As the deadline for filing taxes approaches, corporations with international dealings must ensure they comply with the necessary regulations. One crucial form for these entities is the Form 1120-F, also known as the U.S. Income Tax Return of a Foreign Corporation. In this article, we will delve into the essential facts about Form 1120-F, providing you with a comprehensive understanding of its purpose, requirements, and benefits.

What is Form 1120-F?

Form 1120-F is a tax return form used by foreign corporations to report their income, deductions, and credits to the U.S. government. The form is designed for foreign corporations that are engaged in business in the United States or have U.S. source income. The Internal Revenue Service (IRS) requires foreign corporations to file Form 1120-F to comply with U.S. tax laws and regulations.

Who Needs to File Form 1120-F?

Not all foreign corporations need to file Form 1120-F. The following entities must file this form:

- Foreign corporations engaged in a trade or business in the United States

- Foreign corporations with U.S. source income

- Foreign corporations with U.S. effectively connected income

- Foreign corporations that have made an election to be treated as a domestic corporation

Exceptions and Exemptions

There are certain exceptions and exemptions to filing Form 1120-F. For example:

- Foreign corporations with no U.S. source income or effectively connected income are not required to file

- Foreign corporations that are exempt from taxation under a U.S. tax treaty

- Foreign corporations that have made an election to be treated as a domestic corporation under Section 7701(b)

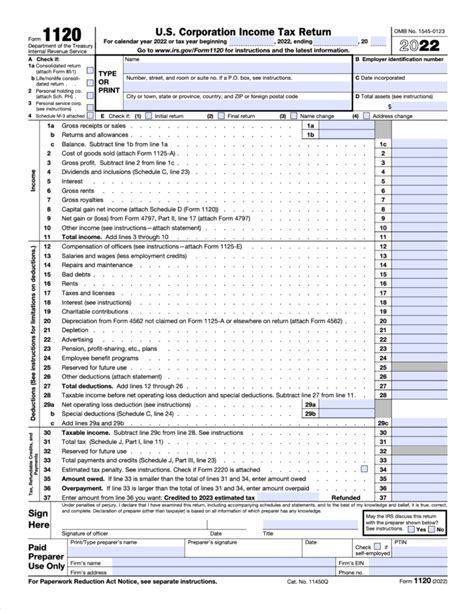

Key Components of Form 1120-F

Form 1120-F consists of several key components, including:

- Income statement: Foreign corporations must report their U.S. source income, including income from sales, services, and investments.

- Deductions: Foreign corporations can claim deductions for business expenses, depreciation, and other eligible expenses.

- Credits: Foreign corporations can claim credits for taxes paid to foreign governments, research and development expenses, and other eligible credits.

- Balance sheet: Foreign corporations must provide a balance sheet that includes their assets, liabilities, and equity.

Filing Requirements and Deadlines

Foreign corporations must file Form 1120-F by the 15th day of the 6th month after the end of their tax year. For example, if a foreign corporation's tax year ends on December 31st, the filing deadline would be June 15th of the following year.

Extension of Time to File

Foreign corporations can request an automatic 6-month extension of time to file Form 1120-F by filing Form 7004. This extension is not an extension of time to pay taxes owed.

Penalties for Non-Compliance

Foreign corporations that fail to file Form 1120-F or fail to pay taxes owed may be subject to penalties and interest. The IRS can impose penalties for late filing, late payment, and accuracy-related penalties.

Benefits of Filing Form 1120-F

Filing Form 1120-F provides several benefits to foreign corporations, including:

- Compliance with U.S. tax laws and regulations

- Reduction of penalties and interest

- Ability to claim credits and deductions

- Transparency and accountability in financial reporting

Conclusion and Next Steps

In conclusion, Form 1120-F is a critical tax return form for foreign corporations with U.S. dealings. By understanding the essential facts about Form 1120-F, foreign corporations can ensure compliance with U.S. tax laws and regulations. If you are a foreign corporation with U.S. dealings, it is essential to consult with a tax professional to ensure accurate and timely filing of Form 1120-F.

We encourage you to share your experiences and insights about Form 1120-F in the comments section below. Additionally, please share this article with others who may benefit from this information.

What is the purpose of Form 1120-F?

+Form 1120-F is used by foreign corporations to report their income, deductions, and credits to the U.S. government.

Who needs to file Form 1120-F?

+Foreign corporations engaged in a trade or business in the United States, or with U.S. source income, or with U.S. effectively connected income.

What are the key components of Form 1120-F?

+The key components of Form 1120-F include the income statement, deductions, credits, and balance sheet.