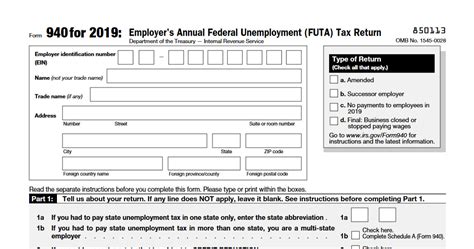

As the year 2019 came to a close, many individuals and businesses were scrambling to meet the deadline for filing their tax returns. One form that played a crucial role in this process was the 940 form, also known as the Employer's Annual Federal Unemployment (FUTA) Tax Return. In this article, we will delve into the top 5 things to know about the 940 form for the 2019 tax year.

What is the 940 Form?

The 940 form is a tax return used by employers to report their annual federal unemployment tax liability. The form is typically filed by employers who have paid wages of $1,500 or more in a calendar quarter or had one or more employees for at least some part of a day in each of 20 or more different weeks in the year.

Who Needs to File the 940 Form?

Employers who meet the above-mentioned criteria are required to file the 940 form. This includes:

- Business owners with employees

- Non-profit organizations with employees

- Government agencies with employees

- Household employers with employees (e.g., nannies, housekeepers)

What is the Deadline for Filing the 940 Form?

The deadline for filing the 940 form is typically January 31st of each year. However, if the employer has deposited all FUTA taxes on time and in full, the deadline may be extended to February 10th.

How to File the 940 Form?

Employers can file the 940 form electronically or by mail. The electronic filing option is available through the IRS's Electronic Federal Tax Payment System (EFTPS). Mailed forms should be sent to the address listed in the instructions for the 940 form.

What are the Penalties for Late Filing or Payment?

Failure to file or pay the 940 form on time can result in penalties and interest. The penalties can range from 2% to 15% of the unpaid tax, depending on the number of days late. Interest is also charged on the unpaid tax and any penalties.

Additional Information

In addition to the top 5 things to know about the 940 form, there are a few more important details to keep in mind:

- Employers must maintain accurate records of employment taxes, including wages paid, taxes withheld, and taxes deposited.

- The 940 form must be signed by an authorized representative of the employer.

- Employers can claim a credit on their state unemployment tax return for the amount of FUTA taxes paid.

Common Mistakes to Avoid

When filing the 940 form, it's essential to avoid common mistakes that can lead to penalties and delays. Some of the most common mistakes include:

- Failure to file the form on time

- Incorrect calculation of FUTA taxes

- Failure to report all wages paid

- Incorrect signing of the form

Conclusion

The 940 form is a critical component of the tax filing process for employers. By understanding the top 5 things to know about the 940 form, employers can ensure accurate and timely filing, avoiding penalties and interest. Remember to file the form on time, accurately calculate FUTA taxes, and maintain accurate records to avoid common mistakes.

Share Your Thoughts

We'd love to hear your thoughts on the 940 form and any challenges you've faced while filing. Share your experiences and tips in the comments below!

What is the purpose of the 940 form?

+The 940 form is used by employers to report their annual federal unemployment tax liability.

Who needs to file the 940 form?

+Employers who have paid wages of $1,500 or more in a calendar quarter or had one or more employees for at least some part of a day in each of 20 or more different weeks in the year.

What is the deadline for filing the 940 form?

+January 31st of each year, unless the employer has deposited all FUTA taxes on time and in full, in which case the deadline may be extended to February 10th.