the Illinois W-2 Form

To file the Illinois W-2 form, employers must meet the following requirements:

- Register with the Illinois Department of Revenue as an employer

- Obtain an Illinois employer identification number (FEIN)

- Withhold Illinois income tax from employee wages

- File the W-2 form for each employee who earned wages subject to Illinois income tax withholding

Deadlines for Filing the Illinois W-2 Form

Employers must file the W-2 form with the Illinois Department of Revenue and the Social Security Administration by the following deadlines:

- January 31st of each year for the previous tax year

- April 30th of each year for amended W-2 forms

Step-by-Step Guide to Filing the Illinois W-2 Form

To file the Illinois W-2 form, employers must follow these steps:

Filing the W-2 Form with the Illinois Department of Revenue

- Gather required information: Collect the necessary information, including employee names, addresses, social security numbers, wages, and taxes withheld.

- Complete the W-2 form: Fill out the W-2 form, including the employer's name, address, and FEIN.

- Submit the W-2 form: File the W-2 form with the Illinois Department of Revenue through their online portal or by mail.

Filing the W-2 Form with the Social Security Administration

- Gather required information: Collect the necessary information, including employee names, addresses, social security numbers, wages, and taxes withheld.

- Complete the W-2 form: Fill out the W-2 form, including the employer's name, address, and FEIN.

- Submit the W-2 form: File the W-2 form with the Social Security Administration through their online portal or by mail.

Electronic Filing Requirements

Employers with 250 or more W-2 forms must file electronically with the Illinois Department of Revenue and the Social Security Administration. Electronic filing is also recommended for employers with fewer than 250 W-2 forms.

Common Errors to Avoid When Filing the Illinois W-2 Form

When filing the Illinois W-2 form, employers must avoid the following common errors:

- Inaccurate or incomplete information: Ensure that all information is accurate and complete, including employee names, addresses, social security numbers, wages, and taxes withheld.

- Missing or late filing: File the W-2 form by the deadline to avoid penalties and fines.

- Incorrect employer identification number: Use the correct employer identification number (FEIN) when filing the W-2 form.

Penalties for Late or Inaccurate Filing

Employers who fail to file the W-2 form on time or with inaccurate information may be subject to penalties and fines. The Illinois Department of Revenue and the Social Security Administration may impose the following penalties:

- Late filing penalty: Up to $50 per W-2 form for late filing

- Inaccurate information penalty: Up to $50 per W-2 form for inaccurate information

Conclusion

Filing the Illinois W-2 form is a critical requirement for employers in Illinois. By following the steps outlined in this guide, employers can ensure that they file the W-2 form accurately and on time. Remember to avoid common errors and penalties by filing the W-2 form electronically and using the correct employer identification number.

We encourage you to share your experiences and ask questions about filing the Illinois W-2 form in the comments section below.

What is the deadline for filing the Illinois W-2 form?

+The deadline for filing the Illinois W-2 form is January 31st of each year for the previous tax year.

Do I need to file the W-2 form electronically?

+Yes, employers with 250 or more W-2 forms must file electronically with the Illinois Department of Revenue and the Social Security Administration.

What is the penalty for late filing of the W-2 form?

+The penalty for late filing of the W-2 form is up to $50 per W-2 form.