Corporations in the United States are required to file Form 1120 with the Internal Revenue Service (IRS) to report their annual income and claim deductions. As part of this process, corporations must complete Schedule J, which is used to calculate the corporation's income adjustments. In this article, we will delve into the world of Schedule J Form 1120, exploring its purpose, benefits, and the steps required to complete it accurately.

Schedule J is a crucial component of Form 1120, as it enables corporations to report their income adjustments, which can significantly impact their taxable income. By accurately completing Schedule J, corporations can ensure they are taking advantage of all eligible deductions and credits, ultimately reducing their tax liability.

What is Schedule J Form 1120?

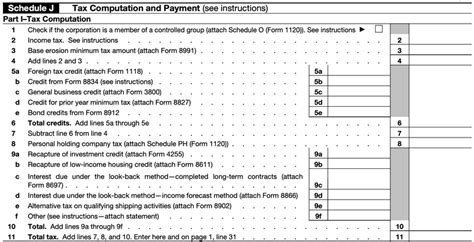

Schedule J is a supplemental schedule to Form 1120, which is used by corporations to report their income adjustments. The schedule is divided into several parts, each addressing a specific type of income adjustment. Corporations must complete Schedule J to report adjustments to their gross income, deductions, and credits.

Benefits of Schedule J Form 1120

Completing Schedule J accurately offers several benefits to corporations, including:

- Reduced tax liability: By reporting all eligible deductions and credits, corporations can minimize their taxable income, resulting in a lower tax liability.

- Improved financial reporting: Schedule J helps corporations to accurately report their financial performance, which is essential for investors, lenders, and other stakeholders.

- Compliance with tax regulations: Failing to complete Schedule J accurately can result in penalties and fines. By completing the schedule correctly, corporations can ensure compliance with tax regulations.

How to Complete Schedule J Form 1120

Completing Schedule J requires careful attention to detail and a thorough understanding of the corporation's financial performance. Here are the steps to follow:

- Gather necessary documents: Before starting Schedule J, corporations should gather all necessary documents, including financial statements, receipts, and invoices.

- Complete Part I: Part I of Schedule J requires corporations to report their adjustments to gross income. This includes reporting income that is not subject to tax, such as dividends received from other corporations.

- Complete Part II: Part II of Schedule J requires corporations to report their deductions. This includes reporting expenses related to business operations, such as salaries, rent, and utilities.

- Complete Part III: Part III of Schedule J requires corporations to report their credits. This includes reporting credits for taxes paid to other countries, research and development expenses, and renewable energy investments.

Tips for Completing Schedule J Form 1120

Here are some tips to keep in mind when completing Schedule J:

- Consult with a tax professional: Completing Schedule J can be complex, so it's recommended to consult with a tax professional to ensure accuracy.

- Keep accurate records: Keeping accurate records of financial transactions is essential for completing Schedule J accurately.

- Report all income: Corporations must report all income, including income that is not subject to tax.

Common Mistakes to Avoid

Here are some common mistakes to avoid when completing Schedule J:

- Failing to report income: Failing to report all income can result in penalties and fines.

- Inaccurate calculations: Inaccurate calculations can result in incorrect reporting of income adjustments.

- Failing to keep accurate records: Failing to keep accurate records can make it difficult to complete Schedule J accurately.

Conclusion

Completing Schedule J Form 1120 is a critical component of the corporate tax filing process. By accurately reporting income adjustments, corporations can minimize their tax liability and ensure compliance with tax regulations. By following the steps outlined in this article and avoiding common mistakes, corporations can ensure a smooth and accurate completion of Schedule J.

We hope this article has provided you with a comprehensive understanding of Schedule J Form 1120. If you have any questions or comments, please don't hesitate to reach out. Share this article with your colleagues and friends to help them understand the importance of accurate tax reporting.

What is Schedule J Form 1120?

+Schedule J is a supplemental schedule to Form 1120, used by corporations to report their income adjustments.

Why is Schedule J important?

+Schedule J is important because it enables corporations to report their income adjustments, which can significantly impact their taxable income.

How do I complete Schedule J?

+Completing Schedule J requires gathering necessary documents, completing Part I, Part II, and Part III, and reporting all income and deductions accurately.