The W-4 form is a crucial document that plays a significant role in determining the amount of taxes withheld from an employee's paycheck. As an employee, understanding the fine print of the W-4 form can help you make informed decisions about your tax obligations and avoid any potential issues with the IRS. In this article, we will provide an in-depth analysis of the W-4 form, its components, and the answers to frequently asked questions.

What is a W-4 Form?

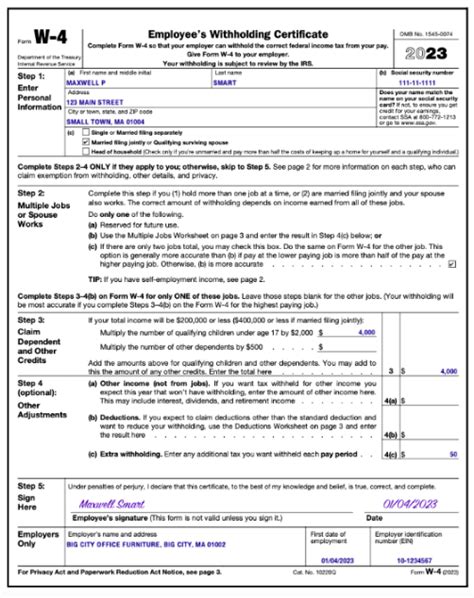

A W-4 form, also known as the Employee's Withholding Certificate, is a document that employees complete to inform their employers of their tax filing status, number of allowances, and any additional withholding amounts. The information provided on the W-4 form determines the amount of federal income taxes withheld from an employee's paycheck.

Components of a W-4 Form

A W-4 form consists of several sections, including:

- Section 1: Employee Information: This section requires employees to provide their name, address, and Social Security number or Individual Taxpayer Identification Number (ITIN).

- Section 2: Filing Status: This section asks employees to select their filing status, which determines the amount of taxes withheld. The options include single, married, married but withhold at higher single rate, head of household, or qualifying widow(er).

- Section 3: Number of Allowances: This section allows employees to claim a certain number of allowances, which reduces the amount of taxes withheld. Employees can claim one allowance for themselves, one for their spouse, and one for each dependent.

- Section 4: Additional Withholding: This section enables employees to request additional taxes to be withheld from their paycheck. This can be useful for employees who have other sources of income or want to avoid underpayment penalties.

- Section 5: Claiming Exemption: This section allows employees to claim exemption from withholding if they meet certain conditions, such as having no tax liability for the previous year or expecting no tax liability for the current year.

How to Complete a W-4 Form

Completing a W-4 form can be a straightforward process if you understand the components and requirements. Here are the steps to follow:

- Review the instructions: Before starting, review the instructions provided on the W-4 form to understand the requirements and any specific rules or regulations.

- Fill out Section 1: Provide your name, address, and Social Security number or ITIN.

- Select your filing status: Choose your filing status from the options provided in Section 2.

- Claim allowances: Claim the number of allowances you are eligible for in Section 3.

- Request additional withholding: If necessary, request additional taxes to be withheld in Section 4.

- Claim exemption: If you meet the conditions, claim exemption from withholding in Section 5.

- Sign and date the form: Sign and date the form to certify the information provided.

W-4 Form Answer Key

Here are some frequently asked questions and answers about the W-4 form:

- Q: What is the purpose of a W-4 form? A: The W-4 form determines the amount of federal income taxes withheld from an employee's paycheck.

- Q: How many allowances can I claim? A: You can claim one allowance for yourself, one for your spouse, and one for each dependent.

- Q: Can I claim exemption from withholding? A: Yes, if you meet certain conditions, such as having no tax liability for the previous year or expecting no tax liability for the current year.

- Q: Can I change my W-4 form at any time? A: Yes, you can submit a new W-4 form to your employer at any time to change your withholding status.

Common Mistakes to Avoid

When completing a W-4 form, it's essential to avoid common mistakes that can lead to underpayment or overpayment of taxes. Here are some mistakes to avoid:

- Underreporting income: Failing to report all sources of income can lead to underpayment of taxes.

- Incorrect filing status: Choosing the wrong filing status can affect the amount of taxes withheld.

- Insufficient allowances: Claiming too few allowances can result in overpayment of taxes.

- Failure to update information: Failing to update your W-4 form when your tax situation changes can lead to incorrect withholding.

Conclusion

In conclusion, understanding the fine print of the W-4 form is crucial for employees to make informed decisions about their tax obligations. By following the steps outlined in this article and avoiding common mistakes, employees can ensure accurate withholding and avoid any potential issues with the IRS. If you have any questions or concerns about completing a W-4 form, consult with a tax professional or contact the IRS for guidance.

We hope this article has provided you with a comprehensive understanding of the W-4 form and its components. If you have any questions or comments, please feel free to share them below.

What is the purpose of a W-4 form?

+The W-4 form determines the amount of federal income taxes withheld from an employee's paycheck.

How many allowances can I claim?

+You can claim one allowance for yourself, one for your spouse, and one for each dependent.

Can I claim exemption from withholding?

+Yes, if you meet certain conditions, such as having no tax liability for the previous year or expecting no tax liability for the current year.