Understanding Foreign Tax Credits and Form 1116

Claiming foreign tax credits can be a complex process, but with the right guidance, it can help reduce your U.S. tax liability. The IRS provides Form 1116, Foreign Tax Credit (Individual, Estate, or Trust), to help individuals and entities claim these credits. In this article, we will delve into the world of foreign tax credits, explore the Form 1116 instructions, and provide you with a comprehensive guide on how to claim these credits.

What is a Foreign Tax Credit?

A foreign tax credit is a non-refundable tax credit that allows U.S. taxpayers to reduce their U.S. tax liability by the amount of foreign taxes paid on foreign-sourced income. This credit is designed to prevent double taxation, ensuring that taxpayers are not taxed twice on the same income. The foreign tax credit is available to individuals, estates, and trusts who have paid foreign taxes on foreign-sourced income.

Who Can Claim Foreign Tax Credits?

To be eligible for foreign tax credits, you must meet the following requirements:

- You must have paid foreign taxes on foreign-sourced income.

- You must have a foreign tax credit carryover or carryback.

- You must file Form 1116 with your U.S. tax return (Form 1040, Form 1041, or Form 1120).

- You must meet the requirements for qualified foreign taxes, which include:

- Foreign taxes paid on foreign-sourced income.

- Foreign taxes paid on income that is not subject to U.S. taxation.

- Foreign taxes paid on income that is not exempt from U.S. taxation.

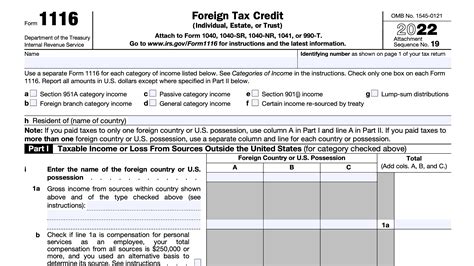

What is Form 1116?

Form 1116 is used to claim foreign tax credits. The form is divided into four parts:

- Part I: Qualified Foreign Taxes

- Part II: Foreign Tax Credit Limitation

- Part III: Foreign Tax Credit Carryover or Carryback

- Part IV: Credit for Foreign Taxes Paid or Accrued

Form 1116 Instructions

To complete Form 1116, follow these steps:

- Part I: Qualified Foreign Taxes

- List the country or countries where you paid foreign taxes.

- Enter the type of foreign taxes paid (e.g., income tax, withholding tax).

- Enter the amount of foreign taxes paid in U.S. dollars.

- Part II: Foreign Tax Credit Limitation

- Calculate the foreign tax credit limitation using the Foreign Tax Credit Limitation Worksheet.

- Enter the limitation on Line 12.

- Part III: Foreign Tax Credit Carryover or Carryback

- Calculate the foreign tax credit carryover or carryback using the Foreign Tax Credit Carryover or Carryback Worksheet.

- Enter the carryover or carryback on Line 15.

- Part IV: Credit for Foreign Taxes Paid or Accrued

- Enter the total foreign tax credit on Line 20.

- Attach Form 1116 to your U.S. tax return (Form 1040, Form 1041, or Form 1120).

Foreign Tax Credit Limitation

The foreign tax credit limitation is the maximum amount of foreign tax credits you can claim. The limitation is calculated using the Foreign Tax Credit Limitation Worksheet. The worksheet takes into account your U.S. tax liability, foreign-sourced income, and foreign taxes paid.

Foreign Tax Credit Carryover or Carryback

If you have excess foreign taxes paid, you may be able to carryover or carryback the excess to other tax years. The foreign tax credit carryover or carryback is calculated using the Foreign Tax Credit Carryover or Carryback Worksheet.

Foreign Tax Credit and AMT

The alternative minimum tax (AMT) can impact your foreign tax credit. If you are subject to AMT, you may need to complete Form 1116 and attach it to your AMT return (Form 6251).

Foreign Tax Credit and Tax Treaties

Tax treaties between the United States and foreign countries can impact your foreign tax credit. Tax treaties may reduce or eliminate foreign taxes, which can affect your foreign tax credit.

Foreign Tax Credit and Passive Income

Passive income, such as rental income or dividend income, may be subject to foreign taxes. If you have passive income, you may be able to claim a foreign tax credit.

Foreign Tax Credit and the Tax Cuts and Jobs Act

The Tax Cuts and Jobs Act (TCJA) introduced changes to the foreign tax credit. The TCJA introduced a new foreign tax credit limitation, which is calculated based on your U.S. tax liability.

Foreign Tax Credit and International Tax Planning

International tax planning is crucial when claiming foreign tax credits. A qualified tax professional can help you navigate the complexities of foreign tax credits and ensure you are in compliance with U.S. tax laws.

Conclusion

Claiming foreign tax credits can be a complex process, but with the right guidance, it can help reduce your U.S. tax liability. Form 1116 is a crucial part of the foreign tax credit process, and understanding the instructions is essential to claiming the credit correctly. By following the steps outlined in this article, you can ensure you are taking advantage of the foreign tax credit and minimizing your U.S. tax liability.

Take Action

If you have foreign-sourced income and have paid foreign taxes, take action today to claim your foreign tax credit. Consult with a qualified tax professional to ensure you are in compliance with U.S. tax laws and to maximize your foreign tax credit.

What is the purpose of Form 1116?

+Form 1116 is used to claim foreign tax credits. The form is used to calculate the foreign tax credit limitation, foreign tax credit carryover or carryback, and credit for foreign taxes paid or accrued.

Who can claim foreign tax credits?

+Individuals, estates, and trusts who have paid foreign taxes on foreign-sourced income can claim foreign tax credits.

What is the foreign tax credit limitation?

+The foreign tax credit limitation is the maximum amount of foreign tax credits you can claim. The limitation is calculated using the Foreign Tax Credit Limitation Worksheet.