Are you a New York resident who has spent part of the year living outside of the state? Or perhaps you're a non-resident who has earned income within New York? Either way, you may be required to file a part-year resident tax form with the New York State Department of Taxation and Finance. In this article, we'll explore the five ways to file your part-year resident tax form, making it easier for you to navigate the process and ensure you're in compliance with state tax regulations.

Understanding Part-Year Residency in New York

Before we dive into the filing process, it's essential to understand what constitutes part-year residency in New York. According to the New York State Department of Taxation and Finance, you're considered a part-year resident if you're a resident of New York for only part of the tax year. This can occur if you move into or out of the state during the tax year, or if you're a non-resident who earns income within New York.

Filing Requirements for Part-Year Residents

As a part-year resident, you're required to file a New York state income tax return if your gross income exceeds the state's minimum filing requirements. For the 2022 tax year, these requirements are as follows:

- Single filers: $9,500 or more

- Joint filers: $19,000 or more

- Head of household: $14,200 or more

5 Ways to File Your Part-Year Resident Tax Form

Now that we've covered the basics, let's explore the five ways to file your part-year resident tax form:

1. E-Filing with Tax Preparation Software

One of the most convenient ways to file your part-year resident tax form is through tax preparation software like TurboTax or H&R Block. These programs will guide you through the filing process, ensuring you're taking advantage of all the credits and deductions you're eligible for. Plus, they'll transmit your return electronically to the New York State Department of Taxation and Finance.

2. Filing a Paper Return

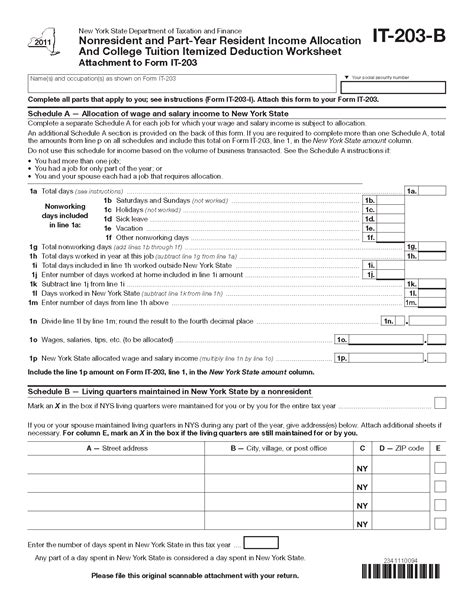

If you prefer to file a paper return, you can download and complete Form IT-203, Nonresident and Part-Year Resident Income Tax Return, from the New York State Department of Taxation and Finance website. Be sure to complete the form accurately and attach all required supporting documentation, including your federal income tax return and any relevant schedules.

3. Hiring a Tax Professional

If you're unsure about how to file your part-year resident tax form or have complex tax situations, consider hiring a tax professional. They'll guide you through the filing process, ensure you're in compliance with state tax regulations, and help you navigate any issues that may arise.

4. Using the New York State Department of Taxation and Finance Website

The New York State Department of Taxation and Finance website offers a range of resources and tools to help you file your part-year resident tax form. You can access tax forms, instructions, and publications, as well as use their online tax calculator to estimate your tax liability.

5. Visiting a Taxpayer Assistance Center

If you need in-person assistance with filing your part-year resident tax form, you can visit one of the New York State Department of Taxation and Finance's Taxpayer Assistance Centers. These centers are located throughout the state and offer help with tax-related issues, including filing your part-year resident tax form.

Additional Tips and Reminders

Before we conclude, here are a few additional tips and reminders to keep in mind:

- Make sure to file your part-year resident tax form by the April 15th deadline to avoid penalties and interest.

- If you're required to make estimated tax payments, be sure to submit them on a quarterly basis to avoid penalties.

- Keep accurate records of your income, expenses, and tax-related documentation in case of an audit.

Take Action Today!

Don't wait until the last minute to file your part-year resident tax form. Take action today and choose the filing method that works best for you. Whether you're e-filing with tax preparation software, hiring a tax professional, or visiting a Taxpayer Assistance Center, make sure you're in compliance with state tax regulations and taking advantage of all the credits and deductions you're eligible for.

What is the deadline for filing a part-year resident tax form in New York?

+The deadline for filing a part-year resident tax form in New York is April 15th.

Do I need to file a part-year resident tax form if I only earned income in New York for a few months?

+Yes, if you earned income in New York for any part of the tax year, you may be required to file a part-year resident tax form. The specific requirements depend on your individual circumstances and the amount of income you earned.

Can I e-file my part-year resident tax form if I have a complex tax situation?

+Yes, many tax preparation software programs can handle complex tax situations, including part-year residency. However, if you're unsure about how to file your return, it's always best to consult with a tax professional.