Are you a student at Houston Community College (HCC) trying to navigate the complexities of your 1098-T form? As a college student, it's essential to understand the significance of this document, especially when it comes to claiming education credits and deductions on your tax return. In this article, we'll break down the ins and outs of the 1098-T form, specifically for HCC students, to help you make the most of your education expenses.

What is a 1098-T Form?

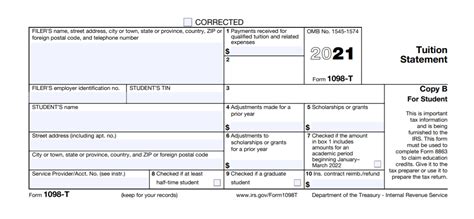

The 1098-T form, also known as the Tuition Statement, is a document provided by colleges and universities to students who have paid qualified education expenses. The form reports the amount of tuition and fees paid by the student during the calendar year, as well as any scholarships or grants received. The 1098-T form is used by students to claim education credits and deductions on their tax return, which can help reduce their tax liability.

How Does Houston Community College Report 1098-T Information?

Houston Community College is required to report 1098-T information to the Internal Revenue Service (IRS) and provide a copy of the form to students by January 31st of each year. The form will include the following information:

- The student's name, address, and taxpayer identification number (TIN)

- The amount of tuition and fees paid by the student during the calendar year

- The amount of scholarships or grants received by the student during the calendar year

- The amount of qualified education expenses that are eligible for education credits and deductions

How to Obtain Your 1098-T Form from HCC

Students can obtain their 1098-T form from Houston Community College in several ways:

- Online: Students can access their 1098-T form through the HCC website by logging into their student account and selecting the "Tax Information" option.

- Mail: HCC will mail a copy of the 1098-T form to students by January 31st of each year.

- In-person: Students can pick up a copy of their 1098-T form at the HCC Bursar's Office.

How to Read Your 1098-T Form

Understanding the information on your 1098-T form is crucial to accurately claim education credits and deductions on your tax return. Here's a breakdown of the different boxes on the form:

- Box 1: Payments received for qualified tuition and related expenses

- Box 2: Amounts billed for qualified tuition and related expenses

- Box 3: Check if the amount in Box 2 includes amounts for an academic period beginning in the next calendar year

- Box 4: Adjustments made for a prior year

- Box 5: Scholarships or grants

- Box 6: Adjustments to scholarships or grants for a prior year

- Box 7: Check if the amount in Box 1 includes amounts for an academic period beginning in the next calendar year

- Box 8: Check if the student is at least half-time

- Box 9: Check if the student is a graduate student

Education Credits and Deductions

The 1098-T form is used to claim education credits and deductions on your tax return. The two main education credits are:

- American Opportunity Tax Credit (AOTC)

- Lifetime Learning Credit (LLC)

The AOTC provides a tax credit of up to $2,500 for qualified education expenses, while the LLC provides a tax credit of up to $2,000. Additionally, students may also claim a tuition and fees deduction of up to $4,000.

Common Mistakes to Avoid When Claiming Education Credits and Deductions

When claiming education credits and deductions, it's essential to avoid common mistakes that can delay or even deny your tax refund. Here are some mistakes to avoid:

- Claiming both the AOTC and LLC for the same student

- Claiming education credits for a student who is not eligible

- Failing to report scholarships or grants on the tax return

- Claiming education deductions for expenses that are not qualified

IRS Resources for Education Credits and Deductions

For more information on education credits and deductions, students can visit the IRS website or consult the following resources:

- IRS Publication 970: Tax Benefits for Education

- IRS Form 8863: Education Credits

- IRS Form 8917: Tuition and Fees Deduction

Conclusion

Understanding your 1098-T form from Houston Community College is crucial to accurately claim education credits and deductions on your tax return. By knowing how to read your 1098-T form and avoid common mistakes, you can maximize your tax refund and reduce your tax liability. Remember to always consult with a tax professional or the IRS if you have any questions or concerns about education credits and deductions.

What is a 1098-T form?

+The 1098-T form, also known as the Tuition Statement, is a document provided by colleges and universities to students who have paid qualified education expenses.

How do I obtain my 1098-T form from Houston Community College?

+Students can obtain their 1098-T form from HCC online, by mail, or in-person at the HCC Bursar's Office.

What are the common mistakes to avoid when claiming education credits and deductions?

+Common mistakes include claiming both the AOTC and LLC for the same student, claiming education credits for a student who is not eligible, failing to report scholarships or grants, and claiming education deductions for expenses that are not qualified.