The world of credit and financial services can be complex and overwhelming, especially when it comes to applying for a Discover card. One crucial step in the application process is providing documentation to verify your income and employment status. This is where the IRS Form 4506-C comes into play. In this article, we will delve into the world of IRS Form 4506-C, its significance for Discover card applicants, and provide a comprehensive guide on how to navigate this process.

What is IRS Form 4506-C?

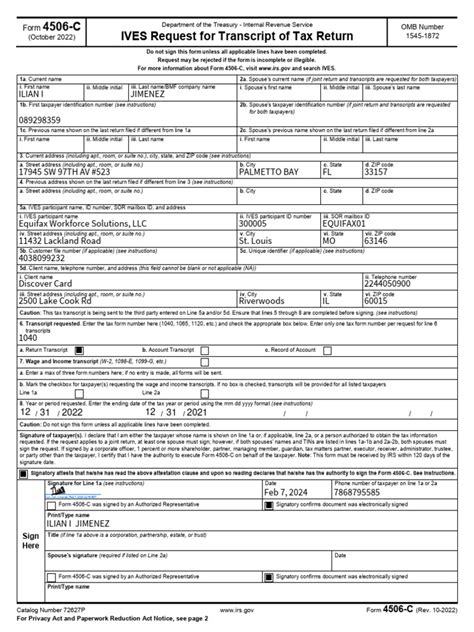

IRS Form 4506-C, also known as the IVES Request for Transcript of Tax Return, is a document that allows the Internal Revenue Service (IRS) to disclose your tax return information to a third party, such as Discover. This form is a crucial component of the credit application process, as it enables Discover to verify your income and employment status.

Why is IRS Form 4506-C Required for Discover Card Applicants?

Discover requires IRS Form 4506-C as part of their credit application process to ensure that the information provided is accurate and reliable. By verifying your income and employment status, Discover can assess your creditworthiness and make an informed decision about your credit application.

Benefits of Using IRS Form 4506-C for Discover Card Applicants

Using IRS Form 4506-C for Discover card applicants offers several benefits, including:

- Streamlined application process: By providing IRS Form 4506-C, you can expedite the credit application process and reduce the risk of delays or rejections.

- Improved accuracy: IRS Form 4506-C ensures that the information provided is accurate and reliable, reducing the risk of errors or discrepancies.

- Enhanced security: IRS Form 4506-C provides an additional layer of security, as it requires your explicit consent to disclose your tax return information to Discover.

How to Complete IRS Form 4506-C for Discover Card Applicants

Completing IRS Form 4506-C is a straightforward process that requires the following steps:

- Download the form: You can download IRS Form 4506-C from the IRS website or obtain a copy from the Discover website.

- Fill out the form: Complete the form by providing the required information, including your name, address, and Social Security number.

- Specify the tax year: Indicate the tax year for which you are requesting a transcript.

- Sign the form: Sign the form to authorize the IRS to disclose your tax return information to Discover.

- Submit the form: Submit the completed form to Discover, either by mail or online.

Tips and Reminders for Discover Card Applicants

When completing IRS Form 4506-C, keep the following tips and reminders in mind:

- Use black ink: Use black ink to complete the form, as this will ensure that the information is legible.

- Be accurate: Ensure that the information provided is accurate and complete.

- Keep a copy: Keep a copy of the completed form for your records.

Common Mistakes to Avoid When Completing IRS Form 4506-C

When completing IRS Form 4506-C, avoid the following common mistakes:

- Inaccurate information: Ensure that the information provided is accurate and complete.

- Missing signatures: Ensure that the form is signed to authorize the IRS to disclose your tax return information to Discover.

- Incorrect tax year: Ensure that the correct tax year is specified.

Conclusion

In conclusion, IRS Form 4506-C is a crucial component of the credit application process for Discover card applicants. By understanding the significance of this form and following the steps outlined above, you can ensure a streamlined and efficient application process. Remember to avoid common mistakes and keep a copy of the completed form for your records.

What is the purpose of IRS Form 4506-C?

+IRS Form 4506-C is used to request a transcript of tax return information from the IRS, which is then disclosed to a third party, such as Discover.

Why is IRS Form 4506-C required for Discover card applicants?

+Discover requires IRS Form 4506-C to verify the income and employment status of credit applicants.

How do I complete IRS Form 4506-C?

+Complete the form by providing the required information, including your name, address, and Social Security number, and sign the form to authorize the IRS to disclose your tax return information to Discover.