As a business owner in Virginia, you are required to file a Sales Tax Return, also known as Form ST-9, with the Virginia Department of Taxation. This form is used to report and pay sales and use taxes on a monthly or quarterly basis, depending on your business's filing frequency. Completing the form correctly is crucial to avoid any penalties, fines, or delays in processing your return. In this article, we will provide you with 5 tips to help you complete Virginia Form ST-9 correctly.

Tip 1: Understand Your Filing Frequency

Before you start completing Form ST-9, it's essential to know your filing frequency. In Virginia, the filing frequency is determined by your business's average monthly sales and use tax liability. If your average monthly liability is:

- $500 or more, you must file monthly

- $100-$499, you must file quarterly

- Less than $100, you must file annually

Make sure you know your filing frequency to ensure you're filing your return on time.

Determining Your Filing Frequency

To determine your filing frequency, you can use the following steps:

- Calculate your average monthly sales and use tax liability for the previous calendar year.

- Use the following chart to determine your filing frequency:

- $500 or more: monthly

- $100-$499: quarterly

- Less than $100: annually

For example, if your average monthly sales and use tax liability is $300, you would file quarterly.

Tip 2: Gather Required Information

To complete Form ST-9 correctly, you'll need to gather the following information:

- Your business's name and account number

- The reporting period (month or quarter)

- Total sales and use tax collected

- Total sales and use tax due

- Any deductions or exemptions claimed

- Any local tax due (if applicable)

Common Mistakes to Avoid

When gathering required information, avoid the following common mistakes:

- Incorrectly calculating total sales and use tax collected

- Failing to claim deductions or exemptions

- Not reporting local tax due (if applicable)

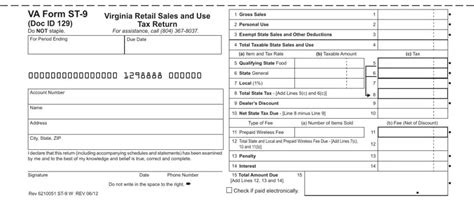

Tip 3: Complete the Form Correctly

Now that you have gathered all the required information, it's time to complete Form ST-9. Here are some tips to help you complete the form correctly:

- Make sure to use the correct form version (current version is ST-9 (12/19))

- Fill out all required fields, including your business's name and account number

- Use the correct reporting period (month or quarter)

- Calculate total sales and use tax collected correctly

- Claim any deductions or exemptions you're eligible for

- Report any local tax due (if applicable)

Using the Correct Form Version

Make sure to use the correct form version (ST-9 (12/19)) to avoid any delays in processing your return. You can find the current form version on the Virginia Department of Taxation's website.

Tip 4: Submit Your Return On Time

The due date for submitting your Form ST-9 return is the 20th day of the month following the reporting period. For example, if your reporting period is January, your return is due on February 20th.

Consequences of Late Filing

If you fail to submit your return on time, you may be subject to penalties and fines. The Virginia Department of Taxation may impose a penalty of up to $500 or 6% of the tax due, whichever is greater.

Tip 5: Keep Accurate Records

Finally, it's essential to keep accurate records of your sales and use tax transactions. This includes:

- Invoices and receipts

- Sales and use tax returns

- Correspondence with the Virginia Department of Taxation

Benefits of Keeping Accurate Records

Keeping accurate records can help you:

- Avoid penalties and fines

- Ensure you're taking advantage of all eligible deductions and exemptions

- Respond to any audits or inquiries from the Virginia Department of Taxation

By following these 5 tips, you can ensure that you complete Virginia Form ST-9 correctly and avoid any delays or penalties. Remember to understand your filing frequency, gather required information, complete the form correctly, submit your return on time, and keep accurate records.

What is the due date for submitting Form ST-9?

+The due date for submitting Form ST-9 is the 20th day of the month following the reporting period.

What is the penalty for late filing of Form ST-9?

+The Virginia Department of Taxation may impose a penalty of up to $500 or 6% of the tax due, whichever is greater.

What records should I keep for Form ST-9?

+You should keep accurate records of your sales and use tax transactions, including invoices and receipts, sales and use tax returns, and correspondence with the Virginia Department of Taxation.

We hope this article has provided you with valuable information to help you complete Virginia Form ST-9 correctly. If you have any further questions or concerns, please don't hesitate to comment below or share this article with your colleagues.