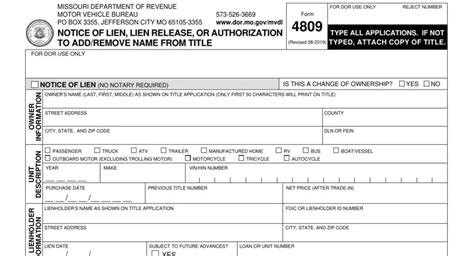

Are you a resident of Missouri preparing to file your state taxes? Filling out Missouri Form 4809, also known as the Missouri Fiduciary Income Tax Return, can be a daunting task, especially if you're new to the process. This form is used by fiduciaries, such as trustees and executors, to report the income and deductions of an estate or trust. In this article, we'll provide you with five tips to help you navigate the process and ensure you're taking advantage of all the deductions and credits available to you.

Understanding the Basics

Before we dive into our tips, it's essential to understand the basics of Missouri Form 4809. This form is used to report the income and deductions of an estate or trust, and it's typically filed by the fiduciary, such as a trustee or executor. The form is used to calculate the tax liability of the estate or trust, and it's typically filed annually.

Tip 1: Gather All Necessary Documents

Before you start filling out Missouri Form 4809, it's essential to gather all the necessary documents. This includes:

- The estate or trust's tax identification number

- The estate or trust's financial statements, including income statements and balance sheets

- Records of all income and deductions, including receipts and invoices

- Any relevant tax documents, such as W-2s and 1099s

Having all these documents on hand will make it easier to fill out the form accurately and ensure you're taking advantage of all the deductions and credits available to you.

Tip 2: Understand the Different Types of Income

Reporting Income on Missouri Form 4809

When filling out Missouri Form 4809, it's essential to understand the different types of income that need to be reported. This includes:

- Ordinary income, such as interest and dividends

- Capital gains and losses

- Tax-exempt income, such as municipal bond interest

Each type of income has its own reporting requirements, so it's essential to understand the rules and regulations surrounding each type.

Tip 3: Take Advantage of Deductions and Credits

Common Deductions and Credits on Missouri Form 4809

There are several deductions and credits available on Missouri Form 4809 that can help reduce the tax liability of the estate or trust. Some common deductions and credits include:

- Administrative expenses, such as fiduciary fees and accounting costs

- Charitable donations

- State income taxes

It's essential to understand the rules and regulations surrounding each deduction and credit to ensure you're taking advantage of all the opportunities available to you.

Tip 4: Report Distributions Correctly

Reporting Distributions on Missouri Form 4809

When filling out Missouri Form 4809, it's essential to report distributions correctly. This includes:

- Reporting the amount of income distributed to beneficiaries

- Reporting the amount of tax withheld on distributions

Failure to report distributions correctly can result in penalties and interest, so it's essential to get it right.

Tip 5: Seek Professional Help

Why You Should Seek Professional Help with Missouri Form 4809

Filling out Missouri Form 4809 can be a complex and time-consuming process, especially if you're new to the process. Seeking professional help from a tax professional or attorney can help ensure you're filling out the form correctly and taking advantage of all the deductions and credits available to you.

A tax professional or attorney can help you:

- Understand the rules and regulations surrounding Missouri Form 4809

- Gather all the necessary documents and information

- Fill out the form correctly and accurately

- Take advantage of all the deductions and credits available to you

By following these five tips, you can ensure you're filling out Missouri Form 4809 correctly and taking advantage of all the deductions and credits available to you. Remember to seek professional help if you're unsure about any part of the process.

Final Thoughts

Filling out Missouri Form 4809 can be a complex and time-consuming process, but by following these five tips, you can ensure you're filling out the form correctly and taking advantage of all the deductions and credits available to you. Remember to seek professional help if you're unsure about any part of the process, and don't hesitate to reach out to the Missouri Department of Revenue if you have any questions or concerns.

Share Your Thoughts

We'd love to hear from you! Have you ever filled out Missouri Form 4809? What was your experience like? Share your thoughts and tips in the comments below.

Frequently Asked Questions

What is Missouri Form 4809?

+Missouri Form 4809 is the Missouri Fiduciary Income Tax Return, which is used by fiduciaries, such as trustees and executors, to report the income and deductions of an estate or trust.

Who needs to file Missouri Form 4809?

+Fiduciaries, such as trustees and executors, need to file Missouri Form 4809 to report the income and deductions of an estate or trust.

What is the deadline for filing Missouri Form 4809?

+The deadline for filing Missouri Form 4809 is typically April 15th of each year.