The Internal Revenue Service (IRS) requires individuals and businesses to file various forms to report their income, claim deductions, and pay taxes. One such form is Form 6781, which is used to report gains and losses from Section 1256 contracts and straddles. If you're involved in trading or investing in securities, commodities, or currencies, you may need to file Form 6781 with the IRS. In this article, we'll provide five tips to help you navigate the process of filing Form 6781.

Understanding Form 6781

Before we dive into the tips, let's take a brief look at what Form 6781 is and who needs to file it. Form 6781 is used to report gains and losses from Section 1256 contracts, which include:

- Regulated futures contracts

- Foreign currency contracts

- Nonequity options

- Dealer equity options

- Dealer securities futures contracts

If you're a trader or investor, you may need to file Form 6781 if you have gains or losses from these types of contracts.

Tip 1: Determine If You Need to File Form 6781

Not everyone who trades or invests in securities, commodities, or currencies needs to file Form 6781. To determine if you need to file this form, you'll need to calculate your gains and losses from Section 1256 contracts. If you have a net gain or loss of $3,000 or more, you'll need to file Form 6781.

Tip 2: Gather Required Information

To complete Form 6781, you'll need to gather information about your Section 1256 contracts, including:

- The type of contract (e.g., futures, options, forex)

- The date the contract was opened and closed

- The gain or loss from each contract

- The net gain or loss from all contracts

You'll also need to have your tax identification number (TIN) and the TIN of any brokers or dealers who handled your trades.

Tip 3: Complete Form 6781 Accurately

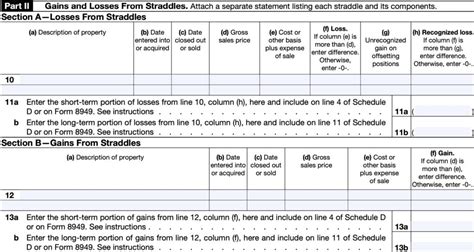

Form 6781 has several sections that require you to report your gains and losses from Section 1256 contracts. Make sure to complete each section accurately, using the information you gathered in Tip 2. You'll need to report the following:

- The type of contract and the date it was opened and closed

- The gain or loss from each contract

- The net gain or loss from all contracts

- Any adjustments to your gain or loss

Tip 4: Attach Supporting Schedules

Form 6781 requires you to attach supporting schedules to report additional information about your Section 1256 contracts. These schedules include:

- Schedule A: Gains and Losses from Section 1256 Contracts

- Schedule B: Adjustments to Gain or Loss

Make sure to complete these schedules accurately and attach them to your Form 6781.

Tip 5: File Form 6781 on Time

Form 6781 is due on the same day as your tax return, which is typically April 15th. If you're filing electronically, you can submit your Form 6781 through the IRS's e-file system. If you're filing by mail, make sure to send your form to the IRS address listed in the instructions.

By following these five tips, you can ensure that you file Form 6781 accurately and on time. Remember to gather required information, complete the form accurately, attach supporting schedules, and file on time.

Additional Resources

For more information about Form 6781 and Section 1256 contracts, you can refer to the following resources:

- IRS Publication 550: Investment Income and Expenses

- IRS Form 6781 Instructions

- IRS Website: Section 1256 Contracts

Conclusion

Filing Form 6781 can be a complex process, but by following these five tips, you can ensure that you complete the form accurately and on time. Remember to determine if you need to file Form 6781, gather required information, complete the form accurately, attach supporting schedules, and file on time. If you're still unsure about the process, consider consulting a tax professional or seeking guidance from the IRS.

What is Form 6781 used for?

+Form 6781 is used to report gains and losses from Section 1256 contracts, which include regulated futures contracts, foreign currency contracts, nonequity options, dealer equity options, and dealer securities futures contracts.

Who needs to file Form 6781?

+You'll need to file Form 6781 if you have a net gain or loss of $3,000 or more from Section 1256 contracts.

What information do I need to gather to complete Form 6781?

+You'll need to gather information about your Section 1256 contracts, including the type of contract, the date the contract was opened and closed, the gain or loss from each contract, and the net gain or loss from all contracts.