What is Form 1099-LTC and Its Importance in Long-Term Care Benefits?

As the need for long-term care services continues to grow, it's essential for individuals and their families to understand the tax implications associated with these benefits. One crucial document that plays a vital role in this process is Form 1099-LTC. In this article, we will delve into the world of Form 1099-LTC, exploring its definition, purpose, and significance in the context of long-term care benefits.

The Purpose of Form 1099-LTC

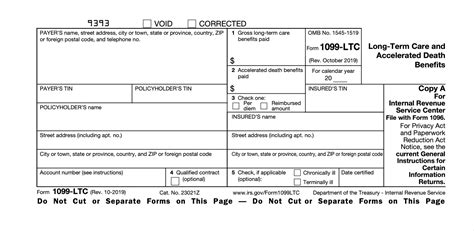

Form 1099-LTC is a tax document used to report long-term care benefits paid to individuals who have received care services, such as home health care, adult day care, or nursing home care. The form is typically issued by insurance companies, health organizations, or other entities that provide long-term care benefits. The purpose of Form 1099-LTC is to inform the recipient of the benefits and the Internal Revenue Service (IRS) of the amount of benefits paid.

Who Receives Form 1099-LTC?

Form 1099-LTC is usually sent to individuals who have received long-term care benefits exceeding a certain threshold, typically $5,000 or more in a calendar year. The form is also sent to the IRS, which uses the information to verify the recipient's tax return.

Information Reported on Form 1099-LTC

Form 1099-LTC contains essential information about the long-term care benefits paid, including:

- The recipient's name, address, and Social Security number

- The payer's name, address, and Employer Identification Number (EIN)

- The type of care services provided (e.g., home health care, adult day care, or nursing home care)

- The total amount of benefits paid

- The amount of benefits paid for each type of care service

How to Use Form 1099-LTC for Tax Purposes

When filing taxes, recipients of long-term care benefits must report the benefits received on their tax return. Form 1099-LTC serves as proof of the benefits paid and helps recipients calculate their taxable income. Recipients may be eligible for tax deductions or credits related to long-term care expenses.

Tax Implications of Long-Term Care Benefits

Long-term care benefits are generally tax-free if they are paid for qualified long-term care services. However, there are some tax implications to consider:

- Benefits paid for non-qualified services, such as custodial care, may be taxable.

- Benefits paid from a tax-qualified long-term care insurance policy may be tax-free.

- Recipients may be eligible for tax deductions or credits related to long-term care expenses.

Examples of Qualified Long-Term Care Services

Qualified long-term care services include:

- Home health care

- Adult day care

- Nursing home care

- Assisted living care

- Hospice care

Common Mistakes to Avoid When Reporting Long-Term Care Benefits

When reporting long-term care benefits, recipients should avoid common mistakes, such as:

- Failing to report benefits received

- Misreporting the type of care services received

- Failing to claim eligible tax deductions or credits

Penalties for Not Reporting Long-Term Care Benefits

Failure to report long-term care benefits can result in penalties, including fines and interest on unpaid taxes.

Best Practices for Managing Form 1099-LTC

To manage Form 1099-LTC effectively, recipients should:

- Keep accurate records of benefits received

- Verify the accuracy of Form 1099-LTC

- Consult with a tax professional to ensure compliance with tax laws and regulations

Conclusion and Next Steps

Understanding Form 1099-LTC is crucial for individuals and families receiving long-term care benefits. By familiarizing themselves with the form and its implications, recipients can ensure compliance with tax laws and regulations, minimize errors, and maximize tax benefits. If you have received long-term care benefits, consult with a tax professional to ensure accurate reporting and explore potential tax deductions or credits.

Who is required to file Form 1099-LTC?

+Insurance companies, health organizations, or other entities that provide long-term care benefits are required to file Form 1099-LTC.

What is the deadline for filing Form 1099-LTC?

+The deadline for filing Form 1099-LTC is typically January 31st of each year.

Can I claim tax deductions or credits for long-term care expenses?

+Yes, you may be eligible for tax deductions or credits related to long-term care expenses. Consult with a tax professional to explore your options.