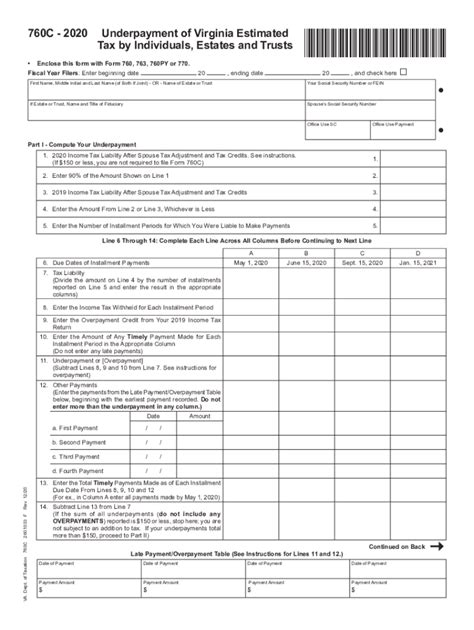

Completing tax forms can be a daunting task, especially when it comes to ensuring accuracy and compliance with regulations. One such form is the Virginia Form 760C, used for underpayment of estimated tax by individuals and fiduciaries. Specifically, Line 3 of this form requires careful attention to detail to avoid any potential issues or penalties. In this article, we will delve into the intricacies of Form 760C Line 3 and provide three ways to complete it correctly.

Understanding Form 760C and Line 3

Before we dive into the methods for completing Line 3 correctly, it's essential to understand the purpose of Form 760C and what Line 3 entails. Form 760C is used to calculate the underpayment of estimated tax by individuals and fiduciaries in Virginia. The form requires taxpayers to report their estimated tax payments, income tax withheld, and any overpayment from the previous year.

Line 3, specifically, requires taxpayers to report their "Required Annual Payment." This is the minimum amount of estimated tax that the taxpayer should have paid throughout the year to avoid penalties. The required annual payment is typically 90% of the current year's tax liability or 100% of the prior year's tax liability (110% if the taxpayer's adjusted gross income is over $150,000).

Method 1: Using the Safe Harbor Rule

One way to complete Line 3 correctly is by using the safe harbor rule. This rule states that taxpayers can avoid penalties if they pay either 90% of their current year's tax liability or 100% of their prior year's tax liability (110% if their adjusted gross income is over $150,000). To calculate the required annual payment using the safe harbor rule:

- Determine your prior year's tax liability (or 110% of it if your adjusted gross income is over $150,000).

- Calculate 90% of your current year's tax liability.

- Choose the lesser of the two amounts and enter it on Line 3.

Method 2: Using the Annualized Estimated Tax Worksheet

Another way to complete Line 3 correctly is by using the Annualized Estimated Tax Worksheet (Form 2210). This worksheet helps taxpayers calculate their required annual payment based on their actual income and tax liability throughout the year. To use the worksheet:

- Complete Form 2210, which can be found on the IRS website or in the instructions for Form 760C.

- Calculate your annualized estimated tax using the worksheet.

- Enter the calculated amount on Line 3 of Form 760C.

Method 3: Consulting a Tax Professional

The third way to complete Line 3 correctly is by consulting a tax professional. If you're unsure about how to calculate your required annual payment or have complex tax situations, it's best to seek the advice of a tax professional. They can help you navigate the intricacies of Form 760C and ensure that you're in compliance with Virginia tax regulations.

Benefits of Accurate Completion

Completing Line 3 of Form 760C accurately is crucial to avoid penalties and interest on underpaid estimated tax. By using one of the methods outlined above, taxpayers can ensure that they're meeting their estimated tax obligations and avoiding any potential issues. Additionally, accurate completion of Form 760C can help taxpayers:

- Avoid penalties and interest on underpaid estimated tax.

- Ensure compliance with Virginia tax regulations.

- Simplify the tax filing process.

Common Mistakes to Avoid

When completing Line 3 of Form 760C, taxpayers should avoid common mistakes that can lead to penalties and interest. Some common mistakes include:

- Underestimating or overestimating the required annual payment.

- Failing to account for changes in income or tax liability throughout the year.

- Not using the correct calculation method (safe harbor rule or annualized estimated tax worksheet).

Conclusion and Next Steps

Completing Line 3 of Form 760C correctly requires careful attention to detail and an understanding of the underlying tax regulations. By using one of the methods outlined above, taxpayers can ensure that they're meeting their estimated tax obligations and avoiding any potential issues. If you're unsure about how to complete Line 3 or have complex tax situations, it's best to consult a tax professional.

FAQ Section

What is the purpose of Form 760C?

+Form 760C is used to calculate the underpayment of estimated tax by individuals and fiduciaries in Virginia.

What is the safe harbor rule for completing Line 3?

+The safe harbor rule states that taxpayers can avoid penalties if they pay either 90% of their current year's tax liability or 100% of their prior year's tax liability (110% if their adjusted gross income is over $150,000).

What is the Annualized Estimated Tax Worksheet?

+The Annualized Estimated Tax Worksheet (Form 2210) is a worksheet that helps taxpayers calculate their required annual payment based on their actual income and tax liability throughout the year.