Form 4797 is a crucial document for businesses and individuals who have sold or disposed of certain types of property, including real estate, equipment, and other assets. The form is used to report gains and losses from these transactions, which can have a significant impact on one's tax liability. In this article, we will guide you through the process of filing Form 4797 with TurboTax, making it easier for you to navigate the complexities of tax preparation.

Understanding Form 4797

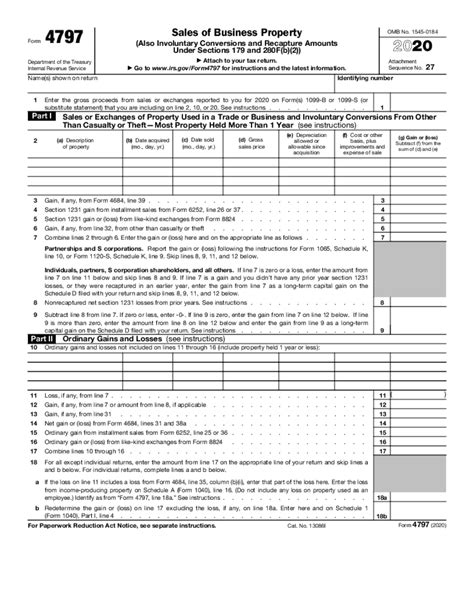

Before we dive into the process of filing Form 4797 with TurboTax, it's essential to understand what the form is and why it's necessary. Form 4797 is used to report the sale or disposition of certain types of property, including:

- Real estate

- Equipment

- Vehicles

- Other business assets

The form is used to calculate the gain or loss from these transactions, which can then be reported on the taxpayer's income tax return.

Gathering Necessary Information

To file Form 4797 with TurboTax, you will need to gather certain information, including:

- The date of the sale or disposition

- The type of property sold or disposed of

- The original cost or basis of the property

- The sale price or proceeds from the sale

- Any depreciation or amortization claimed on the property

Having this information readily available will make the process of filing Form 4797 much easier.

Filing Form 4797 with TurboTax

TurboTax is a popular tax preparation software that can help make the process of filing Form 4797 much easier. Here's a step-by-step guide to filing Form 4797 with TurboTax:

- Log in to TurboTax: If you have already created an account with TurboTax, log in to your account. If not, create a new account.

- Select the correct tax year: Make sure you select the correct tax year for which you are filing Form 4797.

- Answer questions about the sale or disposition: TurboTax will ask you a series of questions about the sale or disposition, including the date of the sale, the type of property sold or disposed of, and the original cost or basis of the property.

- Enter the sale price or proceeds: Enter the sale price or proceeds from the sale of the property.

- Calculate the gain or loss: TurboTax will calculate the gain or loss from the sale or disposition based on the information you provided.

- Review and submit: Review your information carefully and submit your return to the IRS.

Tips and Tricks

Here are some tips and tricks to keep in mind when filing Form 4797 with TurboTax:

- Keep accurate records: Make sure you keep accurate records of the sale or disposition, including receipts, invoices, and other documentation.

- Consult with a tax professional: If you are unsure about how to file Form 4797 or have complex tax situations, consider consulting with a tax professional.

- Take advantage of TurboTax's audit protection: TurboTax offers audit protection, which can provide peace of mind in case of an audit.

Frequently Asked Questions

Here are some frequently asked questions about filing Form 4797 with TurboTax:

Q: What is Form 4797 used for? A: Form 4797 is used to report the sale or disposition of certain types of property, including real estate, equipment, and other business assets.

Q: Do I need to file Form 4797 if I sold my primary residence? A: No, you do not need to file Form 4797 if you sold your primary residence, unless you used the property for business purposes.

Q: Can I file Form 4797 electronically with TurboTax? A: Yes, you can file Form 4797 electronically with TurboTax.

Q: How do I calculate the gain or loss from the sale or disposition? A: TurboTax will calculate the gain or loss from the sale or disposition based on the information you provided.

What is the deadline for filing Form 4797?

+The deadline for filing Form 4797 is typically April 15th of each year, unless you file for an extension.

Can I amend Form 4797 if I made an error?

+Yes, you can amend Form 4797 if you made an error. You will need to file Form 1040X and attach the corrected Form 4797.

Do I need to file Form 4797 if I sold my business assets?

+Yes, you will need to file Form 4797 if you sold your business assets, unless you qualify for an exception.

Conclusion

Filing Form 4797 with TurboTax can seem daunting, but with the right guidance, it can be a straightforward process. By gathering the necessary information, following the steps outlined above, and consulting with a tax professional if needed, you can ensure that you accurately report the sale or disposition of your business assets.