The Earned Income Tax Credit (EITC) is a refundable tax credit designed to help low-to-moderate-income working individuals and families. It's a valuable benefit that can provide a significant boost to your tax refund. However, claiming the EITC requires careful attention to detail and adherence to specific guidelines. In this article, we'll delve into the world of Form 8862, also known as the Information to Claim Earned Income Credit After Disallowance, and explore how to successfully claim the EITC using Turbotax.

Understanding the Earned Income Tax Credit (EITC)

The EITC is a tax credit that's specifically designed to benefit working individuals and families who earn low-to-moderate incomes. It's a refundable credit, which means that even if the credit exceeds the amount of taxes you owe, you can still receive the excess amount as a refund. The EITC is calculated based on your earned income, filing status, and number of qualifying children.

Who Qualifies for the EITC?

To qualify for the EITC, you must meet certain requirements:

- You must have earned income from a job or self-employment.

- You must have a valid Social Security number.

- You must meet the income limits for your filing status and number of qualifying children.

- You must file a tax return and claim the EITC.

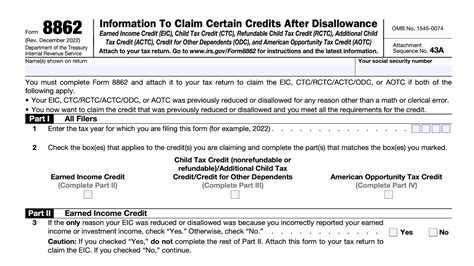

Form 8862: Information to Claim Earned Income Credit After Disallowance

Form 8862 is used to claim the EITC after the IRS has previously disallowed it. If you've previously claimed the EITC and the IRS disallowed it, you'll need to complete Form 8862 to reapply for the credit. This form requires you to provide detailed information about your income, filing status, and qualifying children.

How to Complete Form 8862

To complete Form 8862, you'll need to provide the following information:

- Your name, address, and Social Security number.

- Your filing status and number of qualifying children.

- Your earned income from all sources.

- Your adjusted gross income (AGI).

- The EITC amount you're claiming.

Claiming the EITC with Turbotax

Turbotax is a popular tax preparation software that can help you claim the EITC. To claim the EITC with Turbotax, follow these steps:

- Sign in to your Turbotax account and start a new tax return.

- Answer the questions about your income, filing status, and qualifying children.

- Turbotax will automatically calculate your EITC amount based on your input.

- Review and verify the EITC amount on Form 1040.

Turbotax Tips for Claiming the EITC

Here are some tips to keep in mind when claiming the EITC with Turbotax:

- Make sure to report all your earned income, including tips and self-employment income.

- Ensure you're claiming the correct number of qualifying children.

- Keep accurate records of your income and expenses, in case of an audit.

Common Errors to Avoid When Claiming the EITC

When claiming the EITC, it's essential to avoid common errors that can lead to delays or disallowance of your credit. Here are some errors to watch out for:

- Inaccurate or incomplete income reporting.

- Incorrect filing status or number of qualifying children.

- Failure to sign and date Form 1040.

How to Avoid EITC Errors with Turbotax

Turbotax can help you avoid common EITC errors by:

- Guiding you through the tax preparation process.

- Automatically calculating your EITC amount.

- Reviewing your return for accuracy and completeness.

Conclusion

Claiming the EITC can be a complex process, but with the right guidance and tools, you can successfully claim this valuable tax credit. Form 8862 is an essential document for those who've previously had their EITC disallowed, and Turbotax can help you navigate the process with ease. By following the tips and guidelines outlined in this article, you can ensure you're taking advantage of the EITC and maximizing your tax refund.

What is the Earned Income Tax Credit (EITC)?

+The EITC is a refundable tax credit designed to help low-to-moderate-income working individuals and families.

Who qualifies for the EITC?

+To qualify for the EITC, you must have earned income from a job or self-employment, a valid Social Security number, and meet the income limits for your filing status and number of qualifying children.

How do I claim the EITC with Turbotax?

+To claim the EITC with Turbotax, sign in to your account, start a new tax return, and answer the questions about your income, filing status, and qualifying children. Turbotax will automatically calculate your EITC amount.